Sep 13, 2021

Keeping tabs on CF Benchmarks-powered U.S. BTC ETFs - Part II

One of the few certainties about the first U.S. Bitcoin ETF is that it will be powered by a regulated CF Benchmarks index

The typical late summer lull in institutional markets news means a quieter slate for crypto ETF applications, for now.

But what about the crypto ETF paperwork that’s been piling up on the SEC’s desk for almost every month of the year?

It’s largely a waiting game since the unprecedented volume of crypto filings in recent months. As we saw, BTC (and ETH) filing mania even stepped up a gear in August, following the SEC chair’s not particularly subtle hint on Bitcoin Futures-based ETFs. Beyond that, uncertainty lingers on several key fronts.

Firstly, there’s the question of what happens to the high-profile applications that preceded what amounted to a clarification from the commission on the crypto fund structure that might be approvable. As this August 11 snapshot suggests, the majority were proposals for ‘physically-backed’ funds.

Recall that the SEC chair said he ‘looked forward’ to more BTC ETF filings, “particularly if those are limited to…CME-traded Bitcoin futures”. That leaves a question mark over ‘physical’ filings.

As always, the proviso is that trying to second guess the SEC is inadvisable.

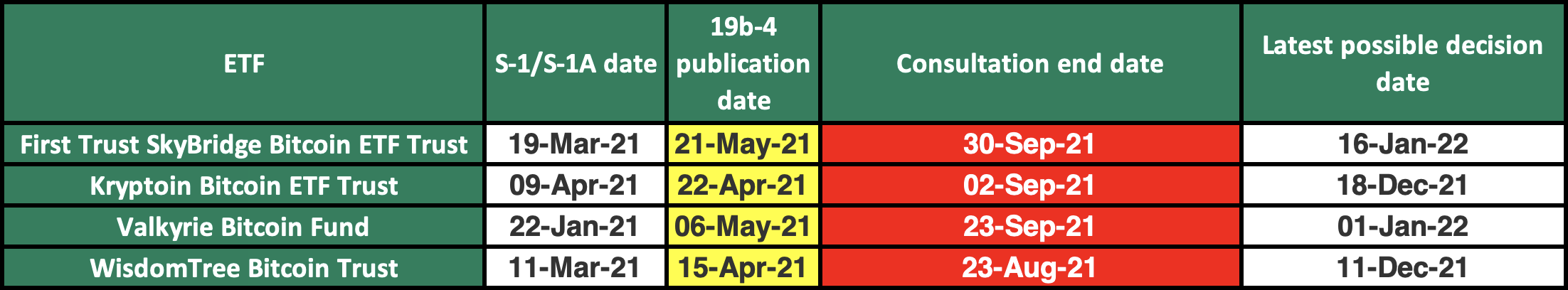

But there’s no getting away from the additional uncertainty, including for the four high-profile planned 'physical' BTC ETFs planning to use a CF Benchmarks index for NAV calculation.

As for planned futures-based crypto ETFs—mostly styled ‘strategy’ funds—around a month ago, none had been corroborated by essential paperwork from their proposed listing exchange, namely Form 19b-4, which typically starts the clock on an active SEC review. By early September, only the Valkyrie XBTO Bitcoin Futures Fund had a 19b-4.

For ‘physical’ BTC applications past the 19b-4 stage, dates on which the SEC might grant approval stretch out to late-2021/early-2022. These potential endpoints are based on the maximum length of time that the SEC can extend review periods, typically in 45-day stretches, including any public consultation.

As is clear to our regular readers, keeping tabs on the numerous BTC ETF threads is a bit of a challenge. However, we’ve again drilled down on the highest profile ‘physical’ Bitcoin ETF filings that propose to utilise a CF Benchmarks index to calculate daily NAV. These applications are, after all, tantamount to the highest-probability prospects of their kind, given that the SEC will continue to seek the greatest possible oversight on public BTC ETFs.

With the SEC opening a period of public feedback on all four CF Benchmarks-powered ‘physical’ filings, the projected ends of these consultation periods are indicated in the summary below.

It’s worth noting that the SEC seeking comments shouldn’t be interpreted as a precursor to a decision (as the commission itself states). The agency sought comments on VanEck Bitcoin Trust (which isn’t planning to strike NAV against a regulated benchmark) way back in June. That consultation was followed by another—you guessed it— ‘review extension’—last week.

All-told, the U.S. Bitcoin ETF saga appears set to run on for many months more, though there is increasing certainty on what the first U.S. BTC ETFs to be approved will look like. At a minimum, they will ultimately be underpinned by the same standards of pricing accuracy, integrity, and representativeness as our CME CF Bitcoin Reference Rate (BRR) regardless of their likely tracking profile (note that ‘tracking’ has been the subject of much discussion since SEC chair Gary Gensler’s August comments).

What’s more, the pace of progress towards a public BTC fund has seen SEC messaging evolve rapidly within just a few months.

It might be wise to also apply the ‘Never second guess…’ rule to the SEC's opposition to physical crypto ETFs. It would be cogent for the agency's stance on that to evolve a little further down the line too, just as the commission's view on any sort of crypto ETF at all did.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks