Apr 02, 2024

CF Benchmarks submits Comment Letters to the SEC in support of spot Ether ETF filings

CF Benchmarks files data and analysis that place Ethereum on the same regulatory footing as Bitcoin, according to regulator's own precedent

We've written a lot of letters

As the first regulated crypto Benchmark Administrator, CF Benchmarks has frequently lent its extensive track record of research into price behaviour, and experience of creating compliant pricing sources, to institutional and official parties involved in bringing digital assets into the realm of regulated markets.

This expertise has often been provided in the form of written submissions to regulatory authorities, in support of partners seeking approval of their regulated products.

Specifically, CF Benchmarks has submitted several contributions over the years - including Comment Letters - to the U.S. Securities and Exchanges Commission (SEC), as it was reviewing applications to list the first spot Bitcoin ETFs.

Legacy submissions: BRR and BRRNY

The rationale underlying these submissions, and the data which accompanied them, were largely based on CF Benchmarks’ regulated CME CF Bitcoin Reference Rate – New York Variant (BRRNY). The BRRNY is an index within our Bitcoin price series. On aggregate, these indices are referenced by the highest proportion of institutional capital that references any set of Bitcoin benchmarks. The indices have the longest demonstrable track record of accuracy and manipulation resistance of any Bitcoin pricing sources.

Following the SEC's approval of spot Bitcoin ETFs late in 2023, we believe our perspective and quantitative data were instrumental in successfully making the case for viable, secure, exchange traded cryptocurrency funds that are capable of comprehensive regulatory look-through.

Eyeing Ether ETFs

Now, as our partners, markets, and the public look towards the next potential digital asset that could become widely available via the ETF wrapper, Ethereum, CF Benchmarks is again uniquely positioned to define cogent regulatory grounds for Ethereum to be made accessible to the investing public within exchange traded funds.

As such, we have formally submitted our views, in the form of ‘Comment Letters’, to the Securities and Exchanges Commission, as we participate in the commission’s request for comments as it reviews applications to list spot Ether ETFs.

It's all about ETHUSD_NY

As with Comment Letters submitted on behalf of spot Bitcoin ETF applicants, the Comment Letters we've sent to the SEC in relation to spot Ethereum ETF applications, are intended to support issuers utilising a regulated CF Benchmarks Reference Rate to calculate the Net Asset Value (NAV) of their Ethereum funds.

In these cases, the index is the regulated CME CF Ether-Dollar Reference Rate - New York Variant (ETHUSD_NY).

ETHUSD_NY is identical to the regulated CME CF Ether-Dollar Reference Rate (ETHUSD_RR) in all but one respect: ETHUSD_RR references the price of Ether at 16:00 London Time, whilst ETHUSD_NY references the price at 16:00 New York Time.

Similar to its Bitcoin counterpart, ETHUSD_RR is demonstrably the most liquid and trusted institutional price of Ether. It is the price to which the CME Group has settled tens of billions of dollars worth of CFTC-regulated Ether futures and options contracts since these began to be available for trade in February 2021. It also serves as the benchmark price for ETPs and OTC contracts offered by several firms around the world.

What is a Comment Letter (and a Proposed Rule Change)?

A Comment Letter is simply a written submission to the SEC providing the submitter's opinion. Comment Letters may be submitted to the SEC by any individual, or commercial or institutional entity with regards to a Proposed Rule change.

Proposed Rule Changes include applications by self-regulatory organisations, specifically stock exchanges, to add securities noted within the Proposed Rule Changes to instruments that can be traded on those respective stock exchanges.

Together with a separate set of documents that must be submitted by fund issuers themselves, Proposed Rule Changes are an integral part of the application process.

When, and for whom

Comment Letters can be submitted at any time with regards to a Proposed Rule Change. Often however, the Commission officially requests submissions of public opinion in the form of Comment Letters within responses to applicants indicating that it requires more time to consider an application.

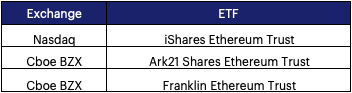

CF Benchmarks has recently provided Comment Letters with regards to Proposed Rule Changes from the exchanges and respective proposed funds below:

In the interests of transparency, and to help facilitate broader public awareness of the application processes, CF Benchmarks has decided to publish the Comment Letters referred to above more widely.

What it says

Summary of the Comment Letter's contents:

- Examination of the SEC's order approving spot Bitcoin ETFs "as the best guide" of the standard required for Ether ETP approval under the Securities and Exchange Act 1934

- Determination by regulatory precedent alone that ETH is a commodity, a prerequisite for the "designation of the proposed ETP shares as commodity trust shares", per Bitcoin ETFs

- Examination of whether standards set out in Section 6(b)(5) of the Securities and Exchange Act 1934 can be met by exchanges wishing to list Ether ETFs, including:

- Establishment of the existence of a surveillance sharing agreement between listing exchanges, and the ETH "market of significant size" - the CME Ether Futures market

- Demonstration, through correlation analysis, that major spot ETH exchange returns and returns of CME ETH Futures (which settle to ETHUSD_RR) are highly correlated

- Conclusion

Given the that the Proposal is correctly classified as the listing of commodity trust shares, and that the Exchange has in place what is necessary to uphold the requirements of the Securities & Exchange Act 1934 Section 6(b)(5), the conclusion is that the Proposal should be approved.

- Note: source code and data for this analysis may be downloaded below

Accessing The Comment Letter and accompanying resources

The Letter

The three Comment Letters are essentially identical, though they have been adapted in each case to refer specifically to the respective issuer and Ethereum Fund that they were submitted on behalf of.

For an example, the Comment letter submitted on behalf of Franklin Templeton Investments' Franklin Ethereum Trust is titled:

'Comment Letter regarding a proposed rule change to list and trade shares of the Franklin Ethereum Trust under BZX Rule 14.11(e)(4), Commodity-Based Trust Shares, pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 and Rule 19b-4 thereunder.'

It has been published on the SEC's website and can be readily viewed or downloaded by clicking this link.

The data

Additionally, for complete transparency, CF Benchmarks has also made the transaction data and the source code (in Python) of the correlation analysis available, for anyone wishing to replicate the research.

Click below to download the data and source code.

Comments welcome

We encourage anyone interested in the continued adoption of digital assets by increased integration into the broader regulated financial system, to read the letter, and if at all possible, repeat our analysis for themselves, in order to corroborate our findings and conclusions. Comments are welcome!

Additional Resources

Index pages

Proposed Rule Change filings

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks