Sep 05, 2023

CF Benchmarks Quarterly Attribution Reports - September 2023

Spot filings & court rulings whipsaw markets as macro uncertainty loom

The next wave of institutional adoption may be around the corner. Recent filings from leading asset managers have increased the possibility of a spot Bitcoin exchange-traded fund (ETF), which has helped bring renewed interest and optimism into digital assets. Bitcoin prices breached the $30K mark for the first time since April, before retracing back to the $25K-$28K range. The implications of a spot ETF for both the industry and Bitcoin itself are profound. For the first time, clients and advisors across the United States will have access to an investment vehicle that offers pure exposure to Bitcoin in a readily accessible, exchange-listed product that offers high liquidity, complies with regulations, is tax-efficient, and eliminates the operational risks of maintaining private cryptographic keys.

While the approval of a spot Bitcoin ETF is still pending, recent court rulings have indicated that U.S. regulators must reconsider the grounds of their previous rejections of such financial products. These judicial decisions have been critical for investors and institutions who have been seeking regulatory clarity. Furthermore, in July, a federal judge ruled that Ripple's XRP token may not always be considered an investment contract or security. This would imply that the current regulatory securities framework may not be applicable to such tokens, something that many crypto industry proponents have been arguing for years.

In the macro environment, following the most aggressive Fed hiking cycle in almost four decades, optimism for a soft landing has begun to permeate through to more bullish pricing sentiment across most risk assets. The US economy has proven more resilient than many anticipated, with growth forecasts trending higher over the next few quarters. This is despite the banking sector turmoil earlier in the year and the more recent debt-ceiling standoff that resulted in a credit rating downgrade. However, the global economy faces a series of complex challenges through the remainder of 2023. Inflation rates in most developed markets are still unacceptably high for monetary policymakers, and it appears this pricing pressure is likely to linger.

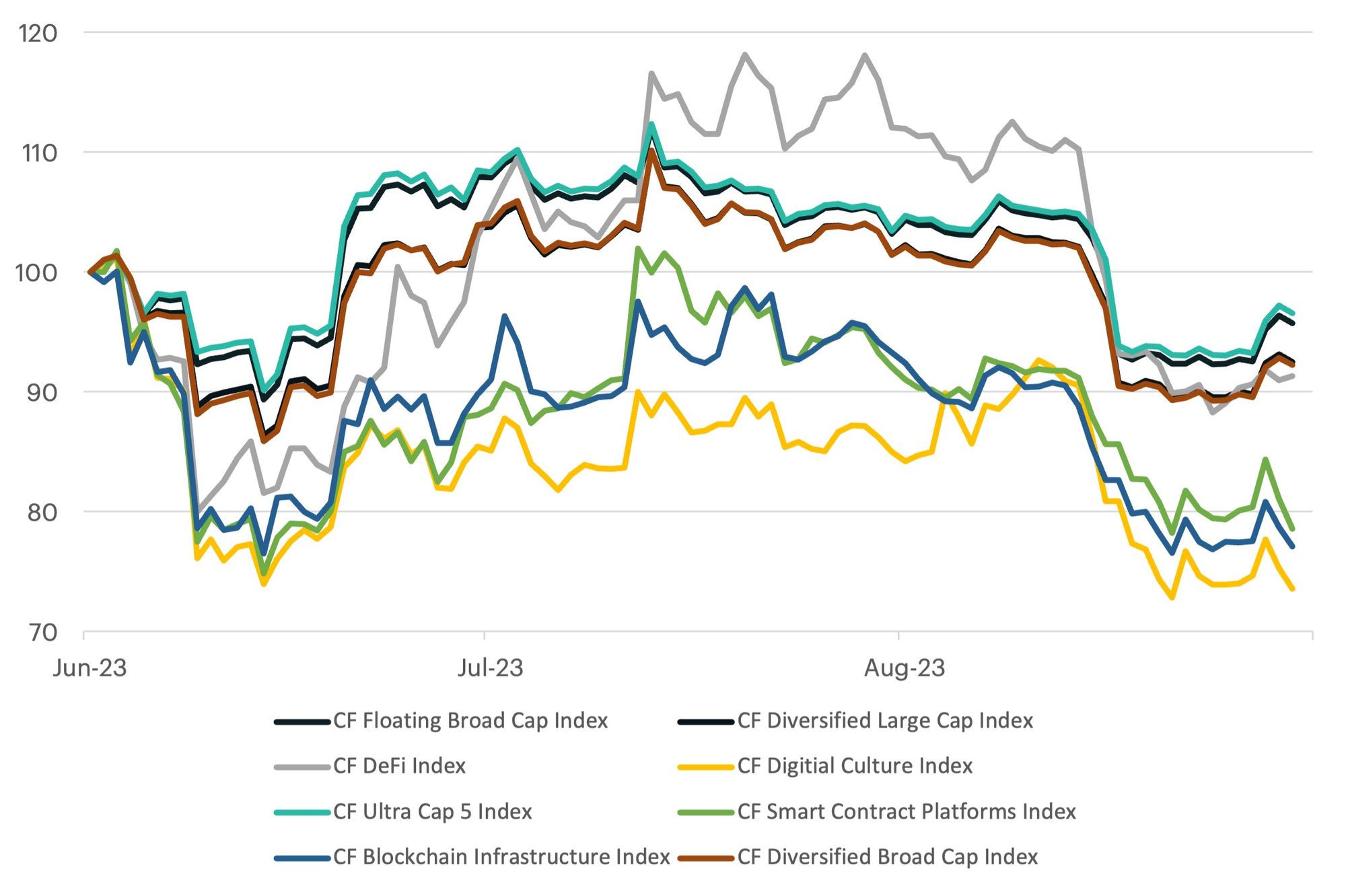

The negative sentiment in the second half of the rebalancing period led to more defensive price action, which resulted in mega cap token resilience. This dynamic enabled our capitalization series, namely the CF Ultra Cap 5 and Floating Broad Cap indices, to relatively outperform the rest of our benchmarks. On the other hand, the CF Digital Culture Composite and Blockchain Infrastructure Indices ended the rebalancing period as the group's worst performers.

Index Performance

To read the full compilation report or a specific index's report, please click on the respective links below:

- Quarterly Attribution Report (PDF Version)

- CF Broad Cap Index Series

- CF Cryptocurrency Ultra Cap 5 Index

- CF Diversified Large Cap Index

- CF DeFi Composite Index

- CF Web 3.0 Smart Contract Platforms Index

- CF Digital Culture Composite Index

- CF Blockchain Infrastructure Index

Lastly, our Quarterly Attribution Reports are designed to help investors understand the performance of digital assets through a purpose-centric lens called the CF Digital Asset Classification Structure (CF DACS). To learn more about CF DACS, please utilize our interactive CF DACS Token Explorer.

Contact Us

Have a question or would like to chat? If so, please drop us a line to:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Digital Asset Index Family Multi Asset Series Reconstitution Announcement

The Administrator announces that the Reconstitution of the CF Digital Asset Index Family Multi Asset Series will take place on March 2nd 2026.

CF Benchmarks

Nasdaq Crypto Index Family - Reconstitution Announcement

The Calculation Agent announces that the reconstitution of the Nasdaq Crypto Index Family will take place on March 2nd 2026.

CF Benchmarks

Monochrome's Jeff Yew and Grayson McLeod on What Makes a True Spot Crypto ETF, Asia Expansion and More

With IBTC recently passing US$100 million in AuM and Monochrome now expanding in South-East Asia, we're stoked to sit down with Monochrome CEO Jeff Yew and Chief Operating Officer Grayson McLeod.

Ken Odeluga