Jun 03, 2024

Market Recap: Rally Broadens as SEC Approves Spot Ether ETFs

Key takeaways for the month:

- SEC Approves Spot Ether ETFs: In a surprising move, the Securities and Exchange Commission (SEC) approved the 19b-4 forms for several spot Ether Exchange-Traded Funds (ETFs). This approval is expected to pave the way for major financial institutions to launch these ETFs, potentially driving significant market growth and institutional adoption for Ethereum, the world's largest programmable blockchain. The SEC's unexpected decision is widely regarded as another crucial milestone, indicating greater acceptance and regulatory clarity for Ether as an investment asset.

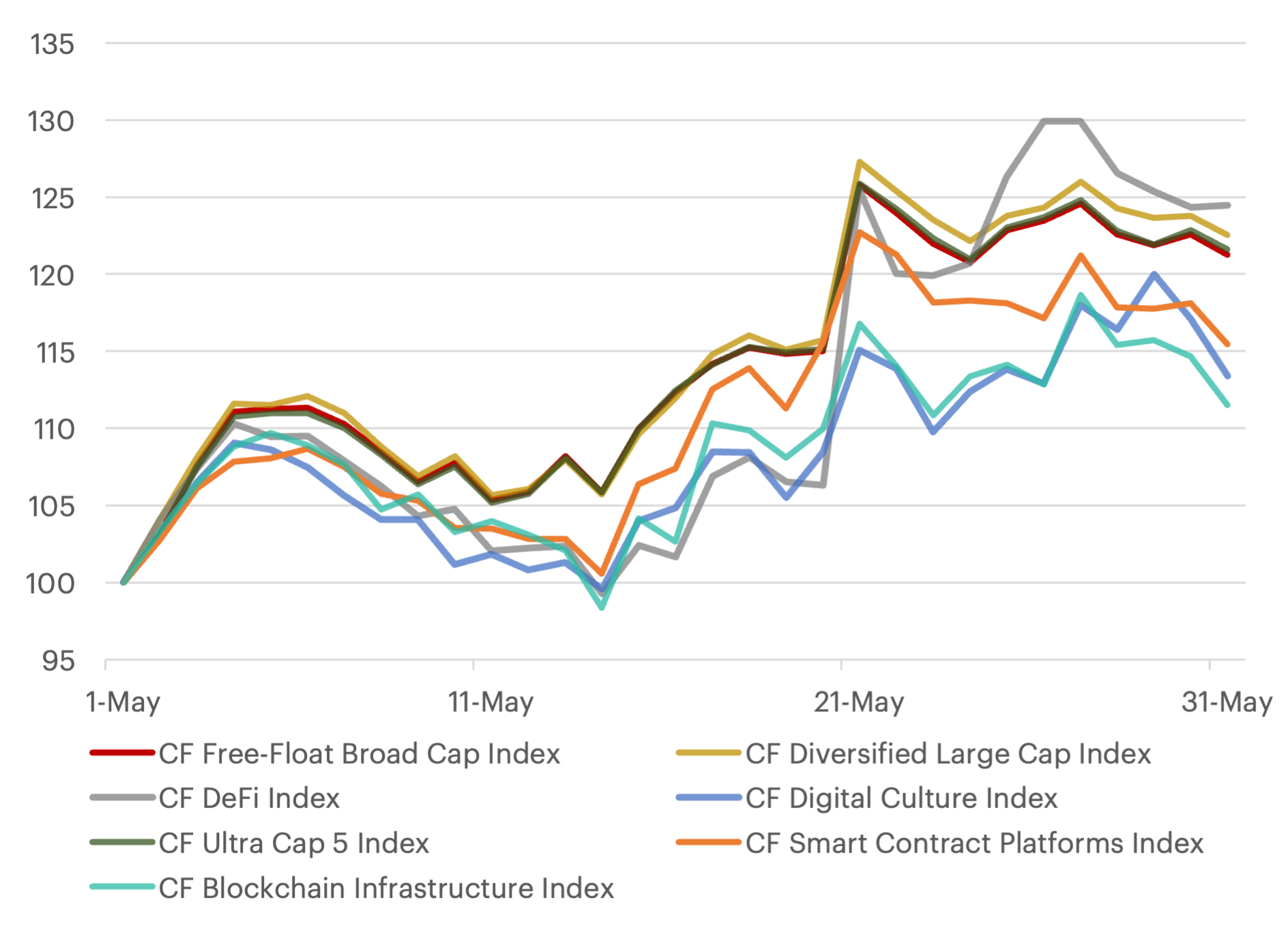

- Market Reaction and DeFi Performance: The positive market reaction to this news was evident in both the price surge and the increased inflow of capital into Ethereum-based Decentralized Finance (DeFi) protocols. These factors contributed to the overall bullish sentiment in the market. The impact of this development is clearly visible in the performance of our CF DeFi Composite Index, which showed the strongest monthly performance, rising by more than 24%. The CF Diversified Large Cap Index closely followed, increasing by as much as 27% before closing the month with a 22% gain.

- Top and Bottom Performers: Uniswap's UNI token (+46.3%) and Chainlink's LINK token (+42.1%) were the top performers in May, benefiting from the positive sentiment surrounding decentralized finance and oracles after the SEC's surprising approval of spot Ether ETFs. Internet Computer's ICP token (-8.0%) and Stacks' STX token (-6.0%) were the month's bottom performers as the two tokens pared some of their strong yearly gains, resulting in a decline in value.

- Regulatory Shift and BIRC Changes: In late May, a regulatory shift coupled with cooling inflation data revived bullish sentiment in the market. This led to a broad-based upward shift in the BIRC, with increases across all tenors except the four-month (4M) maturity. The most significant changes were observed at the short end of the curve, where perpetual (session) funding rates and the one-week (1W) rate experienced notable nominal increases of 16.2% and 4.2%, respectively.

- Bitcoin Network Hash Rate and Mining Revenues: Bitcoin's network hash rate fell slightly in the past month, declining by 4.2% to reach 602 million terahashes per second. The recent halving has increased energy costs to mine Bitcoin, as a result miners are likely to retire their last-generation machines and upgrade to the next generation to remain competitive. Despite the decrease in the hash rate, daily mining revenues increased by 20% to $36.2 million. The increase in revenue was driven by the increase in the price of Bitcoin as well as increased network fees. At the end of May, network fees made up 12.8% of the block reward, up from 9.3% at the end of April.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks