Apr 28, 2023

Announcement of a Consultation on changes to the CF Digital Asset Classification Structure (CF DACS) Methodology

The Administrator announces that it is launching a consultation on proposed changes to the CF Digital Asset Classification Structure (CF DACS) Methodology. The Administrator proposes changes relating only to the sections of the methodology below:

- Section 6.2 – CF Digital Asset Classification Structure and Section 6.2.2 – Examples

- Section 6.2.1 – CF DACS Definitions

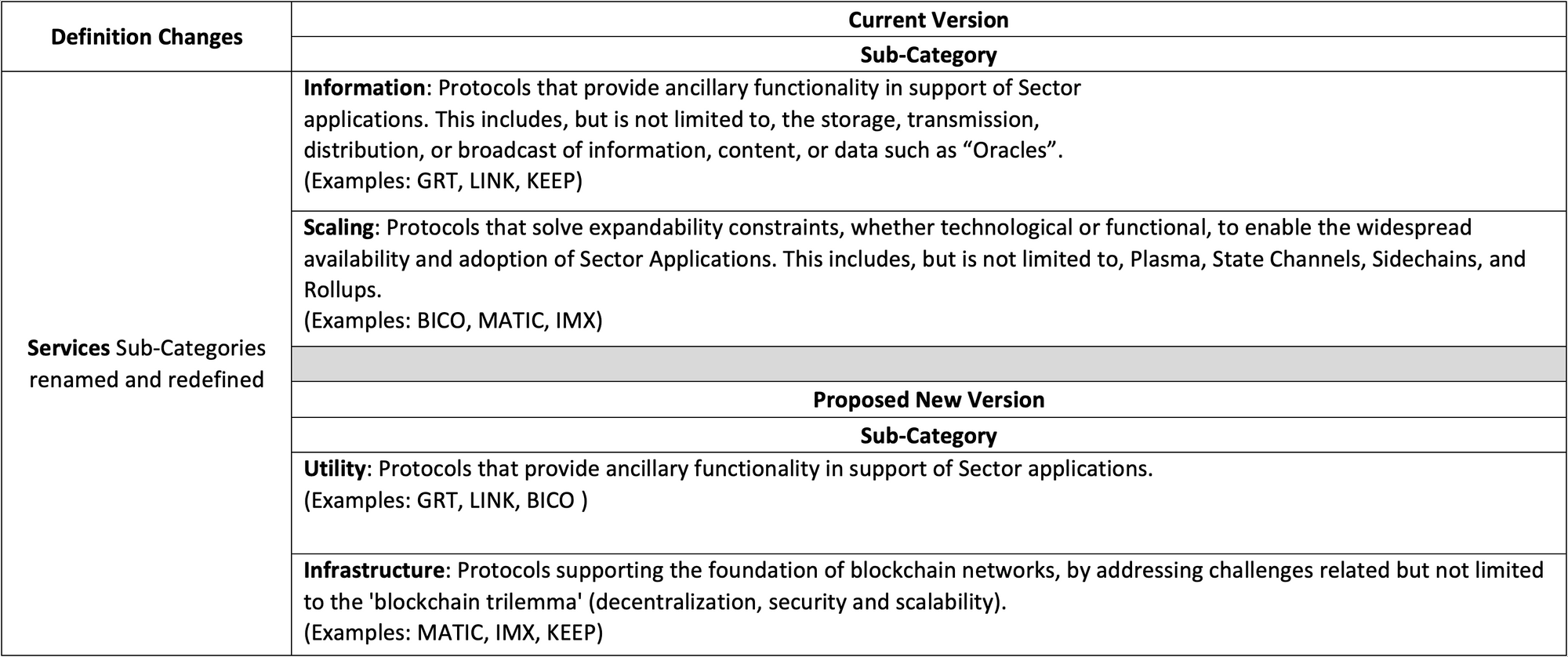

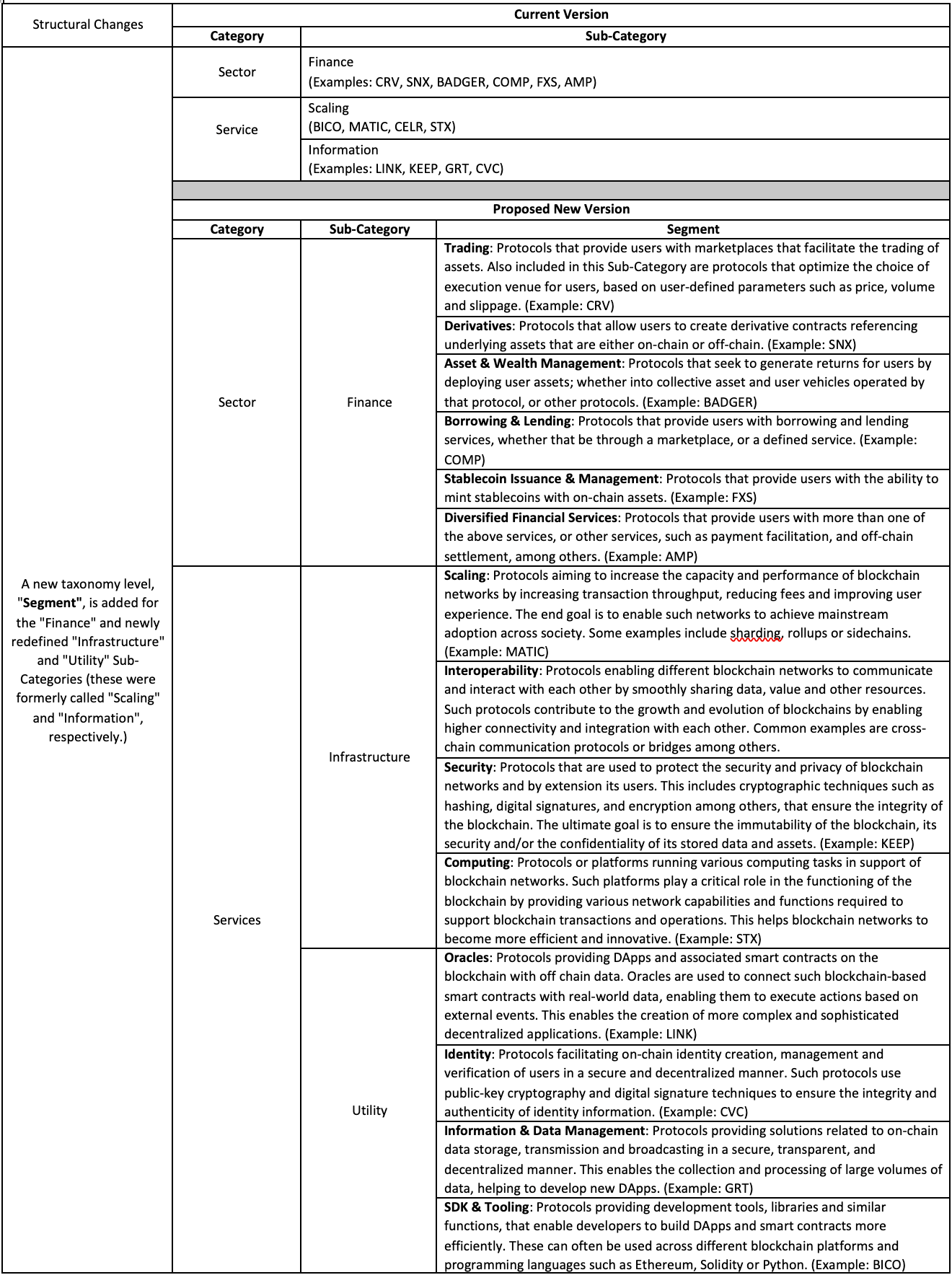

Tables outlining proposed changes follow.

Proposed Changes to Definitions

Proposed Structural Changes

Rationale

On a periodic basis, the Administrator reviews its existing CF Investable Universe. During this process, either new Digital Assets can be added, or the existing Digital Assets can be removed from the CF Investable Universe. The latest review of the CF Investable Universe as well as the evolution of the Digital Asset definitions resulted in changes to the CF Digital Asset Classification Structure (CF DACS), the hierarchy, and to the introduction of granular definitions for different levels within the CF DACS.

Implementation Timeline

The Administrator proposes to implement the proposed changes to the CF Digital Asset Classification Structure Methodology at 1100 London Time on May 12th, 2023, meaning that all products will be utilising the CF DACS’s new adopted structure and definitions from that date forward.

Consultation Process

The consultation will begin on April 28th, 2023, ending on May 5th, 2023, at 1600 London Time. All responses will be treated confidentially in accordance with the Administrator’s policies and procedures and will be overseen by the CF Oversight Function in accordance with UK BMR.

In case of any questions or queries please do not hesitate to contact [email protected].

Any users wishing to file a complaint regarding this consulation process can do so confidentially by writing to [email protected].

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks