Jul 15, 2024

Expansion of the CME CF Cryptocurrency Pricing Products Family to include two new Digital Assets

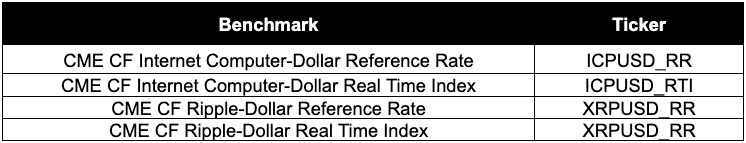

The Administrator hereby announces the addition of two Cryptocurrency Reference Rates and Real-Time Indices to the CME CF Cryptocurrency Pricing Products Family:

Each reference rate will publish the U.S. dollar price of the digital asset once a day at 16:00 London time. Each respective real-time index price will be published once a second, 24 hours a day, 365 days per year.

Publication of these reference rates and real-time indices will commence on July 29th, 2024.

For licensing enquiries please contact [email protected]

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks

Not All Cryptos Are the Same: How CF Factor Data Reveals Sensitivities Across the Digital Asset Taxonomy

We show how combining the CF DACS taxonomy with the CF Factor Data Series reveals sensitivities that enable institutional-grade returns attribution, risk monitoring and strategic implementation.

CF Benchmarks

Factor Friday

The defensive regime remains firmly in control. Downside Beta continues to dominate while Growth and Value have continued to lag since October. Momentum's recent surge and The Settlement category's relative resilience are the two threads worth pulling on this week.

Mark Pilipczuk