Feb 18, 2022

CF Benchmarks Recap - Issue 46

-

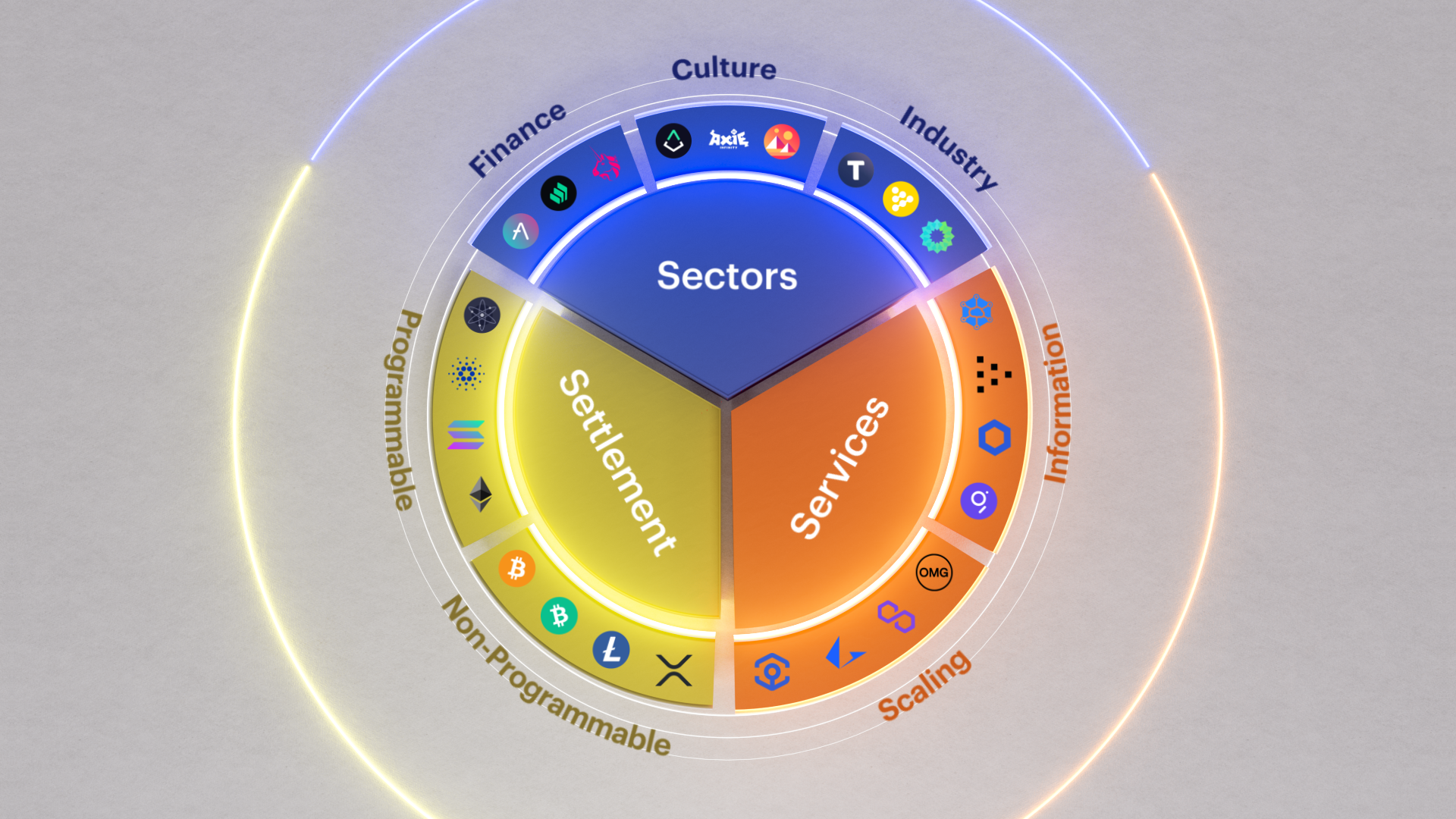

CF Digital Asset Classification Structure: The Compact Primer

-

How CF DeFi Composite Index powers Hashdex’s DEFI11 ETF

-

CFB SOL and ETH prices land on DIA oracle platform

Blackrock eyes 'outright crypto'

Not unusually, institutional resolve is more confident than the cautious market comeback suggests. BTC’s Jan low is holding. BRTI marked $32,977.44 on 24/01/2022 at 13:00:34 UTC. vs. $40,597.19, down 7.57%, at time of writing. ETHUSD_RTI notched $2,160.42 at 14:09:07 and was down 7.69% at $2,884.74 just ahead of publication. Meanwhile, BlackRock, which has been exploring the space for over a year, looks to “get hands-on with outright crypto.” (Making iShares’ ‘Blockchain’ ETF look like an hors d'oeuvre). More broadly, $1.19bn was earmarked for digital asset funding in the week to Feb 11 alone. There’s a ‘dead horse’ aspect in highlighting price/adoption mismatches, but countervailing forces call for balance. See falling chances of a cryptoasset-dedicated regulator, as the CFTC buffs the breadth of its authority; and the SEC continues to telegraph its own. Elsewhere, 'stablecoin hearings' are the “likely vector by which the U.S. government will implement” crypto regulations, according to Chainalysis. Which again underscores why high-quality benchmarks and methodologies are vital. Our new CF Digital Asset Classification System (CF DACS) and continual push to broaden access to benchmark prices are just two ways we pursue that end. Read our CF DACS Compact Primer and about our partnership with open-source oracle platform DIA, below.

‘$1 trillion metaverse’ and other opportunities

The height of ephemeral frivolity, or a $1 trillion opportunity? JPMorgan suggests the latter in its “Opportunities in the metaverse” report, whilst adopting positions on several more digital asset hot topics of late. Other observations include that $54bn is transacted on virtual goods annually, and that the NFT market cap is $41bn. These corroborate the urgent need for our CF Digital Asset Classification Structure, including its ‘Culture’ segment, for cogent investment decisions in the space. JPM’s long-term BTC valuation is similarly bullish: ~$150k vs. early-Feb FV of $38k. Like all forecasts, it excludes volatility effects, but these haven’t deterred more large corporates from adding BTC to treasury, most recently KPMG Canada.

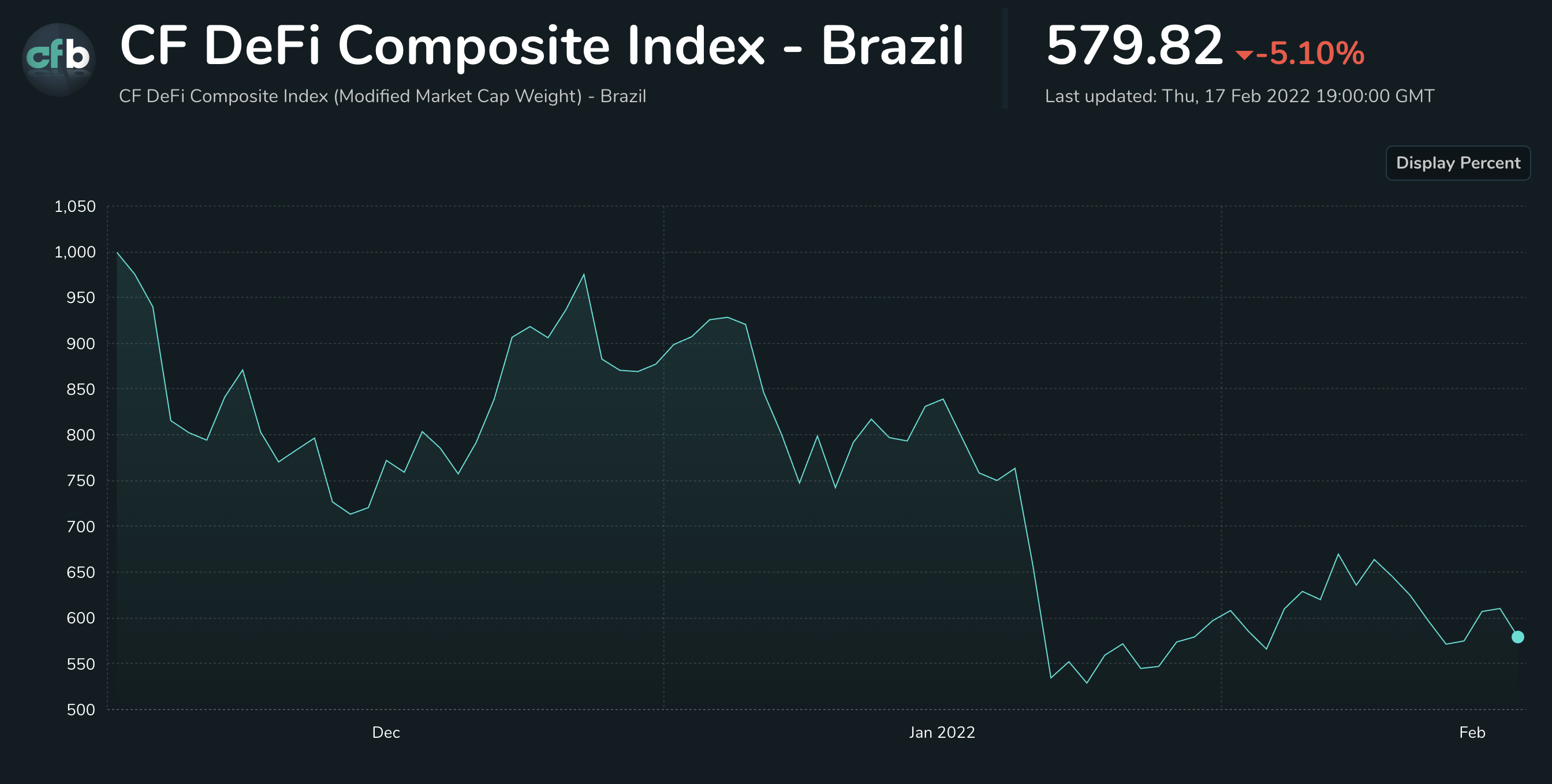

Hashdex DEFI11 now; Aussie crypto ETF soon, says ASX

The ASX has flagged more crypto-related listings after Block (formerly Square Inc.)’s Aussie shares began trading last month. More groundwork for the BTC and ETH ETFs expected to eventually float in Sydney after ASIC published CFB-based crypto guidelines last year. Among current listings, Hashdex’s pioneering DEFI11 ETF, powered by CF DeFi Composite Index, debuted on Sao Paolo’s B3 on Feb 17. In Europe, Fidelity International’s Fidelity Physical Bitcoin ETP (FBTC) also launched this week. The Fidelity affiliate follows in the footsteps of Fidelity Advantage Bitcoin ETF, that floated in Toronto in December.

The Returns: CF DeFi Composite Index’s Three ‘Versions’

Hashdex’s DEFI11, the world’s first pure-play DeFi ETF, also spotlights its reference index, CF DeFi Composite Index. Three ‘versions’ of the same instrument aim to facilitate typical NAV strike times in three key markets, Brazil, where DEFI11 is listed, the U.S. and the UK. Find out more about CF DeFi Comp’s methodology by clicking here.

Featured benchmarks: CF DACS, CF DeFi Composite Index

DIA and CF Benchmarks make compliant digital asset indices available as oracles to Web3 economy

(Zürich, Switzerland / London, United Kingdom) DIA, the open-source data platform for decentralised finance and the UK FCA-regulated crypto index provider CF Benchmarks announced that they will make CF Benchmarks’ crypto index reference prices available via the DIA oracle suite.

With a total settlement volume of more than $500bn since its inception in 2017, UK-based CF Benchmarks Ltd is the world’s leading crypto index provider. Acquired in 2019 by the global digital asset exchange Kraken, CF Benchmarks provides reference rates that are tracked by ETFs and ETPs listed on exchanges around the globe, including Canada, Brazil, Switzerland and Germany.

Announcement continues on our website.

VIDEO: CF DeFi Composite Index

Get under the hood of the CF DeFi Composite Index in just 2 and a half minutes, with our beautifully produced video. It explains the rationale underlying CF DeFi Comp’s construction, how it’s informed by and elaborates on our unique CF Digital Asset Classification Structure, and a lot more.

Click below to watch.

CF Digital Asset Classification Structure: The Compact Primer

Learn how to use the most important tool yet for understanding and investing in the digital asset universe - fast

Essential tool

The statement that CF Benchmarks’ recently launched CF Digital Asset Classification Structure (CF DACS) is one of the most notable junctures in years for adoption of the emerging asset class, is a difficult one to argue against.

CF DACS brings institutional-grade definition and differentiation to the numerous nascent and often rapidly developing concepts in the space, from a UK FCA authorised Benchmark Administrator, for the first time.

That means the structure has quickly become an essential tool for investors seeking improved clarity in their understanding of the digital asset universe, with the ultimate aim of optimising their portfolio construction process.

This particularly applies to institutional market participants, who are obliged to meet stringent internal and regulatory criteria throughout the allocation process.

Simple, by design

As shown in our comprehensive introductory article on CF DACS, the structure is, in essence, simple.

It’s three-part design is intended to be instantly visualisable – and in turn, readily understandable.

(Read on here.)

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks