Jul 23, 2023

Keeping track of U.S. Bitcoin ETF applications - 2023 Edition

This could take some time: key details of the current crop of U.S. spot Bitcoin ETF applications, plus possible decision dates, all in one place

The wait

The race among asset managers to list the first U.S. spot Bitcoin ETF is ongoing. But with several applications already filed, including many by firms that have filed previously rejected applications, progress has moved firmly into the waiting phase. As we’ve often stated, this could last several months.

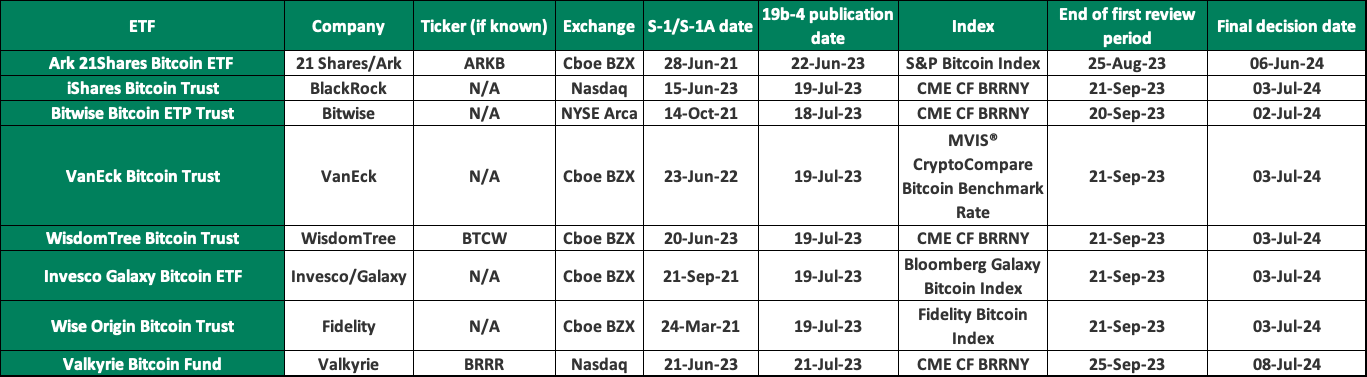

With 8 such applications now on the SEC’s desk though, keeping track of the timing of the commission’s potential decision-making process—which is already pretty convoluted and conditional, as we detailed here—can be extra challenging.

The cream of the crop

As we’ve also indicated previously, the SEC has once again signalled the importance of its long-held prerequisite of extraordinary regulatory look-through for any potential crypto ETF’s market operations, both in principle as well as regarding the specific mechanism—known as a Surveillance Sharing Agreement (SSA).

By extension, as the preeminent regulated cryptocurrency Benchmark Administrator, CF Benchmarks reasons that the commission will demonstrate its preference for the greatest possible visibility into the market participation of the Bitcoin ETF that is ultimately approved for listing.

Logically, that should mean applicants proposing to use CF Benchmarks’ regulated CME CF Bitcoin Reference Rate – New York Variant (BRRNY) as NAV calculation index, would enjoy an implicit additional advantage over ETF filers citing other indices.

Although all of the current crop of applicants have now detailed SSAs in their proposals, only 4 out of these 8 have cited the use of BRRNY. These firms have recognized the additional efficacy of the Benchmark for resisting potential price manipulation by design. They will also have noted the surveillance measures integrated into its calculation methodology by agreement between CFB and the stringently selected CF Constituent Exchanges that contribute price data to it.

If we’re correct, the SEC should also recognise that these measures provide a supplementary layer of visibility into the Bitcoin market as it pertains to the ETF that is approved. Together with the BRRNY’s high-integrity characteristics, such measures would therefore be an essential aspect of any Bitcoin ETF the commission may eventually approve.

So, we offer the list below as a 'cut-out-and-keep' guide for keeping track of ‘live’ spot Bitcoin ETF applications that we’re aware of. We’ll regularly update the list to reflect any important developments and publish further posts here with the details.

Worth remembering

- The SEC’s consideration process remains, at bottom, almost entirely at the commission’s discretion. Therefore, ‘decision dates’ can only ever be a rough guide

- That said, the SEC does have guidelines for the process, so long as an ETF application is progressing in typical fashion

- To date, no spot Bitcoin ETF application has progressed in what could be called a ‘typical' fashion

- We summarised the guidelines here

- In theory, the SEC can conclude its consideration of an application at any time during the first 45-day review period (excluding weekends and public holidays) after which it must notify the applicant of its decision to approve, reject, or indicate that it will take more time to consider the application

- The SEC has never concluded a crypto ETF review within or immediately after 45 days

- Recall that the date on which the SEC actually publishes the form 19b-4 (‘Proposed Rule Change’) from the listing exchange (in the Federal Register) is customarily the date on which the commission begins its consideration period, not the date on which the form was submitted

- Therefore, to calculate review periods and possible decision dates we’ve begun counting from the date clearly indicated as the ‘publication date’, in the Federal Register

- Note that some would-be issuers have filed more than one S1 for their proposed fund, utilizing the facility offered by form S1-A to amend or resubmit initial applications. Generally, when possible, we’ve indicated the most recent version of the filing available in the EDGAR database

Expectations management

Finally, readers familiar with the long journey to the possible listing of a publicly traded crypto fund in the U.S. probably have several layers of déjà vu about current developments. Recalling attempts many issuers (including all current applicants) made just two years ago to get such a fund approved, should be enough of a reminder that regardless of the heartening optimism of crypto’s online social sphere and beyond, at best, the road remains a long one.

If you’re not already, be sure to subscribe to this blog to remain up to date with U.S. crypto ETF filings and everything else that matters for the institutional adoption of digital assets.

Find out more about the CME CF Bitcoin Reference Rate – New York Variant (BRRNY)

- Visit the CME CF BRRNY Index Page

- Read our comprehensive research paper on the BRRNY:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks

Not All Cryptos Are the Same: How CF Factor Data Reveals Sensitivities Across the Digital Asset Taxonomy

We show how combining the CF DACS taxonomy with the CF Factor Data Series reveals sensitivities that enable institutional-grade returns attribution, risk monitoring and strategic implementation.

CF Benchmarks

Factor Friday

The defensive regime remains firmly in control. Downside Beta continues to dominate while Growth and Value have continued to lag since October. Momentum's recent surge and The Settlement category's relative resilience are the two threads worth pulling on this week.

Mark Pilipczuk