Jun 30, 2025

CF Benchmarks Newsletter Issue 85

Odds-On

We recently zoomed in on what appear to be variable outcomes, from the ‘regulatory reset’, with the listed product market – particularly crypto ETFs – showing fewer discernible benefits, so far.

The lack of approval of any ETFs investing in digital assets beyond Bitcoin and Ether at the six-month mark of 2025, after spot BTC and ETH arrived on Wall Street in 2024, is simply an awkward fact. And it's one about which the space is becoming increasingly restive.

That said, qualified opinion emerging in the days following our prior edition offers a strong counterpoint to implied negative interpretations of the pace at which the SEC is progressing the digital asset product market.

It comes chiefly from Bloomberg ETF analysts James Seyffart and Eric Balchunas.

NEW: @EricBalchunas & I are raising our odds for the vast majority of the spot crypto ETF filings to 90% or higher. Engagement from the SEC is a very positive sign in our opinion pic.twitter.com/5dh8G8rK6Y

— James Seyffart (@JSeyff) June 20, 2025

Even the asset with the weakest given odds of being packaged in the ETF wrapper sometime in 2025, according to Seyffart and Balchunas, SUI, one of the newest, and fastest-growing scalability challengers, is rated with a 60% probability.

Still, it’s interesting to note the pair appear to have included whether a CFTC regulated futures market exists in the prospective crypto ETF asset as an input ‘score’ in their probabilities. To be fair, this is my supposition alone. Nevertheless, it’s an interesting one. That's because one of the inferred conditions for approval of the existing crypto ETFs, was, broadly speaking, the existence of a CFTC-regulated futures market in the asset.

Even so, those conditions, were, ironically, quite specific; calling for a Designated Contract Market (DCM) in the prospective asset. Those observed conditions also indicated that contracts needed to be cleared by a Designated Clearing Organization (DCO).

DCMs include CME Group, and latterly, Coinbase’s futures market. However, Coinbase, the largest of the new crypto DCMs, is not yet a DCO.

In fact, among a small handful of recently established crypto DCMs, only Bitnomial, relatively small, in terms of trading volumes, is also a DCO.

Among assets absent so far from the ETF market, Bitnomial offers Solana, Cardano and XRP futures. The majority of prospective ETF cryptos are not available on its futures platform for now. For the three on offer at that DCO, we'd also need to assume their markets pass the SEC's "market of significant size" stipulation, one of its rare on-the-record conditions.

Overall then, if the SEC is continuing to score crypto asset ETF eligibility partially on the existence of a regulated venue, most assets will still score nil on that test, even if the weight of the score has diminished in the crypto ETF era.

One other key counterpoint arguing against a moderate curbing of ‘regulatory optimism’ so far this year, has been the quickening pace of crypto-focused CME product rollouts and expansions.

Below, we spotlight CME Group data showing strong momentum in CME Solana futures, launched around 3 months ago, and in XRP futures, following their debut about a month ago. We also examine the forthcoming addition of Spot Quoted futures to the CME Bitcoin product suite.

CME SOL futures 90 days on; One month of CME XRP

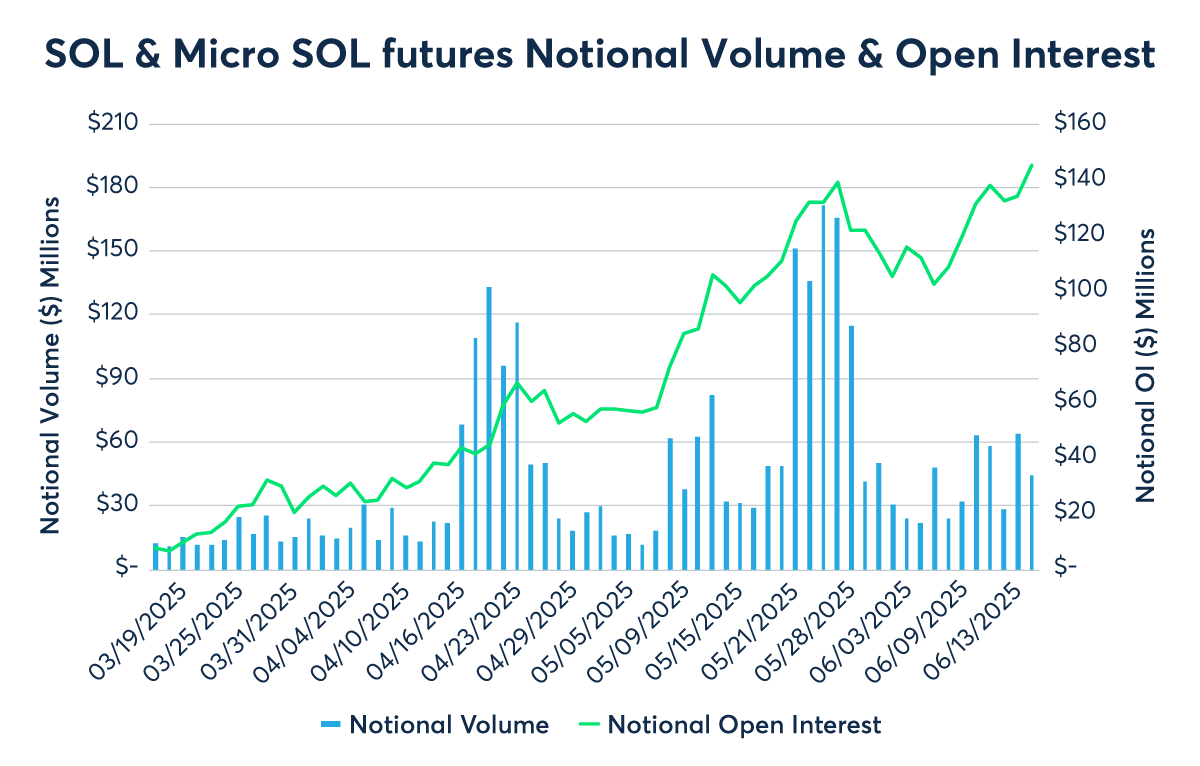

CME Group’s Solana (SOL) and Micro Solana futures, cash-settled based on the CME CF Solana-Dollar Reference Rate (SOLUSD_RR), recently completed their first 90 days of trading. According to CME Group data summarized below, it's been a healthy quarter for volumes and open interest.

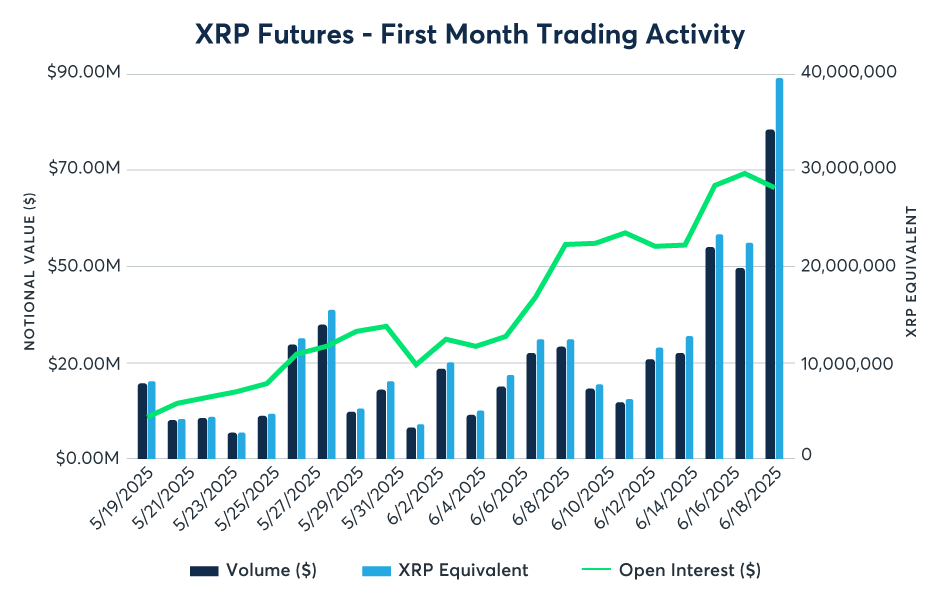

Likewise, the one-month assessment for CME Group’s XRP and Micro XRP futures can safely be that they've quickly established themselves as an effective tool for institutions and major participants to gain exposure to XRP price movements, within the primary CFTC regulated futures market, based on data we'll highlight below.

Key CME SOL metrics since launch

- Volume: Over 106,000 contracts traded, equating to more than $3 billion in notional value.

- Average Daily Volume (ADV): 1,700 contracts, representing 448,000 SOL or over $45 million.

- Institutional Participation: In May, 10% of volume was executed as block trades, averaging 70 contracts (35,000 SOL or $5 million).

- Market Liquidity: Bid-ask spreads have averaged between 1 to 4 ticks.

- Open Interest: A record 2,849 contracts ($146.4 million notional) as of June 17.

Explore CME Group SOL and Micro SOL futures further here.

Key CME XRP first-month insights

- Active participation: On launch, $19.3 million in notional volume was traded across 15 firms and four retail trading platforms

- Global engagement: Since inception, total trading volume has reached $542 million, with 45% of activity originating outside North America.

- Sustained interest: Open interest has continued to rise, with $70.5 million in active positions at the end of the first month.

Read CME Group's one-month on XRP futures review here.

Spot Quoted CME BTC set to launch June 30

BRR-settled CME Bitcoin futures have enabled institutions to access regulated to Bitcoin exposure since 2017. Now, the CME BTC product suite, which includes Micro Bitcoin futures and options, Bitcoin Friday futures (BFF), as well as a host of packaged strategies, such as Bitcoin BTIC, will see the roll-out of another modification - Spot-Quoted futures (SQFs).

CME Group announced the inception of SQFs several weeks ago, notably as a contract model across a wide range of existing assets, with Bitcoin among them.

Put concisely, their headline feature is noted by CME Group below:

“With SQFs, traders can enter a futures position at the current spot price. When closing the position, the final profit or loss might differ slightly due to financing adjustments made during the clearing process.”

From ‘Futures get a fresh look: An introduction to Spot-Quoted futures’

In other words, SQFs offer market participants a contract structure that’s priced at the underlying spot level, with financing adjustments integrated into the daily figure.

The feature is designed to clarify the pricing relationship between futures and spot, making it easier for participants to see and account for the precise cost of carry, which is separated from the contract’s quoted price.

In fact, given its features aimed at increased simplification and accessibility overall – e.g., smaller contract sizes – SQFs would fit well alongside the several crypto products and product features rolled out over the last few years that were aimed primarily at smaller accounts than those CME Group has traditionally catered to.

Again, we could include BFF, and both Micro Bitcoin and Micro Ether futures among such initiatives. We could also note SQF is something like an inverse concession relative to BTIC, in terms of features desired by traders, with BTIC aimed at facilitating the basis trade, while SQF negates it.

Whilst this notional retail vs. institutional/professional demarcation isn't an entirely clear-cut one to stand up, it’s one that Brian Burke, CFA, senior director overseeing crypto options at CME Group, nodded to in a recent appearance on the CFB Talks Digital Assets podcast.

Click here to catch the full episode

Key SQF features

- Spot-referenced trading: Contracts are quoted and traded at the CF Bitcoin Reference Rate (BRR), ensuring alignment with widely observed spot market pricing.

- Daily financing adjustment: Financing costs are applied as a transparent daily adjustment, rather than being embedded in the futures price.

- Flexible structure: SQFs offer smaller contract sizes and longer-dated expiries, which may support a wider range of portfolio strategies.

Institutional interest

Accessibility features are of course no reason in themselves to discount potential institutional interest in SQFs, as Burke also pointed out in the episode clipped above.

ETF issuers, asset managers, and liquidity providers, may find spot-quoted contracts simplify benchmarking, reporting, and hedging by providing greater clarity around costs and execution levels. The structure could also support more precise internal accounting and risk management, since financing adjustments are clearly separated and documented.

Either way SQFs within the CME Bitcoin futures suite offers a new way for participants to manage Bitcoin exposure. By quoting contracts at the spot level and making financing adjustments explicit, the product aims to enhance transparency, facilitate clearer reconciliation, and support a range of trading and investment objectives.

Discover more on SQFs

- Read CME Group's introductory article

- Find CME Group's SQF FAQs here

- Get detailed specs from the CME Advisory Notice

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks