Oct 03, 2025

CF Benchmarks Newsletter Issue 92

- CME announces 24/7 crypto trading, as open interest surges

- CF Benchmarks makes on-chain debut in Reserve Protocol’s LCAP DTF

- REX-Osprey’s ’40 Act formula mints US ETH staking ETF, powered by CFB

Portfolio

There’s little doubt the pulse of the product issuance in the U.S. that quickened in the wake of the approval of Generic Listing Standards (GLS) last month, remains sharply in focus, with those developments most anticipated to follow, duly confirmed, or showing strong signs of materializing.

As expected, Grayscale’s CoinDesk Crypto 5 ETF (GDLC) was first out of the gate, stealing a march on a clutch of rival multi-asset filings, while simultaneously affirming their path to market.

GDLC’s holdings at launch, including ADA, XRP and SOL, as well as BTC and ETH, are instructive. There are no ’33 Act spot XRP, SOL, nor Cardano (ADA) ETPs as yet, though all of those assets are now available to trade on Designated Contract Markets (DCM).

This means GLDC constituents (assets and weights here, as reported by Blockworks) provide final validation of the GLS principle of implied, rather than express permission. That's a definitive green light for issuers teeing up their own multi-token offerings, including several proposing to lean on CF Benchmarks’ regulated index methodology for asset pricing.

Hashdex NCIQ expands

Among these, Hashdex looks set to be among the first firm with an existing multi-asset mandate, via the Hashdex Nasdaq Crypto Index US ETF (Ticker: NCIQ) listed in February, that will expand an existing portfolio with additional assets. (Till now, U.S. crypto portfolios could only invest in Bitcoin and Ether). In Hashdex's case, it will add XRP, SOL and XLM, to NCIQ's existing holdings in BTC and ETH. As per all Hashdex Nasdaq Crypto Index funds, listed in various domiciles, CF Benchmarks serves as their calculation agent for reference pricing.

Indexing in focus

Meanwhile, as suggested by the clip below, from a recent CF Benchmarks and Bitwise joint webinar, featuring Bitwise Head of Research, Ryan Rasmussen, early movers are likely to stress index construction as a differentiator.

Click below to catch the full webinar.

With allocators looking poised to treat multi-asset funds as a core sleeve for crypto, it's also likely that bar has been raised in favor of proven, 'worry-free' index methodologies. Chiefly, those incorporating rules-based eligibility screens, liquidity filters and rebalancing, alongside replication practicality, and, of course, manipulation-resistance.

Whether packaged within our numerous portfolio indices, or as single assets for customized constitution, CF Benchmarks' regulated indices continue to fit the bill.

SOL tops solo chances

Among single-asset prospects, a raft of amended Solana filings points to SOL ETFs as a likely cohort for the next mass, or at least tightly grouped, approval.

The updated paperwork has been documented by Bloomberg's ETF sentinels in the usual way.

NEW: Bunch of updated filings for the Solana ETF prospectuses. Signs of movement from issuers and the SEC. pic.twitter.com/2XXaXct6w7

— James Seyffart (@JSeyff) September 26, 2025

Multiple prospective issuers (e.g., Bitwise, 21Shares, Franklin) indicate intent to use the CME CF Solana-Dollar Reference Rate – New York Variant for pricing.

As is often the case, due to space and time constraints, we can only skim the top of a string of recent product-related highlights as the focus of the rest of this edition.

- These include an adjacent echo of the growing multi-asset trend, as our CF Large Cap (Free Float Market Cap Weight) - US - Settlement Price becomes the first regulated portfolio index to be incorporated into a tokenized DeFi basket.

- CME Group closes the chapter on almost 230 years of tradition, with crypto contracts set be the venue operator’s first non-stop trading products, all settling to CF Benchmarks indices.

- Plus, another first from REX-Osprey within the ’40 Act framework, this time bringing direct ETH staking rewards to Wall Street, with our ETHUSD_NY designated as ETH reference price.

CME flags continuous crypto trading

Pending regulatory review, CME Group crypto futures and options will become available "24 hours a day, seven days a week, beginning in early 2026."

Although the group's announcement doesn't specify which assets will be included in round-the-clock trading, the suggestion is all CME crypto contracts, including the ones launched most recently, providing exposure to XRP and SOL, as well as longer established BTC and ETH contracts, will join the expanded trading window. (XRP and SOL options are set to launch on October 13th.)

All CME Group cryptocurrency derivatives and related products settle to regulated CF Benchmarks reference rates.

The release details "a two-hour weekly maintenance period" for weekends. Additionally, "All holiday or weekend trading from Friday evening through Sunday evening will have a trade date of the following business day, with clearing, settlement and regulatory reporting processed the following business day as well."

"Client demand for around-the-clock cryptocurrency trading has grown as market participants need to manage their risk every day of the week. Ensuring that our regulated cryptocurrency markets are always on will enable clients to trade with confidence at any time."

Tim McCourt, Global Head of Equities, FX and Alternative Products at CME Group, quoted in CME's press release.

The move is the latest example of CME's accelerated pace of crypto-related initiatives, which has emerged in step with a more accommodative regulatory atmosphere seen over the last several months.

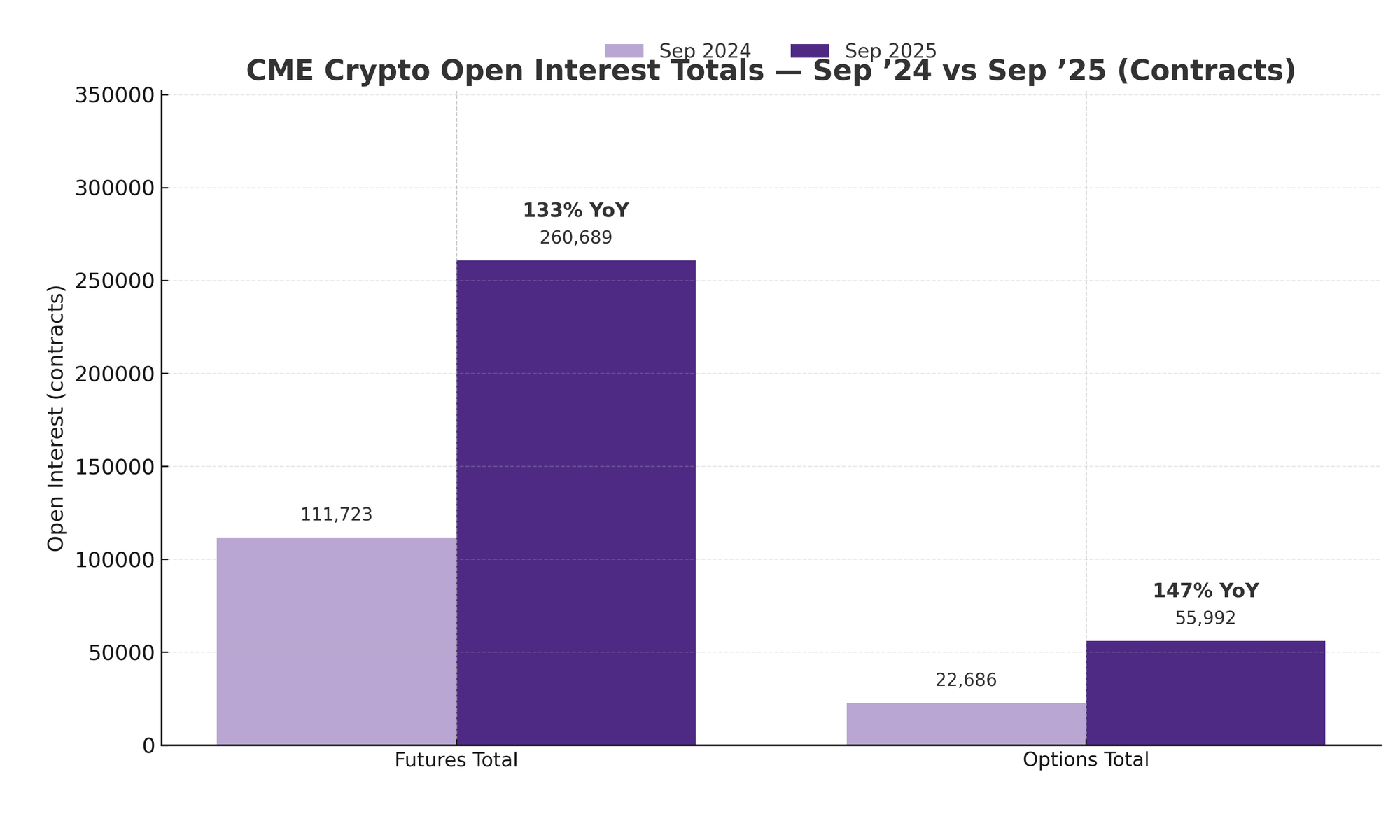

Meanwhile, the decision also coincides with a recent run of record volume and open interest across CME's crypto product suite, as summarized below.

- Total notional crypto open interest: $39 billion (September 18th)

- August average daily open interest: 335,200 contracts, +95% year on year

- August average daily volume (ADV): 411,000 contracts, +230% year on year

- Large open interest holders (LOIH): >1,010, across crypto products in the week to September 25

The graphic below underscore that the move to 24/7 crypto product trading is timely, to say the least.

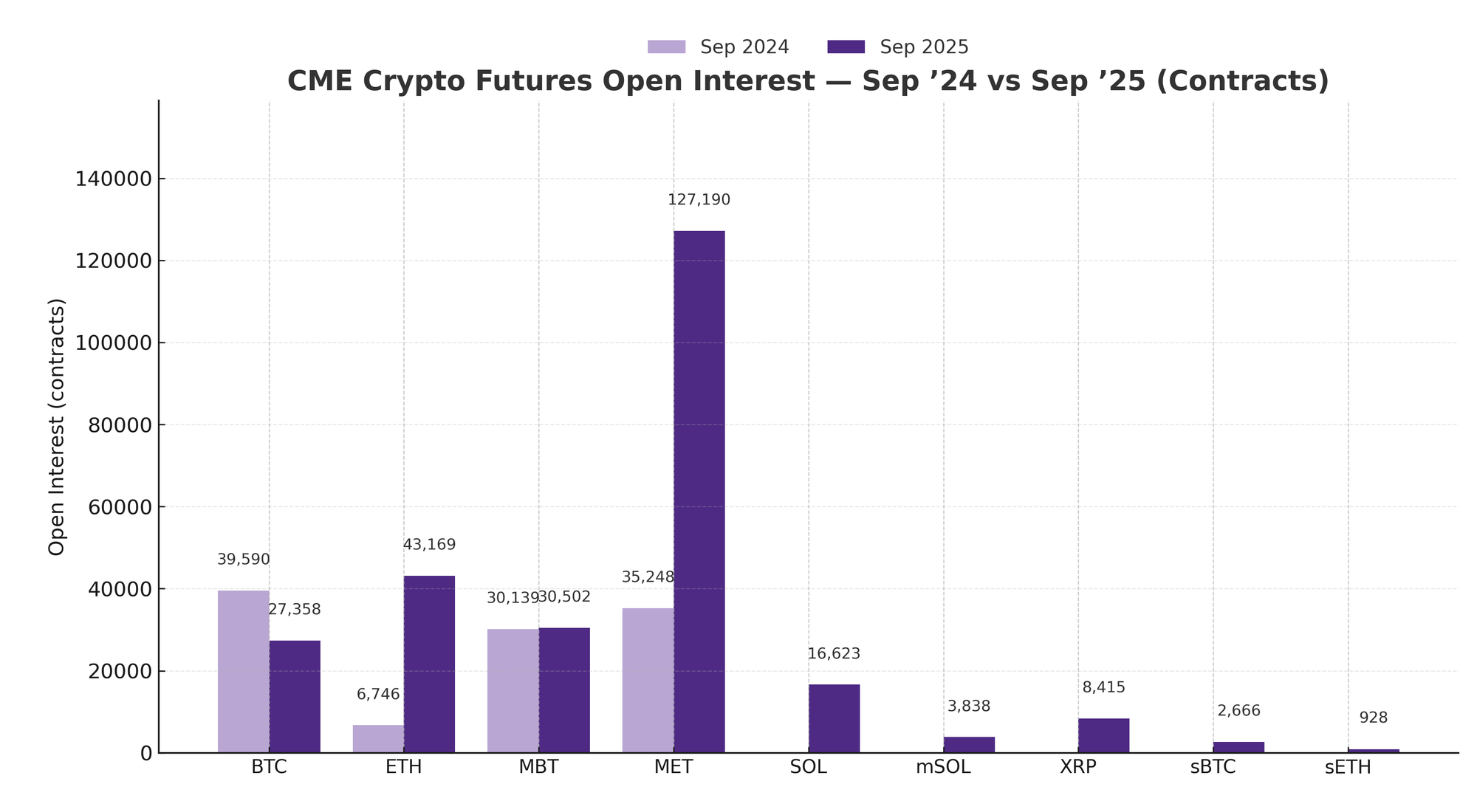

In keeping with Ethereum's ongoing 'renaissance' over the last several months, it is clear from the next chart that it was CME Micro Ether futures trading that did much of the heavy lifting towards open interest milestones, year-on-year.

Key

| Product code | Contract |

|---|---|

| MBT | Micro Bitcoin futures |

| MET | Micro Ether futures |

| mSOL | Micro SOL futures |

| sBTC | Spot-Quoted Bitcoin futures |

| sETH | Spot-Quoted Ether futures |

At the very least, with non-stop CME crypto trading on the horizon amid increasingly deluxe liquidity conditions, the precision of already tight spreads around expiries should zero-in even further, when the transaction window widens across additional time zones.

That would indicate a virtuous cycle may be in the offing. Particularly if we assume increased systematic demand for benchmark-anchored hedges. All of which should reinforce the role of CME CF Reference Rates as the backstop of institutional settlement.

Reserve's LCAP is first regulated portfolio-based DTF

Reserve Protocol has deployed the CF Large Cap (Diversified Weight) – US – Settlement Price as the benchmark for a new Decentralized Token Folio (DTF).

The CF Large Cap Index DTF is the first use of a CF Benchmarks portfolio index in a DTF, bringing diversified exposure on-chain, with transparent, rules-based construction, and instant auditability. A DTF paired with a regulated portfolio benchmark brings all the replicability and governance benefits TradFi users of our indices are familiar with, into the world of DeFi.

It's an early step towards enabling regulated fiduciaries to square tokenized structures with institutional standards.

As tokenization rails improve, on-chain portfolios backed by regulated, manipulation-resistant indices should lower operational risk and make it easier for fiduciaries to justify incremental allocations.

Read our launch post below.

REX-Osprey's latest first: ETH staking

REX-Osprey has listed its ETH + Staking ETF (ESK)—the first U.S. ETF to offer access to direct ETH staking rewards.

ESK is REX-Osprey's fourth crypto ETF since July to use a CF Benchmarks Reference Rate. For ESK's ETH reference price (excluding staking rewards) the index is our CME CF Ether-Dollar Reference Rate – New York Variant.

Each crypto ETF in the group's recent run of launches is registered under the ’40 Act, a framework that can accelerate time-to-market, albeit with implied structural limits, especially following the approval of GLS.

For now though, REX-Osprey's creditable introduction of ESK brings staking economics into a listed wrapper for the first time, while retaining ETHUSD_NY for representative, replicable tracking.

It's worth noting these ETF debuts have this week resulted in the group's assets under management surpassing the $500 million milestone. With the partnership in place for less than a year, it's a pace of asset gathering that speaks for itself.

Read our launch post below.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Tracking Bitcoin's Flows

Bitcoin is down 47% from its October high. But behind the drawdown, 13F filings reveal a structural transformation: speculative hedge fund capital is retreating while advisory firms, sovereign wealth funds, and endowments are building permanent allocations. Here's what the ownership data shows.

Gabriel Selby

Kraken MTF Lists Large Cap DTF Perp

EU-domiciled institutional investors can now access a perpetual contract based on Reserve Protocol's multi-token LCAP DTF.

CF Benchmarks

Notice of the Demising of Three Indices Within the Token Market Price Benchmarks Series

The Administrator announces that three Token Market Price Benchmarks Series indices are to be demised.

CF Benchmarks