Jun 27, 2024

Exploring Bitcoin Basis Trades: How Price Singularity in ETFs and Futures is Bolstering Market Activity

The alignment of price benchmarks between spot Bitcoin ETFs and CME futures contracts plays a crucial role in enabling precise arbitrage opportunities. Six of the spot Bitcoin ETFs utilize the CME CF Bitcoin Reference Rate - New York Variant (BRRNY) to determine the Net Asset Value (NAV) for creation and redemption. Simultaneously, CME futures contracts settle using the same reference rate. This synchronization ensures that both instruments are inherently linked to the same price benchmark, facilitating more efficient basis trades.

Understanding the Fundamentals of Basis Trades

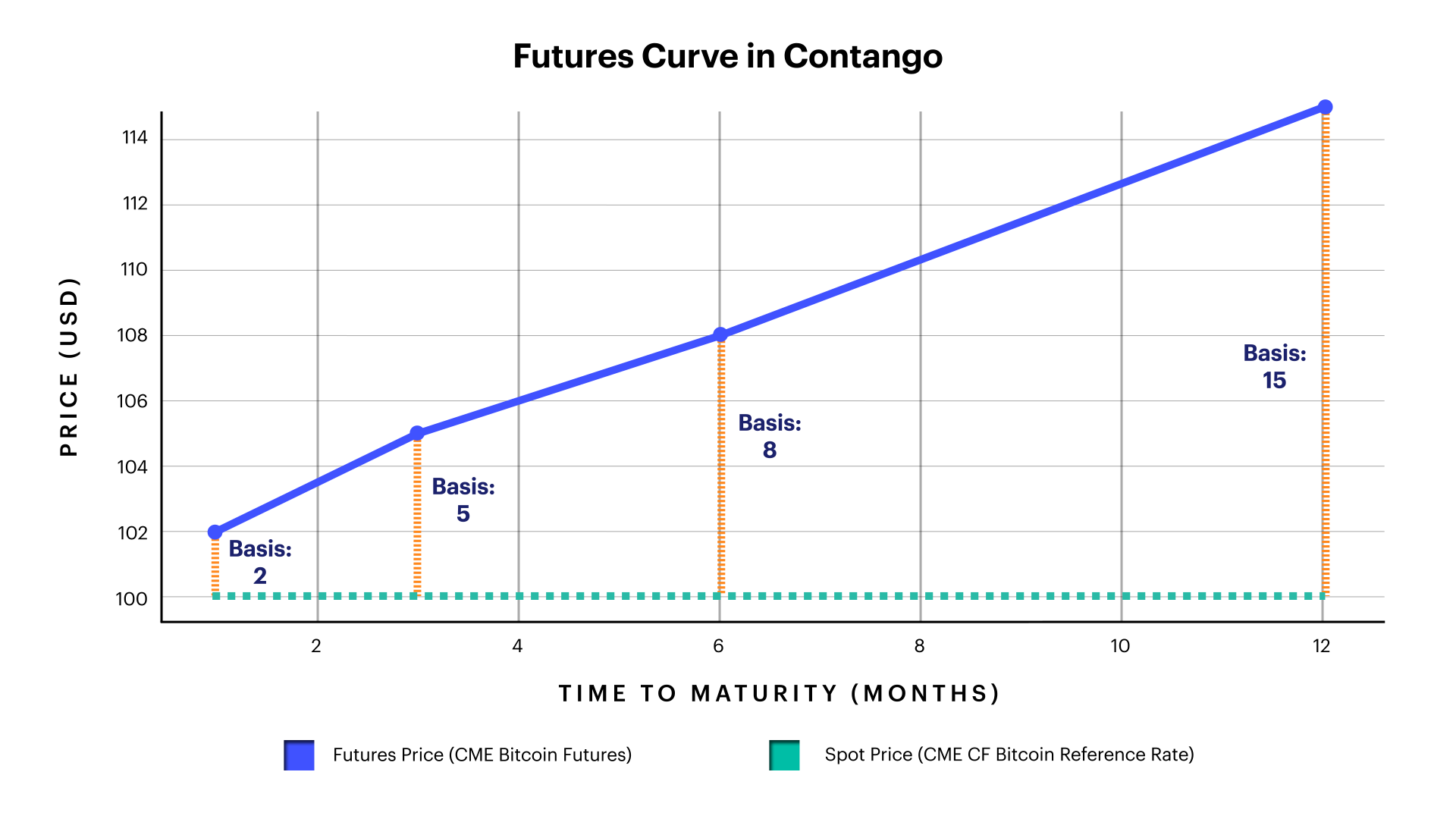

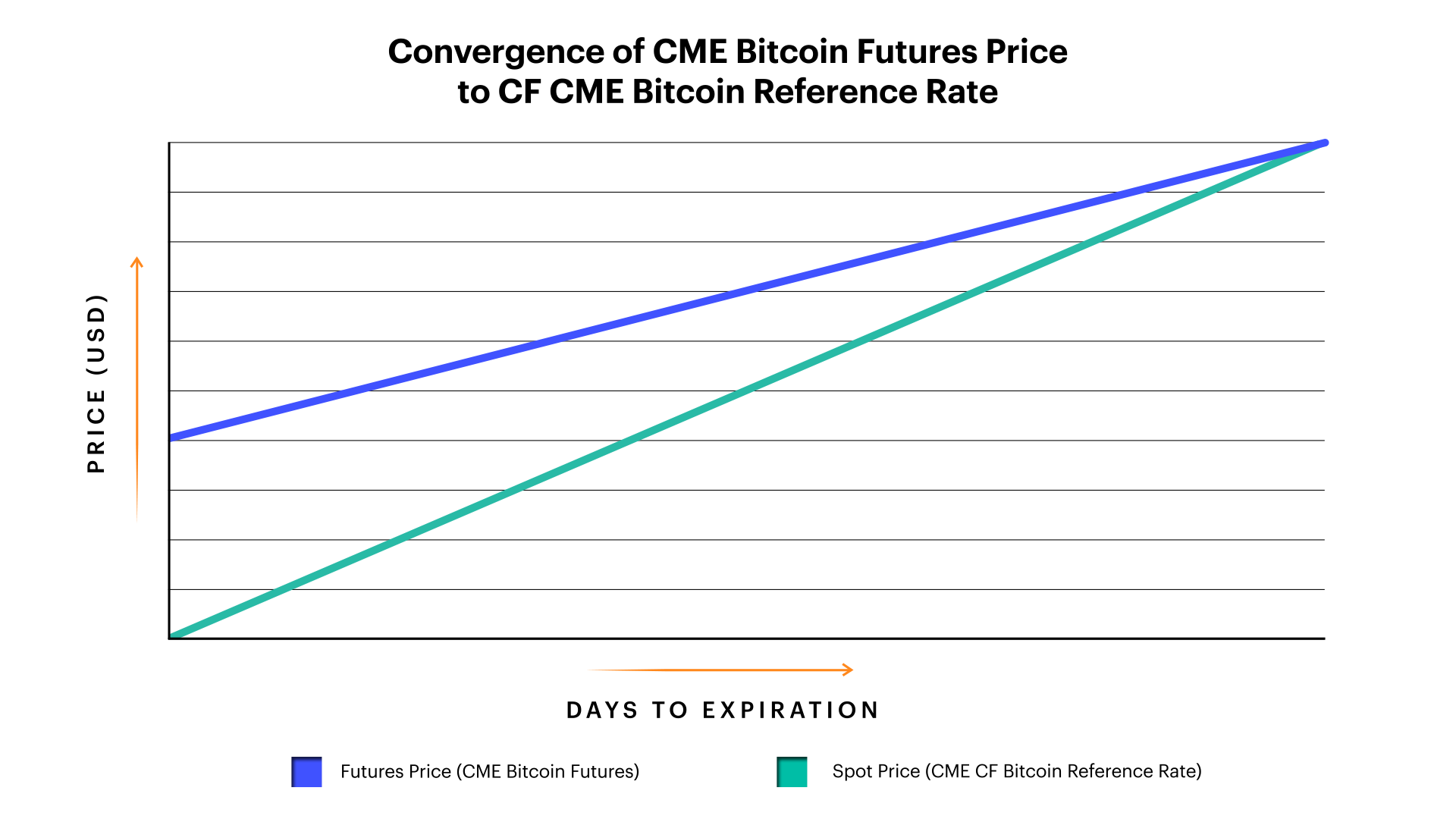

At its core, a basis trade involves simultaneously taking positions in the spot market and the futures market for the same asset. The objective is to profit from the convergence of the spot and futures prices at the expiration of the futures contract. When the futures price is higher than the spot price (known as a positive basis), traders typically buy the underlying asset and sell the corresponding futures contract. Conversely, when the futures price is lower than the spot price (a negative basis), traders sell the asset and buy the futures contract.

The success of a basis trade hinges on the expectation that the futures price will converge towards the spot price as the contract approaches maturity. This convergence allows traders to lock in the price difference as profit, while hedging against potential price fluctuations in the underlying asset.

Institutional Involvement in Basis Trades

Basis trades are primarily executed by institutional investors, such as hedge funds, proprietary trading firms, and large financial institutions. These entities leverage their substantial capital and sophisticated trading tools to identify and exploit market inefficiencies. Market makers and arbitrageurs also engage in basis trades, employing advanced strategies to profit from the convergence of futures and spot prices.

The participation of institutional investors in basis trades contributes to improved market efficiency and liquidity. By actively trading on price discrepancies, these entities help to narrow the gap between spot and futures prices, promoting more accurate price discovery and reducing market fragmentation.

The Interplay of Spot Bitcoin ETFs and Futures Markets

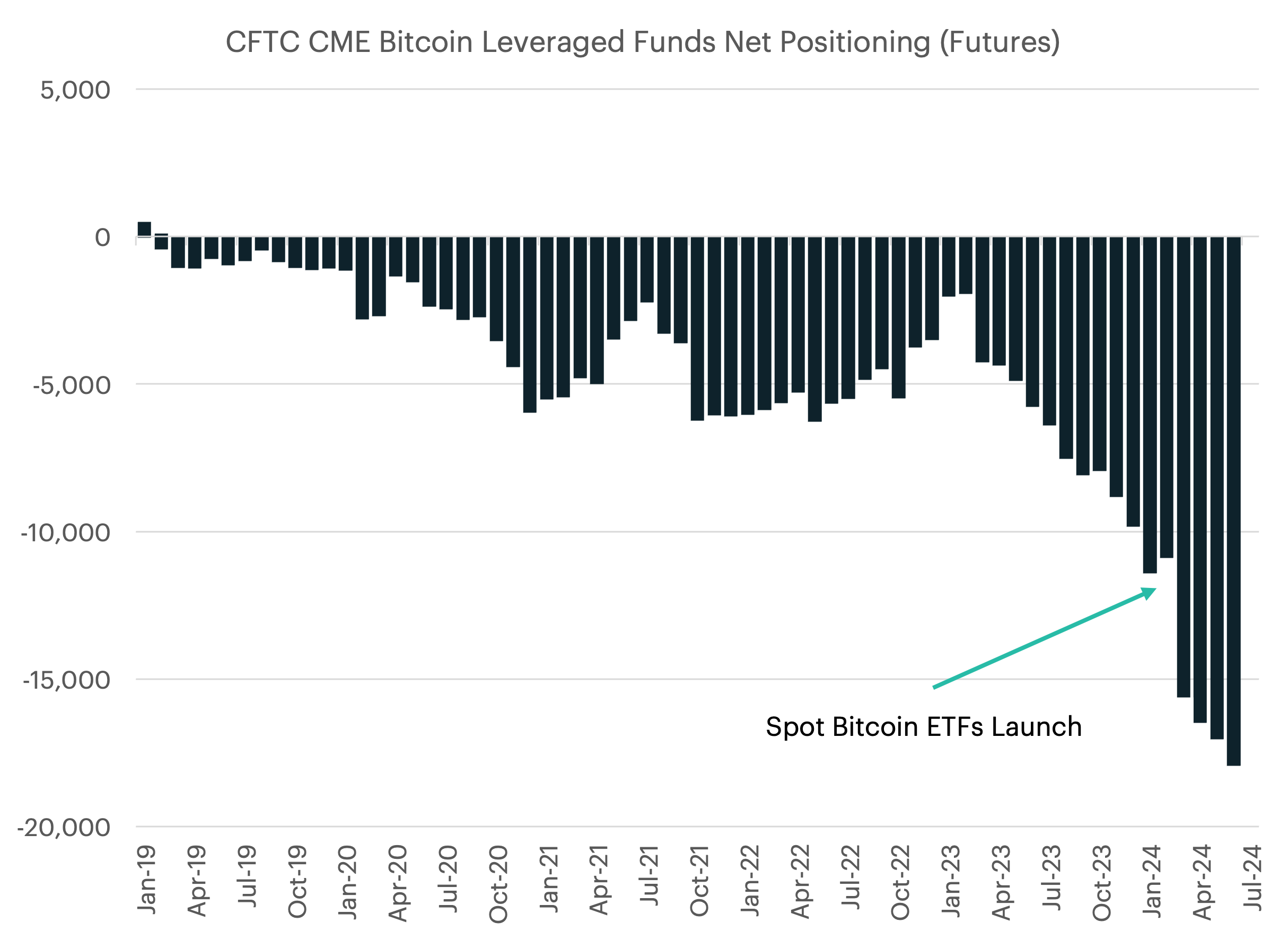

The recent launch of spot Bitcoin exchange-traded funds (ETFs) has had a significant impact on the dynamics of basis trades in the cryptocurrency market. These ETFs provide institutional investors with a more accessible and regulated avenue to gain exposure to spot Bitcoin, enabling them to capitalize on positive basis opportunities.

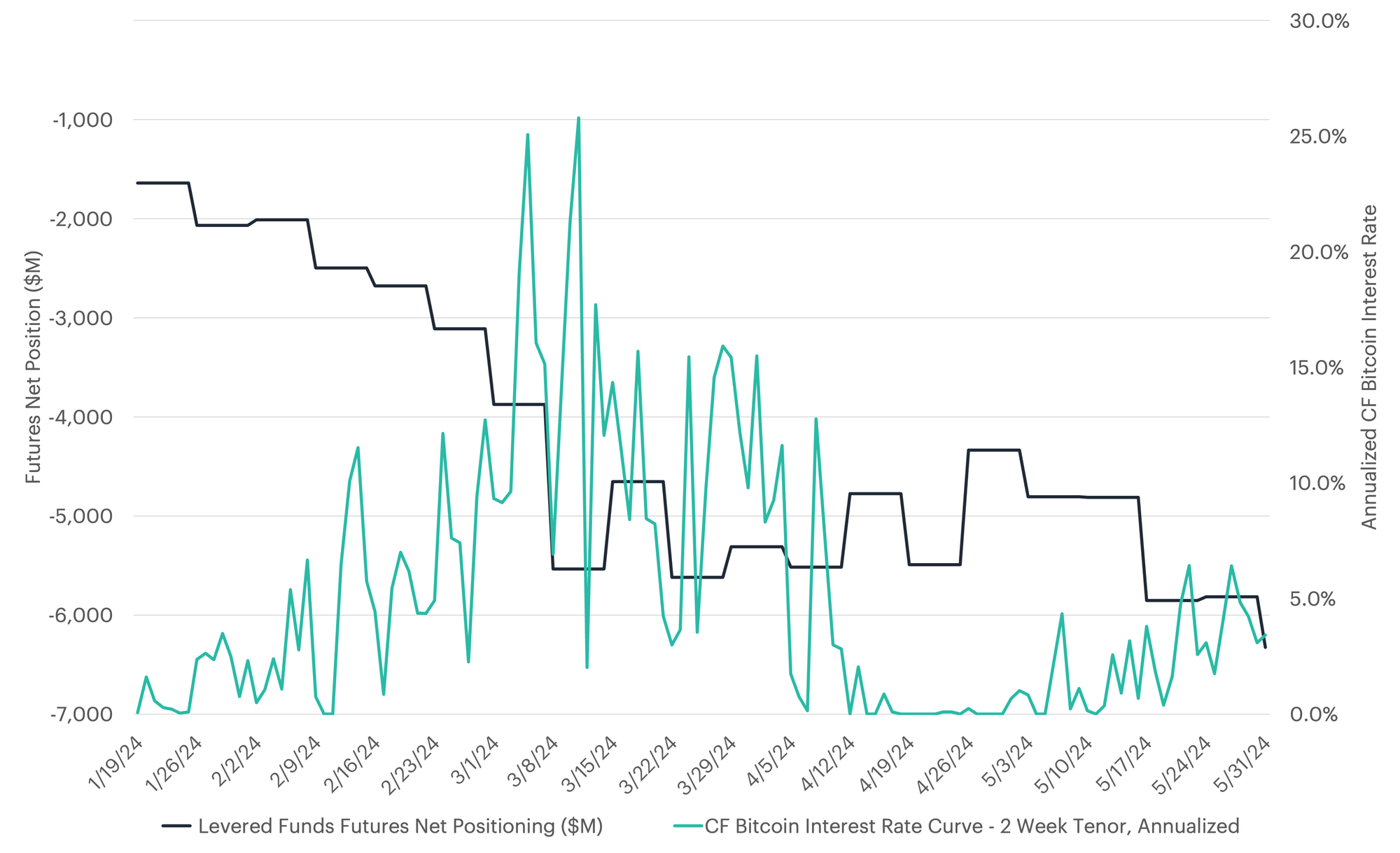

Since the introduction of spot Bitcoin ETFs, the CME Bitcoin Futures market has witnessed a notable increase in net short positioning among levered funds. This surge in short positions has coincided with an upward shift in the short-term tenors of the CF Bitcoin Interest Rate Curve (BIRC). For instance, in March 2024, the 2-week tenor on the BIRC reached 25%, indicating a significant premium of futures prices over the spot price. Concurrently, the CME Bitcoin futures market saw an addition of $1.6 billion on the short side, suggesting that institutional investors were actively engaged in basis trades, anticipating a convergence of futures and spot prices.

Conversely, in mid-April, when the BIRC dropped to 0%, the futures market recorded over $1 billion in net long positions. This shift likely reflects the closing out of basis trades initiated in the preceding weeks, as traders sought to realize profits from the convergence of spot and futures prices.

The Role of Price Singularity in Facilitating Arbitrage

The alignment of price benchmarks between spot Bitcoin ETFs and CME futures contracts plays a crucial role in enabling precise arbitrage opportunities. Six of the spot Bitcoin ETFs utilize the CME CF Bitcoin Reference Rate - New York Variant (BRRNY) to determine the Net Asset Value (NAV) for creation and redemption. Simultaneously, CME futures contracts settle using the same reference rate. This synchronization ensures that both instruments are inherently linked to the same price benchmark, facilitating more efficient basis trades.

The establishment of robust and replicable price benchmarks enhances market transparency and reduces the risk of price discrepancies arising from disparate valuation methodologies. This, in turn, fosters a more level playing field for market participants and encourages greater liquidity in both spot and futures markets.

Bitcoin futures basis fluctuations offer market participants opportunities to optimize exposure. Investors with long Bitcoin positions can tactically sell futures contracts against their holdings, generating cash yield similarly to covered call strategies in options trading. However, unlike covered calls, short futures positions don't obligate Bitcoin holders to sell their assets, providing more flexibility. This delta-neutral approach benefits various market conditions. During bullish movements, a widening basis allows traders to roll futures contracts forward, arbitraging the higher basis. Conversely, in a Bitcoin sell-off, the typically compressed futures basis enables profitable closing of futures positions, offsetting losses on long Bitcoin holdings and reducing downside capture. Hedge funds employing this strategy may improve their Sortino ratio, a risk-adjusted performance ratio that focuses only on downside risk, by lowering downside volatility through tactical short futures positions.

Implications for Market Liquidity and Price Discovery

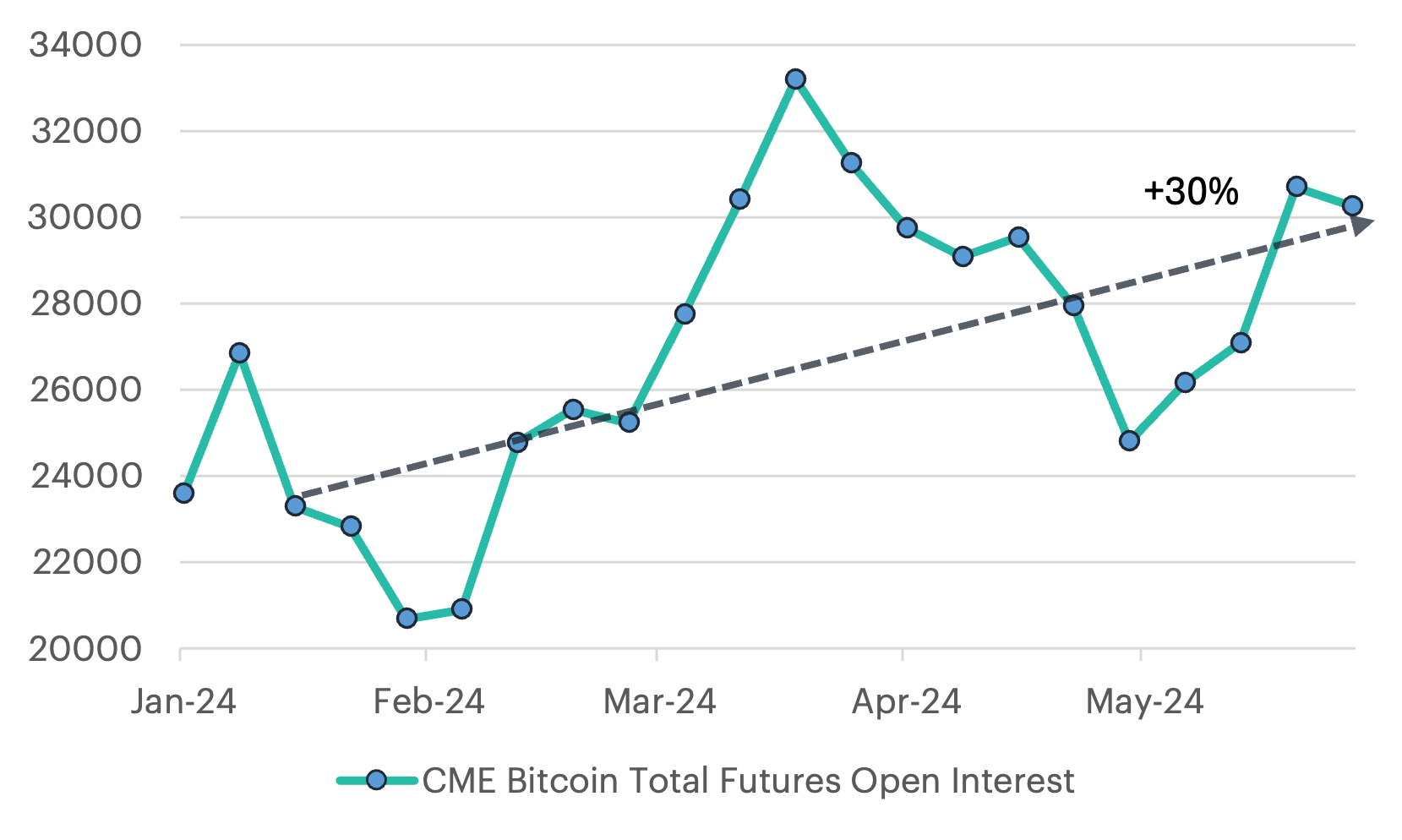

As more institutional investors engage in basis trades, the liquidity landscape of the Bitcoin futures market is expected to evolve. Open interest on Bitcoin futures has already witnessed a 30% increase since the launch of spot Bitcoin ETFs, with a significant concentration of volume at the short end of the futures curve. This trend suggests that traders are actively arbitraging the basis at shorter maturities, seeking to capitalize on the convergence of spot and futures prices.

In Summary

Basis trades are expected to remain a significant driver of activity, with institutional investors capitalizing on price discrepancies between spot and futures markets, particularly following the launch of spot Bitcoin ETFs. This growing engagement of sophisticated participants contributes to enhanced liquidity, efficient price discovery, and price convergence.

As traders continue to seek to arbitrage the basis at various points along the futures curve, liquidity is expected to extend to longer-dated contracts, akin to the dynamics observed in other cash-settled futures markets for financial assets. The alignment of regulated price benchmarks across spot ETFs and futures contracts, combined with increased institutional participation, fosters a more robust and interconnected market ecosystem.

Looking forward, the potential expansion of basis trading strategies to other cryptocurrencies, such as Ethereum, may entice market participants to engage in basis trades. The upcoming launch of spot Ether ETFs is poised to introduce similar trading opportunities in the Ethereum market, likely driving an increase in open interest on CME Ether futures.

Investors and arbitrageurs should continue to monitor these dynamics for potential opportunities for alpha generation and effective risk management in the evolving market landscape.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks