Dec 04, 2023

Market Recap: November 2023

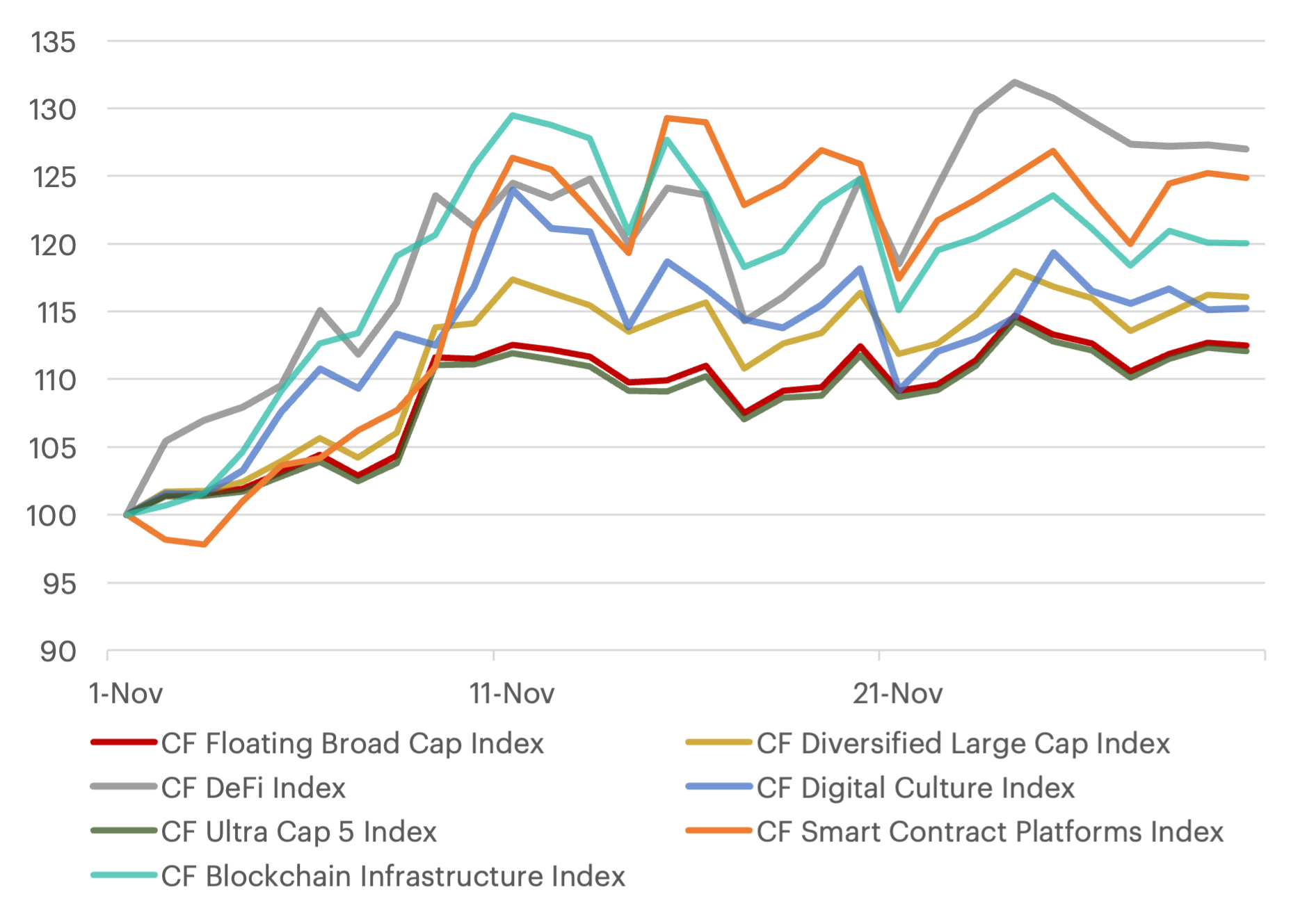

DeFi outperforms as user activity ramps up

Key takeaways for the month:

- A wave of positive momentum swept across our flagship indices, lifted by swelling institutional interest and optimistic technical factors, driving double-digit gains broadly. Bellwether assets Bitcoin and Ether advanced over 8% and 12%, respectively. Notably, Bitcoin reclaimed the $38,000 level for the first time since May of 2022, according to our Bitcoin Real-Time Index. Meanwhile Ether reached new highs, breaking through resistance above $2,100 for the first time since April.

- Our DeFi barometer handily outpaced peers, vaulting 26% higher. The sector’s ongoing price revival kept pace with another leg up in Total Value Locked – a trusted gauge of the expanding DeFi landscape. And our Smart Contract index was another top performer, rising 24% fueled by rallies in premier constituents, underscoring robust appetite for vanguard blockchains.

- Bitcoin futures activity ratcheted higher, with open interest climbing 11% to an all-time peak of nearly 22,000 contracts in November. Ether futures were also on the upswing, rising 13% against the backdrop of a landmark spot ETF filing from BlackRock – the world's largest asset manager.

Monthly Index Performance

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Nasdaq Crypto Index Family – Free Float Supplies Announcement

The reconstitution and rebalance of the Nasdaq Crypto Index Family will take place on March 2nd, 2026.

CF Benchmarks

CF Digital Asset Index Family Multi Asset Series – Free Float Supplies Announcement

The reconstitution and rebalance of the CF Digital Asset Index Family Multi Asset Series will take place on March 2nd 2026.

CF Benchmarks

Weekly Index Highlights, February 23, 2026

Crypto's risk-off tone deepened last week, with BTC's -0.6% slide masking sharper alt weakness, e.g., XRP -6.1%. Our CF DACS universe was uniformly lower though, with Culture and Infrastructure both -7.5%. Meanwhile, implied volatility eased while realized firmed and short-term rates repriced lower.

CF Benchmarks