Nov 03, 2022

CF Benchmarks Monthly Market Recap

Here's the first edition of a monthly compilation of digital asset market data, analysis and insights by CF Benchmarks' Lead Research Analyst Gabe Selby.

This report has been designed to help you see at a glance which blockchain economic categories have been driving recent crypto market performance, get a sense of where institutional investors are allocating capital earmarked for digital assets, and understand how crypto fits into, impacts and is influenced by the broader market picture.

‘Uptober’ brings broad gains

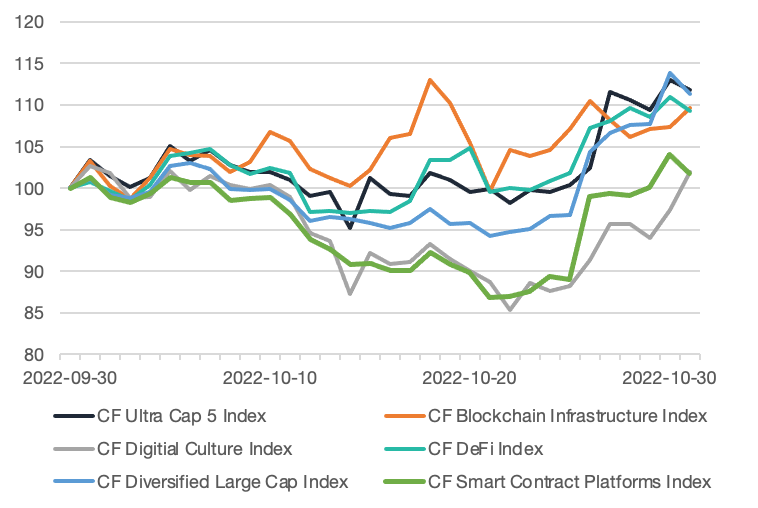

- All our benchmark indices finished October in positive territory

- Larger-cap tokens saw the strongest relative performance with the Ultra Cap 5 (+11.8%) and Diversified Large Cap (11.3%) indices outperforming

- The CF Digital Culture and Smart Contract Platforms indices lagged but still finished the month up approximately 2%

Monthly Index Performance

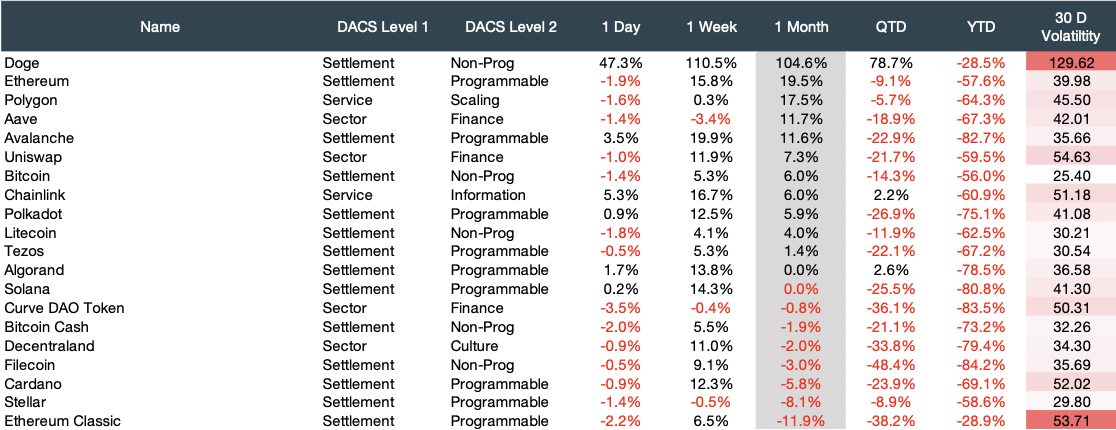

Major Crypto-Pairs (USD)

- Doge prices rose over 100% for the month, this positive price performance followed Elon Musk’s recent acquisition of Twitter

- Most major tokens finished in positive territory, with Ethereum and Polygon continuing to see post-merge momentum

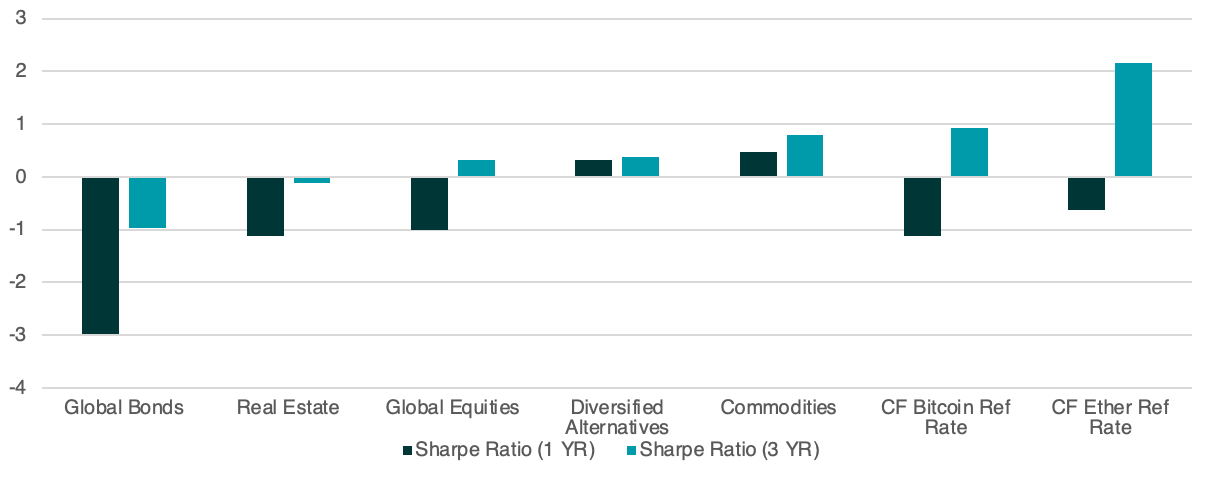

Trailing Risk-Adjusted Returns

When compared to other traditional asset classes, Bitcoin and Ethereum continue to provide the best risk-adjusted performance over a longer-time horizon.

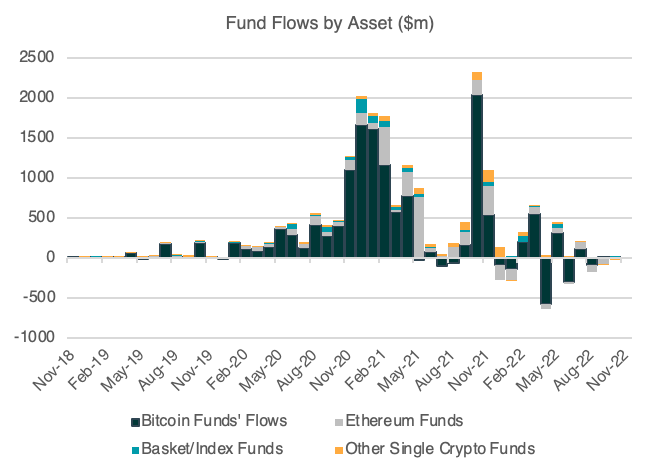

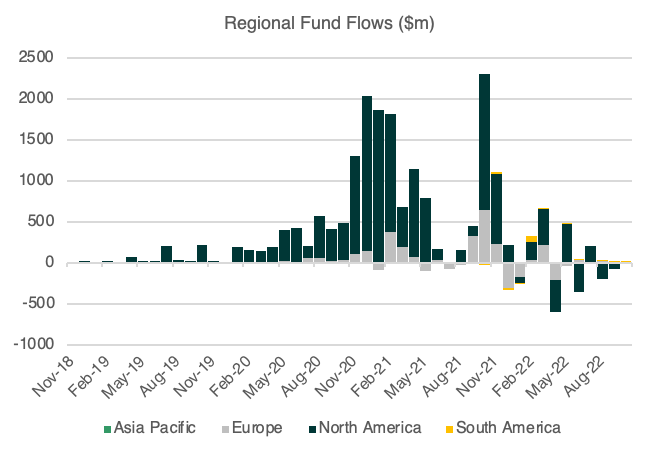

Currency of Flows

- Fund flows remain relatively muted and slightly positive (+$6m); mostly concentrated in Bitcoin (+$14m)

- From a regional perspective, most fund inflows were in the North America region, while Europe saw -$8.7m in outflows

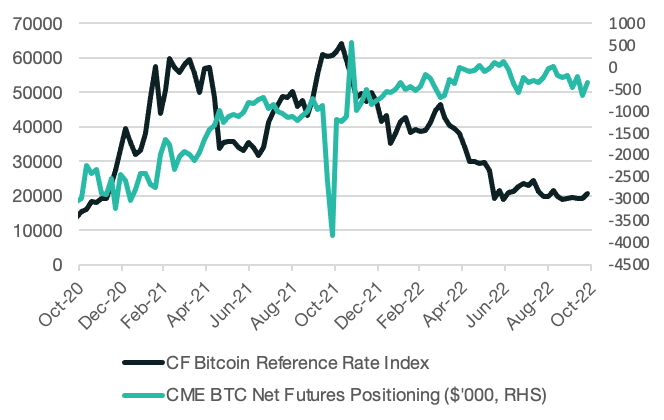

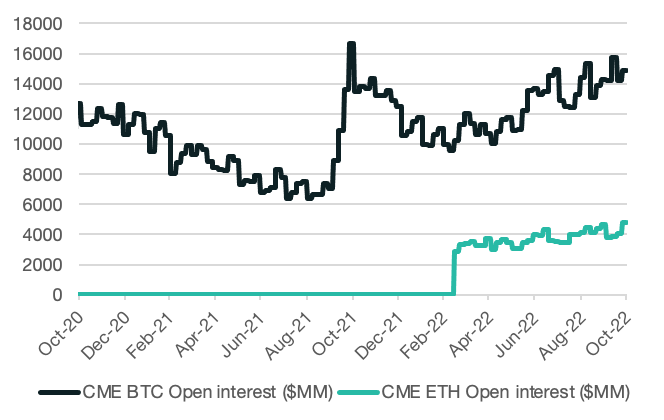

Futures Positioning and Open Interest

- Futures positioning has stabilized since the start of the month, rising slightly to -$357K

- Open interest for Bitcoin and Ethereum futures continues to trend higher

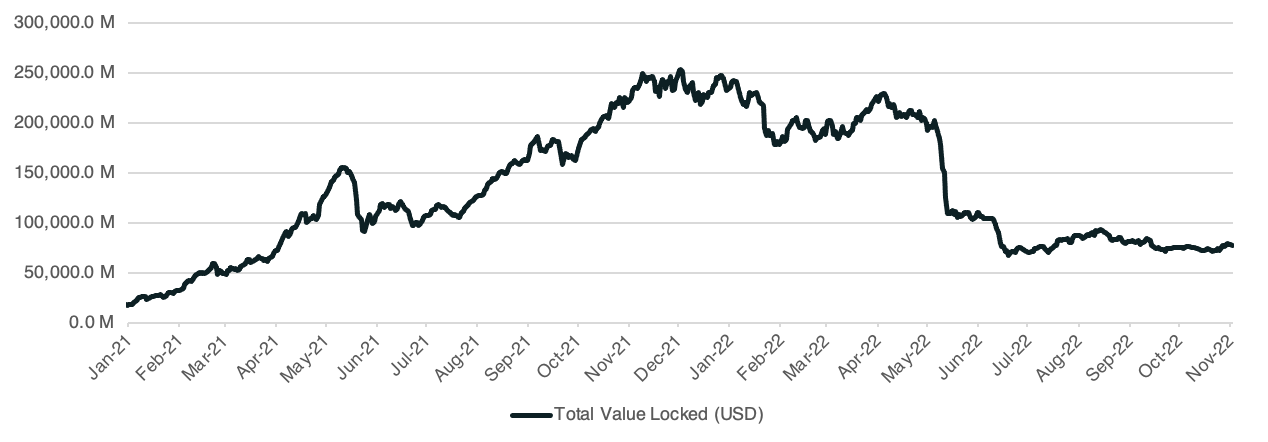

On-chain updates: Total Value Locked in DeFi

Total Value Locked in DeFi protocols remained muted in October, rising to approximately $777m from $750m.

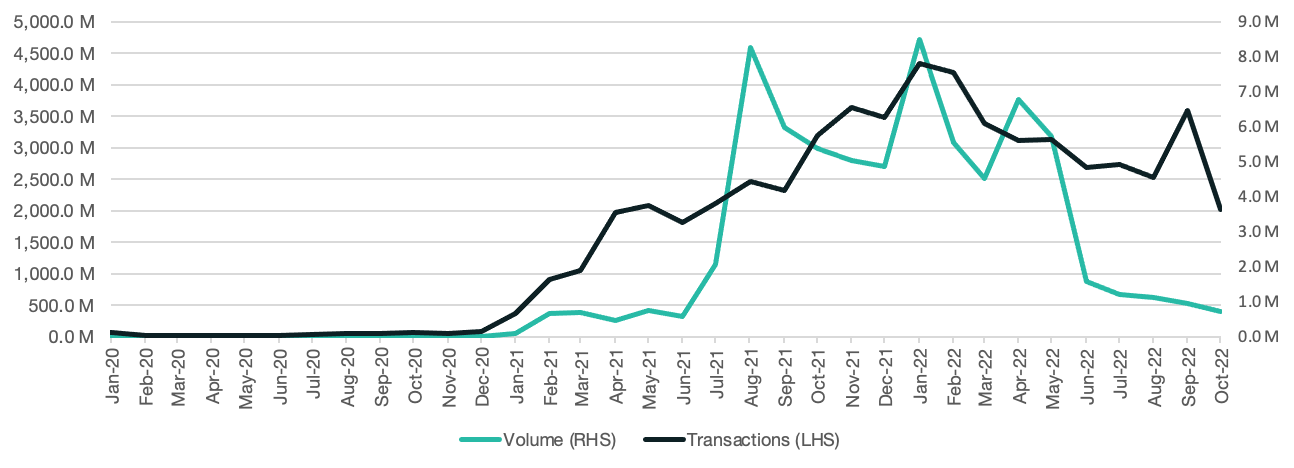

On-chain updates: NFT Transactions and Volumes

NFT transactions and volumes continued their downward trajectories, falling approximately 43 and 24% in October.

Download The CF Benchmarks Monthly Market Recap here (PDF file)

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks