Jun 16, 2025

CF Benchmarks Newsletter Issue 84

Reset

Regulated crypto product developments through the half-year have generally vindicated The 'Regulatory Reset’ thesis. From crypto working group, to Task Force; the cessation of almost all of the SEC’s lawsuits against crypto platforms, followed by 5 distinct ‘roundtables’ with industry contributors. These covered topics like how to determine whether assets are securities or commodities, custody, how regulation can evolve to encompass crypto trading, and most recently, the first, public, if tentative, engagement by the Commission, by its own volition, on the subject of “DeFi and the American Spirit.”

Caution

Still, the SEC’s broader signaling on crypto investment products - meaning chiefly ETFs - throughout the half year, has been a reminder of its more customary cautious footing.

This stance is revealed by the state of play of spot crypto ETF filings. Specifically, filings to list funds investing in digital assets which are still ‘novel’ to stock markets (i.e., everything except Bitcoin and Ether).

All applications for these novel ETFs have been punted: the Commission has begun extended reviews for each filing in play beyond the 45-day mark. That's the amount of time that typically needs to elapse, as directed by the Exchange Act, before the SEC typically either rejects the application, extends consideration while inviting public comment, or extends its review together with a statement that it simply needs more time.

At stake

As well as filings for 'novel' digital assets, many issuers have made it known, privately or publicly, since Ether ETFs came to the U.S. market in July 2024, they wanted to move towards the next obvious progression for these funds – by somehow including staking rewards.

Firms putting their heads above the parapet so far with applications to amend existing ETH ETFs: 21Shares, Bitwise, Fidelity and Grayscale.

All of these applications have also been shunted - at least once.

Extensive

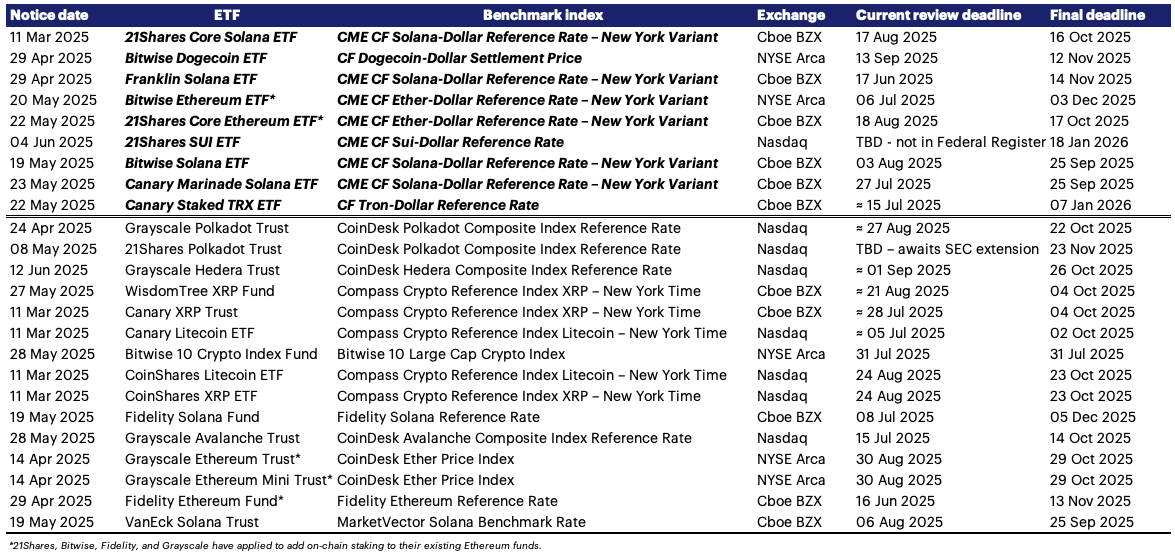

We’ve tallied what we believe to be all filings in both categories in the table below. The sizable proportion of funds looking to utilize a regulated CF Benchmarks index for net asset value (NAV) calculation is denoted with bold italics.

It's worth noting the list would be even longer if it included the amendments filed by NYSE Arca, Nasdaq and Cboe BZX since April, on behalf of already listed funds whose issuers want to switch from cash creation/redemption to the in-kind model.

The agency is still in the comment-gathering and possible extension phase for these applications.

REX/Osprey filings prep for takeoff

Meanwhile, we’ve also excluded another subcategory of planned filings from the table. These include a clutch of applications tabled by REX Shares/Osprey, to list separate Solana and Ether staking ETFs, as well as several funds that will invest in meme coins, like Trump, DOGE, BONK and others.

For the moment, these filings remain relatively distant prospects compared to the funds in the table. That's because:

- They include staking (as noted above, all staking ETF proposals have hit a roadblock)

- Not only that, these filings are also ’40-Act registrations. Such applications don’t automatically trigger the statutory start of 45-day review periods, with a 240-day max review period. ’33-Act filings do; and all of applications listed in the table above were submitted on the basis of the Securities Act of 1933.

This means the '40-Act filings by REX/Osprey filings mentioned above need an exchange to essentially start their review process with a 19b-4 filing.

At last check, this hadn’t happened for those specific REX/Osprey filings.

It's a similar situation for Canary Capital’s Canary Staked CRO ETF. Plans for that fund also, for now, consist of just a registration statement (S-1) and no exchange filing (19b-4).

Familiar pace

One key overall takeaway: regulatory reset or not, the SEC does not appear to be inclined to progress the crypto ETF market on to the next set of assets beyond Bitcoin and Ether in a relatively accelerated fashion.

The same applies to filings for staking, and in-kind creation/redemption. Instead, proposals to convert existing funds are being dealt with at a pace all digital asset ETF managers are familiar with.

CFB Talks Digital Assets Episode 45: 3iQ's Pascal St-Jean on crypto's next institutional watershed: SOL staking, and beyond

North America's true spot crypto ETF pioneers are Canadian.

The first physical Bitcoin funds listed on Toronto's TSX in early-2021.

Now, Canadian issuers are leading crypto's integration into mainstream markets again, with the region's first Solana ETFs - and - the first to incorporate staking.

Among these, 3iQ's Solana Staking ETF (tickers: SOLQ.U. SOLQ) is gathering assets fastest to date, and the firm is also staging an exciting expansion into a broader range of digital asset investment products and services.

So, for a timely overview on Canada's regulated crypto space, exclusive insights on how staking works in ETFs, plus pointers on what 3iQ's building right now, we're honored to welcome their CEO, Pascal St-Jean, to the CFB Talks Digital Assets podcast.

Join us for exclusive insider insights, including:

- Why Solana staking ETFs were the next logical frontier

- How 3iQ plans to leverage crypto native R&D to compliantly stake above 50%

- How Canada's pragmatic regulatory regime makes XRP the obvious choice for the next crypto ETFs

- A sneak peek at 3iQ's custom solutions for wealth and advisory channels, and cutting-edge institutional DeFi rails

- Keep a close eye on Canada's pension and wealth allocators

Click one of the links below to listen to this episode on your favorite platform, or find us wherever you get your podcasts.

Listen on Spotify

Listen on Apple Podcasts

Listen on YouTube Audio

Listen on Amazon Music

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks