Sep 10, 2025

CF Benchmarks Newsletter Issue 90

- US crypto ETF floodgates open, as filings hit a record

- CME ETH, XRP, SOL futures Open Interest outpaces BTC

- FCA takes first step to UK retail crypto ETPs

Paperweight

The sheer weight of live crypto ETF filings deposited on the desks of SEC officials has ballooned to the highest volume yet in recent weeks.

The rise has been partially fueled by the latest benign signaling from the Commission that its ‘crypto-constructive’ ethos, telegraphed chiefly by chair Paul Atkins, remains on track.

Also apparently still on track, though: the simultaneous counter current of deliberation meticulously displayed by Atkins’ SEC. Intentionally or not, this does simultaneously convey the appropriate caution, and, or course, independence, of the Commission’s decision making.

How it’s going so far

Hence, as we’ve spotlighted over the last few months, concrete regulatory advances have now been strongly inked. But progress toward complete enactment of key proposals remains painfully slow.

- For example, the SEC has provided outright approval for ‘In-kind’ in recent weeks.

- In principle, a little earlier, it also authorized the listing of multi-asset digital asset funds.

- Meanwhile, the SEC essentially ‘stepped aside’, in line with specific procedure for ’40 Act applications, in the case of REX-Osprey’s ’40 Act SOL + Staking ETF, thereby enabling a trouble-free listing; and consequently setting dual precedent on staking and Solana as well (in theory).

What’s not working

In practice though, again, as you’ve seen, if you’ve been following along through the summer months, it's only in-kind creation and redemption permission that’s been completely finalized. The remainder of the key facilities outlined above, and others, keenly sought by providers, remain in limbo.

Meanwhile, Commission leadership continues to pursue a delicate balance of sustaining product issuers’ confidence that these enablements will be enacted sooner rather than later, while maintaining its conspicuously unhurried pace.

And looking at the pile of digital asset ETP applications that’s now built up to an unprecedented wall of paperwork at the Commission, the SEC is enjoying evident success in at least mediating the idea that it will eventually approve these key rules.

Bloomberg ETF analyst James Seyffart documents the mammoth amount of crypto work facing SEC staffers in the tweet below:

NEW: Here is a list of all the filings and/or applications I'm tracking for Crypto ETPs here in the US. There are 92 line items in this spreadsheet. You will almost certainly have to squint and zoom to see but best I can do on here pic.twitter.com/lDhRGEQBoW

— James Seyffart (@JSeyff) August 28, 2025

We pull out some key takeaways a little lower down in this edition.

Generics

Meanwhile, the likely approval of Generic Listing Standards (GLS), specifically for crypto asset ETPs, would represent another case in point of that balance the SEC is attempting to strike.

The standards are aligned with legislation passed in July, that is directly aimed at redressing the ‘asset’ side of the formerly murky regulatory regime: The CLARITY Act.

- Get a precis from corporate law firm Jones Day, here.

- And here’s an assessment of the proposed listing standards from another firm, Chapman

Choreography

The GLS precepts emerge from the type of multipart choreography often seen with uncontested rulemaking: coordinated proposed rule change filings from national exchanges Cboe BZX, NYSE Arca, and Nasdaq (incidentally, these filings echo aspects of a late-July policy paper released by the White House’s Working Group on Digital Assets). Then the process was book-ended by Paul Atkins’ “Project Crypto” speech, which expressly cited the Working Group's policy paper.

With implications for the gamut of top-of-mind crypto ETP issues, including staking and multi asset, it’s easy to see why GLS is now among the latest touchpoints for crypto ETP issuers, while ironically joining the ever-growing list of unresolved issues the same participants are watching with rapt attention.

Federally Registered

On timing, GLS are simply another rule-change application, so ultimately, the SEC’s review could last as long as 240 days. Still, given the 21-day Comment Period was triggered by publication of the filings in the Federal Register on August 4th, and an informed view that “GLS are reasonably constructed” (Blockchain Association General Counsel, Greg Xethalis) expeditious approval has reasonable odds.

“Likely Sept/Oct for all”, according to Senior Bloomberg ETF analyst, Eric Balchunas.

Framing the filing frenzy

As stated above, the record wave of U.S. spot crypto ETP filings that’s hit the SEC in recent weeks appears tied to signals that the Commission may be considering “generic listing standards”—rules that would allow certain spot crypto ETPs to be approved en masse, rather than case-by-case. This would compress time-to-market and reduce first-mover advantage, reshaping the competitive landscape.

With filings at crescendo levels though, there’s quite a bit of noise. Some applications will almost certainly turn out to be less ‘substantial’ than others. For a clearer view of the more material trends, below, we offer commentary on a curated sample of key filings.

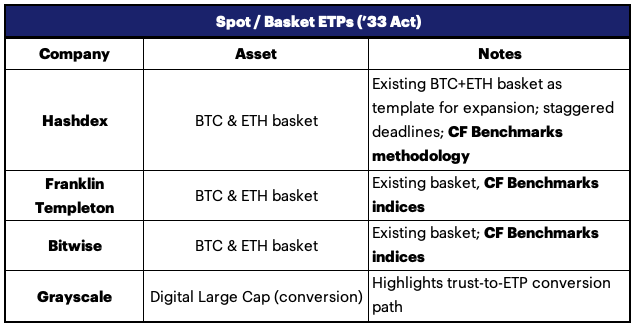

Here are some of the key multi-asset basket filings:

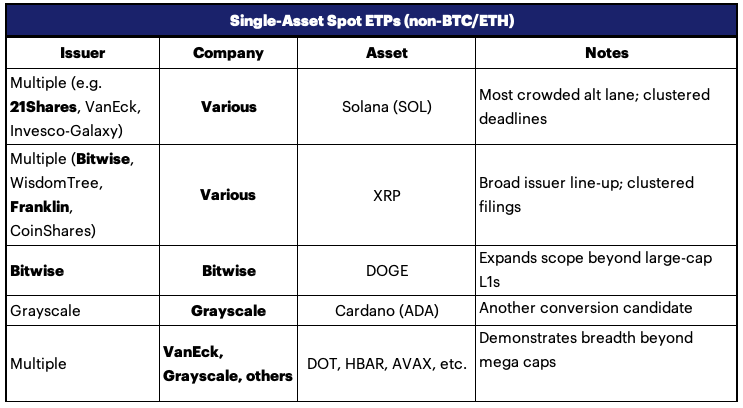

And you can get a flavor of the single-asset applications waiting in the wings below:

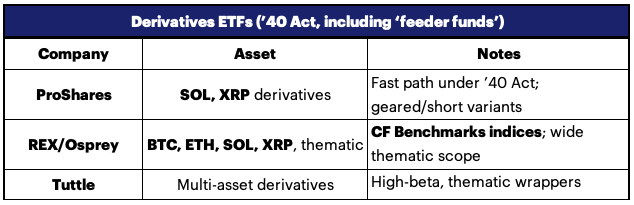

As well, interestingly, several issuers are continuing to pursue derivatives-based crypto 'strategy' ETP applications, many of which are filed under the '40 Act framework.

Perhaps expediently, we've included REX-Osprey's follow-up crypto filings in this sample. These use a similar template to its SOL + Staking ETF (SSK) referencing CF Benchmarks' SOLUSD_NY index, that was listed in July.

Institutional takeaways

- Breadth and deadline clustering signal policy shift: Assets span SOL, XRP, DOGE, ADA, DOT, HBAR, AVAX, and more, with clustered deadlines, as issuers position for a generic listing framework.

- Two regulatory pipes: ’33 Act spot products vs. ’40 Act derivative products, with the latter moving faster, but the former setting the stage for broader adoption.

- Conversions matter: Several trust-to-ETP conversions are flagged—with potential to port AuM and liquidity overnight.

- Issuer lineup = depth of ecosystem: Top-tier issuers (Franklin, Bitwise, Grayscale, 21Shares, VanEck, WisdomTree, Hashdex, REX-Osprey, etc.) suggest the eventual build-out of robust secondary markets. Crucially, many of these issuers already cite CF Benchmarks’ regulated indices as the source of NAV calculation—reinforcing our position as the most-cited index provider in the crypto ETF filings pipeline.

- Benchmark integrity critical: With breadth comes risk. Market representativeness, replicability, and manipulation resistance will continue to help determine which filings succeed—underscoring CF Benchmarks’ role.

CME Crypto Open Interest peaks

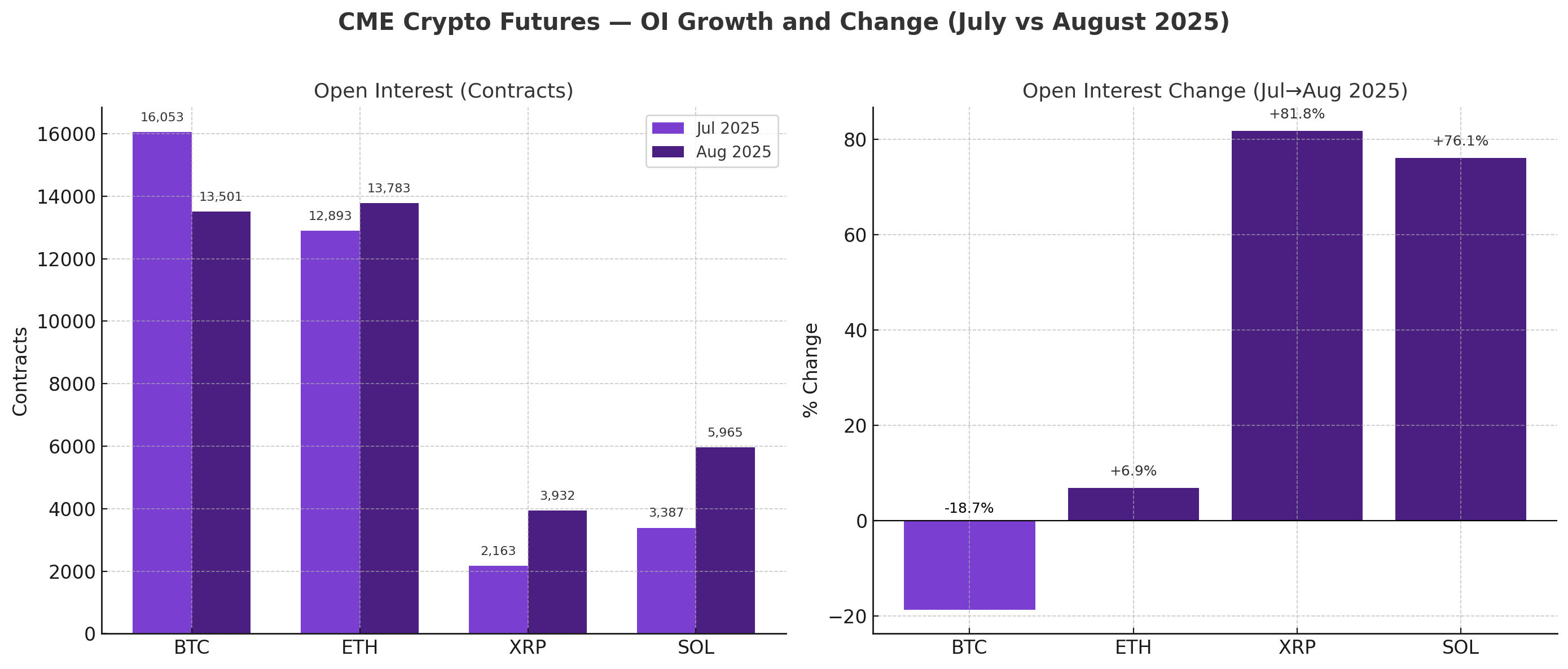

Institutional participation in regulated crypto derivatives markets intensified over the summer months, with CME Group reporting record aggregate open interest across its crypto futures complex, a sign that regulated venues remain the preferred channel for institutional demand.

The standout metrics from of August were as follows:

- XRP Futures: Open interest surged to nearly 4,000 contracts, an 82% jump month-on-month, making it the fastest CME crypto product ever to surpass $1 billion notional open interest.

- Solana Futures: OI climbed 76% to almost 6,000 contracts, with monthly trading volume spiking above 24,000 contracts. This rapid growth highlights Solana’s position as a rising institutional asset.

- Aggregate CME OI: Across all contracts, open interest pushed to new highs — reflecting broadening engagement beyond Bitcoin and Ether into multi-asset exposure.

XRP, Solana advance

These developments mark a shift in institutional participation that’s worth noting.

As the combined graphic below illustrates, CME Bitcoin and Ether futures remain unequivocally at the heart of institutional volumes. Yet the rapid adoption of the CME’s newest crypto futures contracts, providing exposure to XRP and Solana, obviously reflects clear and near-immediate diversification of institutional crypto strategies.

OI highlights

XRP led the expansion, with open interest (OI) leaping +81.8% month-on-month (m/m) to 3,932 contracts, amid rising volumes, making CME XRP the fastest contract to surpass $1 billion in notional OI at the world’s largest derivatives marketplace.

Meanwhile, Solana essentially kept pace. CME SOL futures OI surged +76.1% m/m to 5,965 contracts, with monthly trading volume topping 24,000 contracts. The move echoes prevailing observations from spot and DeFi rails: SOL’s participation base is widening, with derivatives emerging as an institutional on-ramp.

CME ETH's record

Among the longest established crypto futures products, it was ETH which set a record, while BTC consolidated. CME Ether futures OI rose +6.9% m/m to a record 13,783 contracts, while Bitcoin futures OI pulled back 18.7% m/m to 13,501 contracts.

Together, these dynamics suggest a tactical rotation: in August, investors trimmed BTC futures exposure while adding ETH (and select alts), consistent with the $3.9bn August inflow to U.S. spot ETH ETPs vs. $322m outflow from BTC, we outline later in the newsletter.

All CME crypto products settle to CF Benchmarks reference rates, ensuring replicability, transparency, and resistance to manipulation as the foundation for regulated institutional participation in digital asset markets.

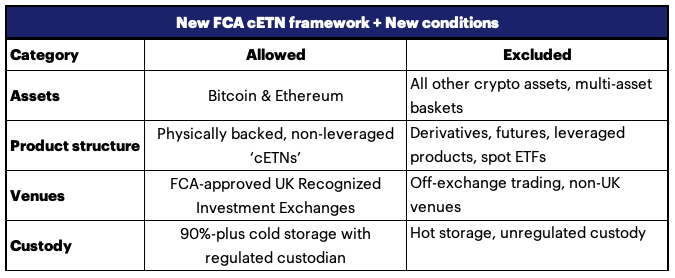

UK FCA edges towards retail access for crypto ETPs

The UK Financial Conduct Authority has formally lifted its ban on retail access to crypto ETNs (cETNs), effective October 8, 2025.

It’s an important step that, in effect, sets the UK on the path to catching up with Europe and the U.S. in terms of access to crypto ETPs, while redirecting existing retail demand into safer, regulated channels.

Limits

As indicated, the change is limited, for now. Only physically backed, non-leveraged ETNs tracking Bitcoin or Ethereum will be permitted, and only if listed on FCA-approved UK exchanges.

Below we sketch out what this incremental switch allows, and what remains prohibited, for now.

Safeguards include:

- Cold storage requirements (90%-plus of assets to be held offline)

- Consumer Duty and Restricted mass market investments (RMMI) classifications are applicable

- Clear risk warnings required

- Exclusion of derivatives, futures, leveraged products, and spot ETFs

For providers, one of the key unresolved questions is whether these products will qualify for ISAs and SIPPs, as that could determine commercial viability.

A First Step

Stop-gap

The FCA’s move is widely viewed as an interim measure, not an endgame. cETNs provide a controlled pathway for retail exposure, but the chief goal remains comprehensive approval for firms to offer spot ETFs and other products to consumers.

Issuers unclear

Additionally, it is not yet clear which issuers are likely to lead an emergent UK cETN market. Names like 21Shares, WisdomTree, VanEck, or Bitwise EU may explore, but the more important point is that any entrant will need benchmarks that meet FCA requirements for replicability, governance, and manipulation resistance.

First-Authorized view

Most U.S. spot crypto ETF assets already reference CF Benchmarks indices, and all CME crypto products settle to CFB rates. Meanwhile, CF Benchmarks was the first crypto Benchmark Administrator to be authorized by the UK FCA, way back in 2019.

All told, CF Benchmarks has the regulated track record, operational rails, expertise, and regulatory experience, that will be as valuable to UK issuers and exchanges, as these qualities have demonstrably been for issuers globally; and which will be required in order for UK providers to meet the FCA’s Consumer Duty and RMMI standards.

Ethereum ETF momentum update

Spot ETF flows continued to flip the script in August.

While U.S. Bitcoin spot ETFs saw net outflows, U.S. spot Ether ETFs drew roughly $3.9bn of net inflows, continuing ETH’s multi-month resurgence and signaling a rotation in institutional bids.

As mentioned in an earlier section, regulated derivatives confirm the institutional bid behind ETH. CME Ether futures open interest hit a record in late August, with large open-interest holders (≥25 contracts) climbing to an all-time high—clear evidence of rising participation from professional traders and asset managers.

One unavoidable takeaway is that the ETF wrapper is rapidly becoming the status quo for institutional ETH investment exposure, particularly given ETH ETF optics that echo those of Bitcoin ETFs.

It's BlackRock's iShares Ethereum Trust ETF (ETHA) that dominates the distribution, with cumulative flows – since all major U.S. ETH ETFs launched in July 2024 – of approximately $12.67 billion.

Relatedly, this picture also places CF Benchmarks' regulated Ether indices at the heart of ETH's belated ETF take off, slotting into the longstanding prevalence of these benchmarks on the institutional ETH risk management side, as outlined below:

- All CME Ether futures and options settle to the CME CF Ether-Dollar Reference Rate (ETHUSD_RR) — the FCA-regulated benchmark used for NAVs and settlement design, built for replicability and manipulation resistance

- CME CF Ether-Dollar Reference Rate (New York variant) — published at New York market close, aligns with U.S. fund operational cut-offs as the NAV-calculation benchmark for ETHA, and several other ETFs.

CFB Talks Digital Assets Episode 48: John Todaro on Wall Street’s Crypto Embrace: IPOs, Treasuries & Regulatory Clarity

A surge in crypto IPOs, the rise of corporate digital asset treasuries (DATs), and an expanding pipeline of deals, are all reshaping the crypto landscape.

Now, with the CLARITY Act promising regulatory certainty, the pace of institutional engagement is set to accelerate even further.

To explore these themes more deeply, we're chuffed to be joined by John Todaro, Managing Director of Crypto, HPC/AI Research at Needham & Co., the Wall Street broker/dealer and serial crypto IPO bookrunner, for another listen-through-in-one-sitting episode of CFB Talks Digital Assets!

Just a few of several highlights:

- Why Needham chose to launch dedicated crypto coverage back in 2021 and what they’re tracking now

- The red-hot crypto equity and IPO market: are valuations too hot, or is this simply the release of pent-up demand?

- Inside the wave of corporate digital asset treasuries: from BTC and ETH adoption to systemic risks that could emerge

- The CLARITY Act: what the new regulatory framework means for institutional participation and M&A in the space

For those watching the intersection of traditional finance and digital assets, this episode is essential listening. Join hosts Gabriel Selby, Mark Pilipczuk and Ken Odeluga as they unpack these topics with one of Wall Street’s leading crypto analysts.

Listen on Spotify

Listen on Apple Podcasts

Listen on Amazon Music

Listen on YouTube

Catch all episodes here

Subscribe for updates!

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks