Sep 21, 2024

CF Benchmarks Newsletter - Issue 71

- Bitwise's ETC buy catalyzes EU institutional crypto

- Monochrome could list ETH ETF by end-September, if approved

- A peek at BlackRock's new investor education report on Bitcoin

Surprise

Inevitably, cross-market attention has been fixated on Federal Reserve policy probabilities and implications in recent weeks, leaving large cap crypto, like most other ‘risk assets' in a proto funk in the run-up to the decision.

The Fed’s subsequent first cut in 4 years, on Wednesday September 18th, successfully wrong-footed expectations on the magnitude of easing, with a 50 basis point (bp) reduction of the federal funds target range to 4.75%-5%, vs. overwhelming consensus for a 25bp move. The surprise wrought the requisite positive market reaction; lifting oil, equities – the S&P 500 notched a new record later in the week – and Bitcoin.

September CME BTC Futures, which settle to our CME CF Bitcoin Reference Rate (BRR), reached as high as $64,200 by Friday, the contract’s best price since late August, up from around $60,000 just prior to the Fed’s decision.

Ambivalence

Inevitably though, ambivalence regarding the near-term economic outlook remains; including doubts expressed by some high-profile voices. These were in step with contours in the FOMC’s statement and forecasts, as well as chair Jerome Powell’s comments cautioning participants not to assume the half-point move was a pace setter for medium-term policy.

The chair’s indication of a base case involving a robust jobs market and inflation gliding back to historical norms was the source of much disparate discussion:

“Strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

Meanwhile, FOMC officials projected a 2.9% long-run rate, compared with 2.8% in their June projections, whilst their median-term estimate (by Q3 2025) fell to 3.4% from 4.1% in June.

As CF Benchmarks’ Head of Research, Gabe Selby, CFA, notes below, broad market forecasts appear sceptical of the committee’s expressed median expectation.

The greenback bounced along with longer-dated yields within 24 hours of the Fed decision, whilst stocks and large cap crypto closed lower on Friday, albeit firmer for the week.

Our selection of the most consequential recent institutional developments can be found further down, though read on below for a concise assessment of the macro outlook, and its market implications, from Gabe.

Markets & Macro

How Low Can We Go?

By CF Benchmarks Head of Research Gabriel Selby, CFA

The Federal Reserve's recent policy shift marks the first pivot since Fall 2021, signalling a recalibration of their monetary policy. Additionally, central banks worldwide have already begun cutting policy rates over the summer months, moving ahead of the Fed.

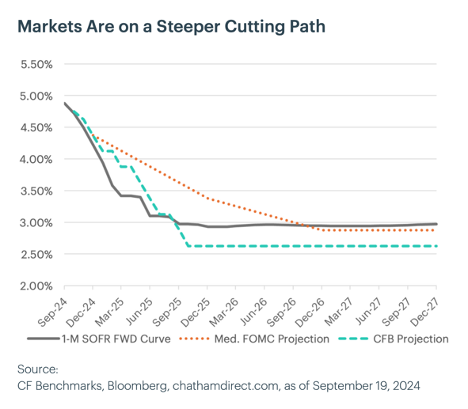

Market participants are pricing in a terminal rate range of 2.75-3.00% by September 2025. We believe this trajectory is more realistic than the central bank's official guidance, and we expect the Fed will eventually align closer with the market as they reengage their "autopilot" trajectory (or a persistent 25 bps rate cut pattern).

Ultimately, we anticipate that softer than expected labor market growth and economic activity will guide us towards a slightly lower than expected terminal rate of 2.50%-2.75% over the next 12 months. Through year-end, we foresee two additional 25 bps rate cuts at each of the remaining meetings. This would result in a total of 100 bps in cuts for the full year. Key risks to our forecasts include a resurgence in inflationary pressures. Additionally, a material increase in job growth or overall labor market strength would likely put an end to our anticipated trajectory for future rate cuts.

Quarterly Attribution Report highlights

Crypto's Q3 retreat

The moderate post-Fed rebound across a large swathe of the digital asset market needs to be seen within the context of a firmly negative prior quarter, as detailed by the CF Benchmarks research team, Gabriel Selby, CFA and Mark Pilipczuk, in their June - September 2024 Quarterly Attribution Report (QAR).

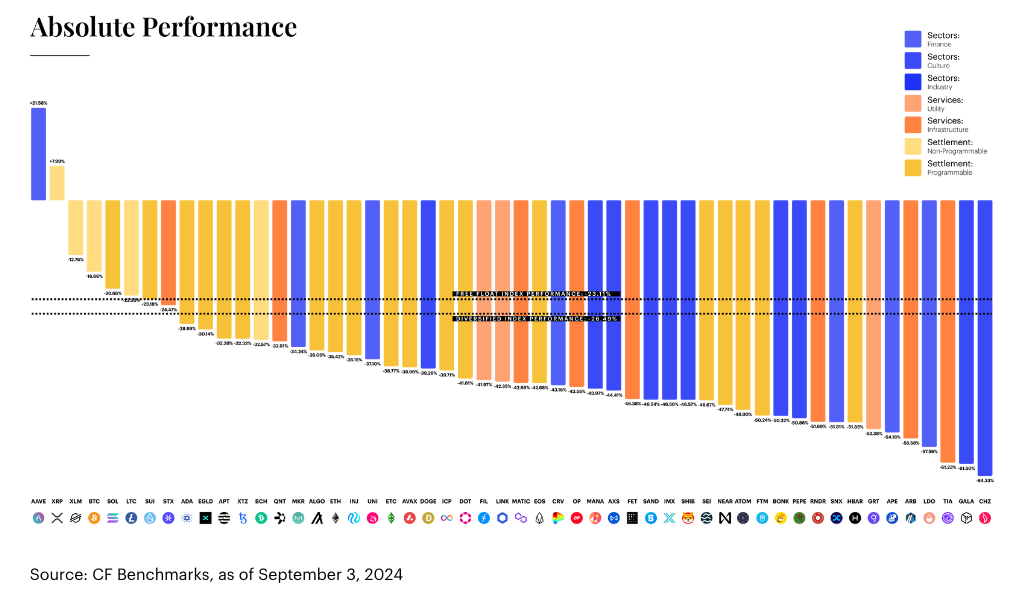

Our CF Large Cap (Diversified Weight) benchmark portfolio dropped -25.08% between quarterly rebalances, equating to large cap tokens delivering their worst performance since December 2022.

Each quarter, the CF Benchmarks QAR deploys an adapted modern portfolio theory-based methodology to derive the kind of returns analysis routinely conducted by institutional investment managers on portfolios comprised of traditional assets. Note the exercise is always conducted within the context of the CF Digital Asset Classification Structure (CF DACS), the only digital asset taxonomy standard of investible assets published by a UK FCA regulated Benchmark Administrator, under EU-equivalent Benchmarks Regulation.

This provides institutional professionals with a readily comprehensible and credible framework for understanding the performance of digital assets, all within the same quarterly window through which cross-asset markets are typically assessed.

Below, we present some highlights from the June - September QAR, enabling analysts to observe current market dynamics against the recent quarter's digital asset performance.

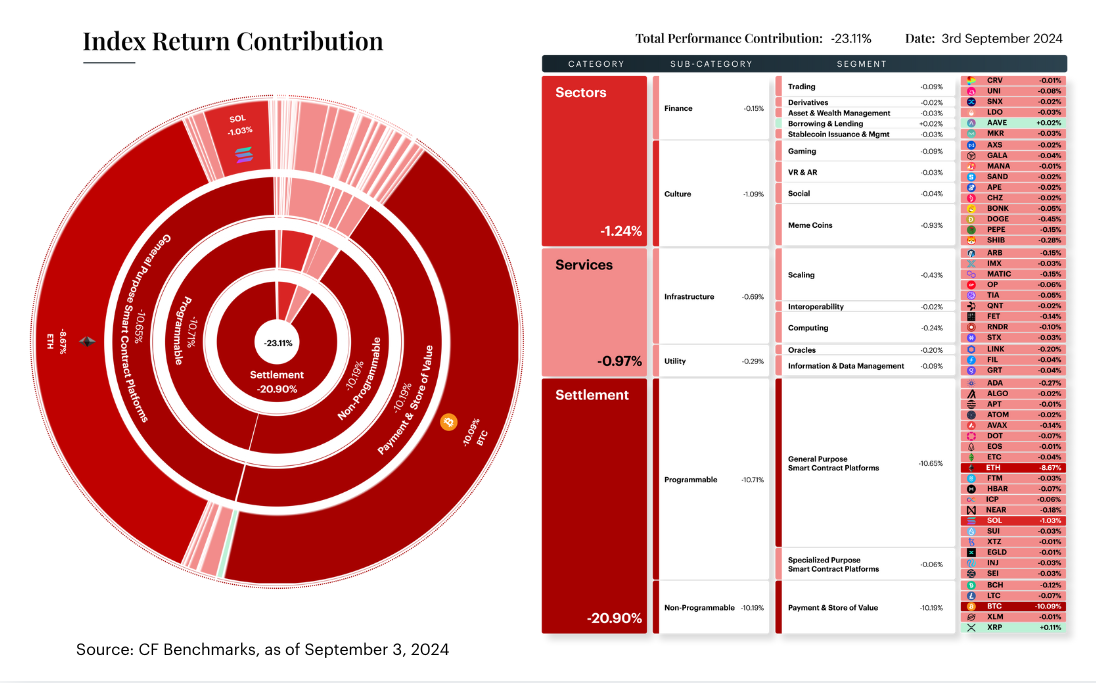

Performance Attribution (Free Float Market Cap)

- The CF Broad Cap Index fell by -23.11% over the most recent rebalancing period, slightly outperforming the diversified weighted variant by approximately 300 basis points.

- The two bellwether tokens, Bitcoin (BTC) and Ether (ETH), contributed the most to the overall decline in performance (-10.09% and -8.67%, respectively).

- From a CF DACS perspective, this translated into the Settlement category contributing the most to the negative performance, with the total contributions split fairly evenly between the programmable and non-programmable subcategories.

Widespread Losses Overshadow Isolated Gains

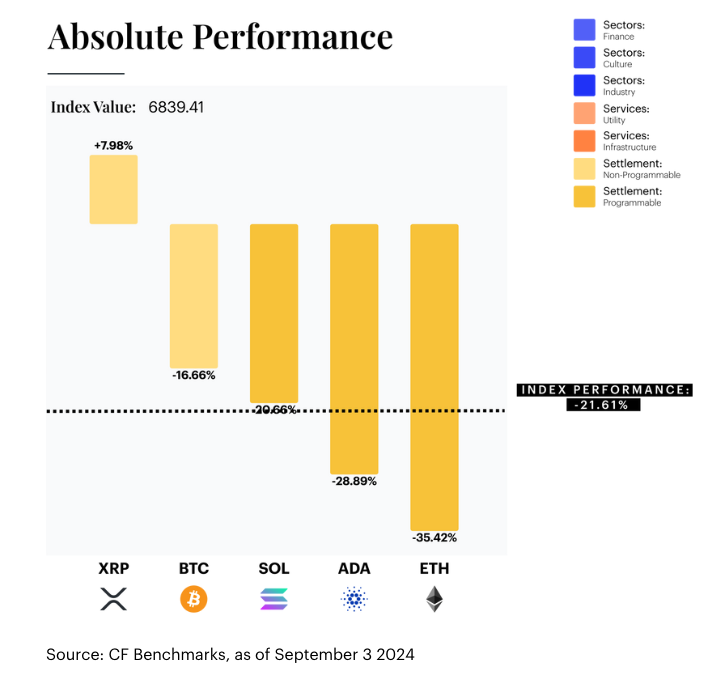

Constituent performance was even more broadly negative than the prior rebalance period, with only two tokens posting positive results. This translated to both of the bellwether tokens underperforming the headline index. Bitcoin prices fell by over -16%, and Ether's ETF debut was not enough of a catalyst for relative outperformance, resulting in a -35% decline.

Ripple’s XRP Bucks the Trend

Our CF Ultra Cap 5 Index witnessed broadly negative price action across its constituents. Ripple's XRP token outperformed its blue-chip peers and was the only token to finish the rebalance period in positive territory (+7.98%). The blockchain, popularly used for cross-border payments and Central Bank Digital Currency (CBDC) management, showed relative strength after network activity surged on its Automated Market Maker (AMM) platform. This led to an increase in fee generation and open interest. Ripple announced plans to launch a native lending protocol along with an Ethereum Virtual Machine (EVM) side chain to integrate into the DeFi ecosystem.

Click below to find the individual September 2024 QARs for key CF Benchmarks portfolio indices, as well as the complete compilation report.

CF Benchmarks News

Bitwise expands into Europe with ETC buy

‘Kindred spirits’ combine to become one of Europe’s biggest crypto fund managers

- Key U.S. client Bitwise, acquires an EU-focused one, ETC

- Group secures large EU footprint as region gears up for U.S. competition

- Deal comes months after Bitwise launched two of the first U.S. spot crypto ETFs

Unsurprisingly, from our point of view, the acquisition of one high-profile CF Benchmarks client by another warrants closer examination for that reason alone.

But Bitwise’s purchase, announced last month, of London-based ETC Group was salient enough to be widely reported, given takeaways for the broader investment management industry. So, for similar reasons related specifically to our institutional digital asset space, we take a closer look below.

To begin with, we note both firms evince a corporate ‘first mover’ inclination in their DNA. Founded in 2019 (two years after Bitwise) ETC listed its flagship ETC Group Physical Bitcoin (BTCE) the same year; when most firms would typically still be bedding down their corporate specialisation. BTCE quickly became Europe’s largest and most heavily traded spot crypto ETP (current AuM: around $1.1bn).

Similarly, Bitwise’s path to the listing one of the first U.S. spot Bitcoin ETFs in January this year, Bitwise Bitcoin ETF (BITB) can be traced back to the launch of its OTC-traded Bitwise 10 Crypto Index Fund (BITW), in November 2017, soon after the firm was founded. BITW remains the largest publicly traded crypto index fund with an AuM currently standing at $925m.

As ETC co-founder Bradley Duke noted in comments to the FT:

“Bitwise and ETC are kindred spirits in the way we run our business, in the way we specialise in digital assets and crypto products only.”

In other words (proviso: they're our words), the pair appear to be a ‘good cultural fit’.

Both firms opting to utilise our regulated benchmark methodology to strike net asset value (NAV) of some of their funds, also seems aligned with those DNA strands.

Bitwise deploys the CME CF Bitcoin Reference Rate – New York Variant (BRRNY) as the reference price for Bitwise Bitcoin ETF (BITB) whilst its Bitwise Ethereum ETF (ETHW) is powered by the CME CF Ether-Dollar Reference Rate – New York Variant (ETHUSD_NY).

Meanwhile, ETC Group’s newest Bitcoin fund, ETC Group Core Bitcoin ETP (BTC1), which saw its primary listing on Deutsche Börse in April 2024, derives its unique ‘Tri-NAV’ methodology from the ‘extended primary market liquidity’ available by use of all three CME CF Bitcoin Reference Rate variants: BRR itself, BRRNY, and their Asia Pacific-synched counterpart, BRRAP.

Bitwise and ETC having already voted with their feet by selecting CF Benchmarks as Benchmark Administrator likely took care of a certain tranche of DD, as well as providing some confirmatory answers to wider questions of culture.

Meanwhile, including BTC1, the combined group’s suite of ETPs now includes ETC’s nine European-listed physically backed funds.

As well as covering cryptos that have yet to win U.S. regulatory approval for wrapping within ETFs, these ETC funds span several assets previously unrepresented in single-product form in Bitwise’s lineup, such as Solana, XRP and Cardano.

Bitwise noted all ETC products would be rebranded under the Bitwise brand in coming months, underlining the new pathway into Europe for the acquiring firm. In fact, Bitwise looks to have become one of the top digital assets-focused fund managers operating in Europe, in total asset terms, with its newly combined AuM rising to $4.5 billion. (Jersey headquartered CoinShares reported group AuM on June 30th, 2024, of around £4.20 billion, or roughly $5.58bn).

Product name switches aside, Bitwise has signalled it’s likely to avoid certain key operational changes for now. For instance, ETC Group employees are being retained, with several senior executives quickly amending their public profiles to reflect their new roles within Bitwise.

For insights into Bitwise’s potential broad-based strategy for Europe, click below for an episode of our CFB Talks Digital Assets podcast from May, featuring Chanchal Samadder, CFA, who’s now been appointed Bitwise’s Head of Product & Capital Markets, Europe.

More broadly, no material changes to the construction or objectives of existing ETC investment strategies are planned for now either, according to ETF Express.

All told, one of the largest and highest profile investment management M&A deals of the year looks cogent in its ability to deliver the stated aim of Bitwise CEO Hunter Horsley: “to serve European investors, to offer clients global insight, and to expand the product suite with innovative ETPs”.

The potential expansion of end-investor access and choice likely to be possible from the development, and, more broadly, that the deal may catalyze within Europe’s institutional digital asset space as a whole, could be considerable and significant, especially given notable pockets of inertia remaining in the region on this asset class.

Naturally, CF Benchmarks is proud to have served among a select few joint service providers to both firms in the months and years prior to their combination. We look forward to continuing to provide best-in-class regulated crypto pricing sources to the enlarged group to help fuel its global goals.

Monochrome eyes Ether ETF

Australia's Monochrome Asset Management aims to continue ethos of ‘direct-investor-access’ with spot Ether fund

Monochrome Asset Management, which launched the first Australian spot Bitcoin ETF to provide investors with direct access to their holdings, has filed an application to offer one of the country’s first spot Ether ETFs. Again, the fund would offer direct investor access to ETH entitlements.

Monochrome, which was one of CF Benchmarks’ earliest investment management clients and the first financial firm to be specifically authorised by ASIC to provide crypto investment products in Australia, listed the Monochrome Bitcoin ETF (IBIT) in June, on Cboe Australia.

IBIT’s net asset value (NAV) is struck against our CME CF Bitcoin Reference Rate – Asia Pacific Variant (BRRAP), enabling key ETF transactions to occur within the timeframe of deepest liquidity for the region.

IBIT’S AuM was around A$13.30m ($9.04m) by the market close on September 20th.

The Monochrome Ethereum ETF (IETH) will also be listed on Cboe Australia, pending regulatory approval, which could come as soon as the end of September 2024. Like IBIT, Monochrome said IETH will “also be a dual-access fund which will allow cash and in-kind applications and redemptions for investors.”

Monochrome’s news comes during a time of significant acceleration of institutional adoption of crypto in Australia, including the listing of the first direct--investor-access fund on the main Aussie exchange, ASX, in July, by DigitalX. The NAV of the DigitalX Bitcoin ETF (BTXX) is also calculated by means of our regulated benchmark methodology, this time utilising CFB's 4 pm London Time BTC price, published daily as the CME CF Bitcoin Reference Rate (BRR).

The growing ranks of direct-investor-access Australian crypto ETFs, many of which combine this more beneficial structure with CFB’s best-in-class regulated benchmarks, contrast with Aussie ETFs primarily structured as ‘feeder funds.’ These are essentially listed firms investing in overseas Bitcoin ETFs, which therefore cannot provide investors with in-kind redemption of their BTC entitlement.

Featured Benchmark:

- CME CF Bitcoin Reference Rate - New York Variant (BRRNY)

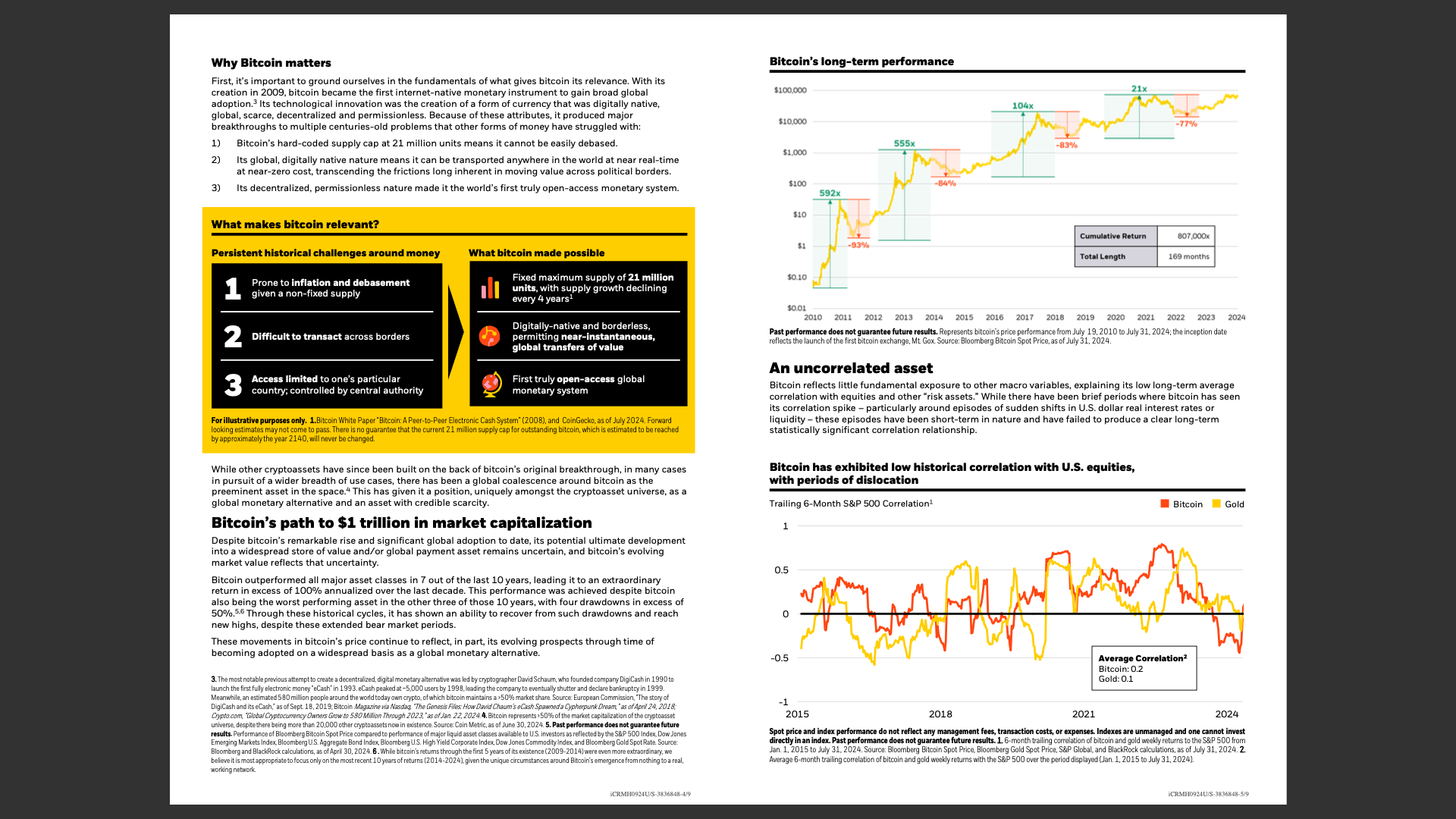

Excerpt from 'Bitcoin: A Unique Diversifier', published by BlackRock

Below, we're delighted to present an excerpt from an investor education report recently published by BlackRock, Inc.

Background

BlackRock's iShares Bitcoin Trust ETF (IBIT) became the world's largest Bitcoin fund in May this year, eclipsing the long-time prior holder of that title, Grayscale's GBTC, around four months after a tranche spot BTC ETFs were listed in the U.S. for the first time, and GBTC converted from an OTC fund to an ETF. IBIT's Net Asset Value (NAV) at the U.S. market close on September 20th, 2024, was approximately $22.50bn.

iShares deploys the regulated CME CF Bitcoin Reference Rate - New York Variant (BRRNY), published and administered by CF Benchmarks, as the reference index for calculation of IBIT's NAV, enabling optimal tracking and unquestionable market integrity.

Just like previous reports in BlackRock's ongoing crypto investor education program, the latest, titled 'Bitcoin: A Unique Diversifier', is provided as information for the benefit of potential investors in the asset, in general.

Please find excerpts of the report below. It's followed by a link from which the full report can be downloaded in PDF format.

Click here to download a PDF of the complete report

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks