Dec 29, 2022

2023 Market Outlook

Key Takeaways: Looking for the three ‘R’s’

Dear reader,

We at CF Benchmarks are pleased to present our inaugural outlook for the 2023 calendar year. This annual exercise is designed for existing or prospective crypto investors who are trying to better understand how to allocate capital in today’s challenging environment. Our team has been privileged to be on the vanguard of both facilitating and witnessing the institutional adoption of this emerging asset class. Although this past year has presented significant challenges, the team at CF Benchmarks has been able to achieve significant milestones: indexed Assets under Reference (AuR) rose steadily past $2b USD, we have launched a series of new products including, 7 portfolio indices and over 30 reference rates, along with the first ever Bitcoin Interest Rate Curve (BIRC), and finally, a comprehensive framework for categorizing digital assets (the CF Digital Asset Classification Structure). As we head into the new year, we couldn’t be more optimistic for the long-term future of digital assets. We appreciate this despite elevated levels of uncertainty and numerous industry hurdles still intact. Therefore, we have concisely laid out our base-case roadmap for crypto markets in this outlook which can be centered on three major themes for 2023:

- Relief of the macro-head winds: It is our view that crypto's hostile macroeconomic environment will fade in 2023. The crusade on fighting inflation has pushed central banks to increase their policy rates rapidly, while at the same time, removing supportive liquidity out of financial markets. This has unquestionably had a substantive negative impact on the performance of digital assets. It appears now that inflationary pressures have started to roll over and economic activity is softening. This will ultimately lead to a macroeconomic turning point next year that will shift the direction of the prevailing headwinds.

- Regulatory clarity: Crypto has faced a series of collapses that has hurt investors and shattered confidence in crypto. These failures have many causes, some unique, but most of them could have benefited from a more robust regulatory framework. It is our view that these unfortunate events will spark lawmakers across the globe to begin to develop clearer guidance and regulations for digital assets, which will likely lead the way for further adoption at an institutional level.

- Recovery led by secular crypto trends: Key trends in emerging crypto market segments are likely to recoup momentum as this crypto-winter begins to thaw. Institutional adoption is anticipated to shift into higher gear with decentralized finance (DeFi) and metaverse segments bridging established players with crypto-natives. Additionally, the decentralized application (dApp) revolution that began in the last bull-market cycle is likely to lead digital assets to a recovery in prices. Strategic exposure to these trends will remain critical for investors.

Sincerely,

C.E.O. CF Benchmarks

2022 Recap: macro headwinds & deleveraging bring crypto winter

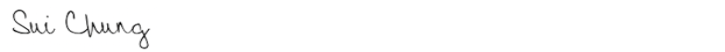

Crypto investors will likely look back at 2022 as a year to forget. The shift in the macro climate that began in late 2021 has had a profound impact on the asset class. Central banks across the globe conceded to being too passive on inflation, which has led to sizable increases in policy rates and interest rates overall. What was once a steady period of easy financial conditions was over, and now risky assets (like crypto) had to face a higher discounting mechanism.

This hostile macro environment eventually sparked a new bear-market cycle. Our CF Bitcoin Reference Rate Index has fallen over 75%. Adding to higher rates, a series of exogenous shocks has led crypto markets lower. The bear market that began earlier this year has only intensified after each over-levered institution or organization collapses. Each failure has had a cascading impact on the overall asset-class, with the falling prices of crypto markets sparking an industry deleveraging exercise, spreading contagion that leads to even further discounting of crypto assets. These events and circumstances have inspired the three themes of our 2023 outlook: Relief of the macro-heads, Regulatory clarity, and a subsequent Recovery led by secular crypto trends.

Relief: searching for a macro pivot

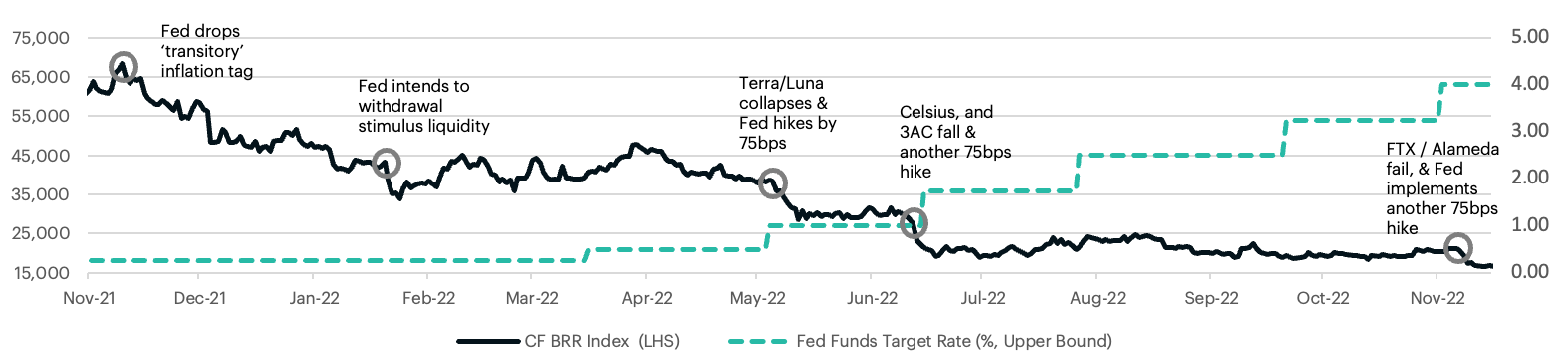

Risk sentiment has begun to look into the future for an eventual pivot or slowdown in monetary tightening. The most recent inflationary trends indicate that headline pricing pressures may have peaked in June. This dynamic has shown to be supportive of crypto-markets, which particularly face headwinds from a rising interest rate environment. However, as prior leading categories of inflating begin to fall (i.e., energy), core services inflation is likely to be more difficult to tame and the overall level of inflation is likely to remain above any acceptable threshold for some time.

As we look ahead into 2023, the key monetary-policy variables for investors will be a shift from focusing on the pace of rate hikes (which will slow), to monitoring the level and duration of terminal policy rates.

Our view…

Level: we believe that the Fed will pause their rate hiking cycle in the early second quarter of 2023, marking the peak Fed funds target at 5%.

Duration: our outlook is that the world will face a mild (or shallow) recession in 2023 that will lead to central banks across the globe to slowly begin cutting rates sooner than policymakers have suggested, potentially in early 2H’23.

Relief will arrive for the Fed and investors as inflation and aggregate demand cool off. Risk sentiment will likely continue to price ahead of this pivot, which should likely shift last year’s headwind into a slight tailwind.

Regulation: present & future

Current:

- Commodities vs. Securities: There’s conflict between the SEC’s view of cryptoassets and the CFTC’s view. The SEC has consistently indicated it believes most cryptos will turn out on close examination to be securities, excepting bitcoin. By contrast, the CFTC had signalled until very recently that it regarded bitcoin and ethereum as commodities. CFTC Commissioner, Rostin Behnam, stated late in November 2022 that only bitcoin should be viewed as a commodity, contradicting previous statements.

- FINCEN: Expects exchanges to comply with the FATF ‘Travel Rule’ that covers domestic wire transfers, (an anti-money laundering measure).

Incoming:

- The highest profile U.S. regulatory development this year precedes FTX/Alameda though still pre-emptively focused on many issues the debacle raised. The White House Framework for Responsible Development of Digital Assets was produced by a U.S. Treasury led interagency group in September. Incoming regulations are likely to take the form of responses to the framework and will be adapted and additionally informed in the wake of FTX/Alameda.

Current:

- Cryptocurrencies are broadly considered legal across the European Union, though specific regulations – particularly with respect to exchanges – differ somewhat across member states. Taxation varies but many member-states charge capital gains tax on cryptocurrency-derived profits at rates of 0-50%.

- 2020’s Fifth Anti-Money Laundering Directive (5AMLD) brought cryptocurrency-fiat currency exchanges under EU anti-money laundering legislation. In December 2020, 6AMLD came into effect: the directive made compliance more stringent by adding cybercrime to the list of money laundering predicate offenses.

Incoming:

- Like the U.S., the EU had one of the most comprehensive policy frameworks under development among large economies before the high-profile crypto-related failures of 2022. The European Commission is developing a set of proposals known as the Markets in Crypto-Assets Regulation (MiCA) that set out measures for cryptocurrencies, including the introduction of a new licensing system issuers, industry conduct rules, and new consumer protections.

Current:

- Such progress as there has been in UK crypto laws has generally settled on the legal status of digital assets as property – the UK classified “cryptoassets” as property relatively early – for the purposes of taxation.

- After leaving the EU in 2020, the UK transposed cryptocurrency regulation requirements into domestic law. Therefore, exchanges need to register with the FCA and comply with AML/counter-terrorist reporting obligations.

Incoming:

- Definite signals have been telegraphed by UK regulators suggesting the development of regulatory frameworks will accelerate in 2023.

- Particular attention should be paid to the UK’s planned Financial Services and Markets Bill, a set of rules under development that pre-existed 2022 events but that is now being elaborated to include crypto-specific elements.

Current:

- Exchanges are required to be registered with FinTRAC. Canada’s regulators are widely seen to have been as cautious as those in the U.S. regarding cryptoassets, albeit more proactive, primarily regulating them as securities. Canada leads North America in terms of exchange traded crypto products, with several listed on major exchanges, including those managed by CFB client Evolve. Digital assets have been treated as currencies under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) since 2014.

Incoming:

- Ironically, there are fewer signs of further evolution in Canadian cryptoasset legislation on the horizon than in the U.S. With Canadian Securities Administrators (CSA) publishing guidance for issuers as recently as 2021, it’s likely that authorities and the industry will look to assess the impact of recently implemented measures before impetus for further rules materializes. The guidance set out expectations for disclosures that crypto issuers must provide about how they protect their assets against loss and theft.

Current:

- Crypto and crypto exchanges are legal in Australia against one of the most progressive regulatory backdrops among developed economies. Guidelines for exchange traded cryptoassets that strongly echo CFB principles, were published in 2021. The first digital assets followed in May 2022, though some were delisted only six months later.

- The country’s digital assets governance progressed notably during 2019-2022, with a clear framework published aiming to enable consumers to safely purchase and sell crypto assets in a regulated environment.

Incoming:

- The pattern of proactive cryptocurrency regulation is now well established in Australia, and these latest regulations illustrate the country’s continued effort to provide a clear framework for crypto businesses to operate in the coming years. In view of the pace of regulatory developments in recent years, together with probable setbacks in public and official perceptions triggered by events in 2022, a pause in the setting of new guidelines is likely in the coming months.

Current:

- Cryptocurrency exchanges and ICOs are illegal in China and financial institutions have been prohibited from handling Bitcoin transactions since 2013. Still, a 2020 amendment to China’s Civil Code ruled that cryptocurrencies have the status of property for the purposes of determining inheritances, one of many indirect signals clarifying that ownership of digital assets is not illegal.

- But on-shore mining was banned In June 2021, and September 2021 regulation banned exchanges too. The use of platforms via VPN, etc., is common, though illegal.

Incoming:

- The outlook for crypto in China is among the easiest to predict for any major economy. There’s little indication that China intends to loosen rules in the near term. Likewise, although China’s central bank has been working on an official digital currency for years and in 2021 said it had completed tests of an e-CNY, the timeline for the full introduction of its CBDC is unclear.

Regulatory clarity: Key themes for 2023

Unfortunately, the most memorable events associated with crypto markets and finance this year have been some of the most egregious ever seen in the short history of digital assets. Among the litany of high-profile cryptocurrency project collapses this year the most notable include the disintegration in May of Terraform Labs’ algorithmic ‘stablecoin’ UST, and governance token LUNA; which in turn triggered a spate of insolvencies, including hedge fund Three Arrows Capital, lenders Voyager, Celsius; before FTX’s implosion in November - which served the final straw for BlockFi, among others.

Aside from the direct impacts of these multiple event clusters, at the corporate level, on consumers, and on market equilibrium, all of which are quantifiable to a degree and likely to become more so in the medium term, the extent of corrosion of institutions’ inclination to adopt digital assets — as market participants and as service providers — will take longer to assess. Some of the most likely set of consequences are widely expected to be the acceleration of the development of regulatory controls and standards.

Our view…

It should be clear that regulatory responses must reflect the variety and complexity of crypto services available and their providers, or the measures are likely to be ineffective. As the leading regulated cryptocurrency Benchmark Administrator, CF Benchmarks obviously has a keen interest in all aspects of digital asset regulation for the furtherance of our mission to promote the integrity of its markets and services for the benefit of all.

In view of expectations that the development of crypto regulation is likely to accelerate in the year ahead, we think our view of the regulatory outlook for digital assets in 2023 will be instructive. Policymakers have a historical opportunity to tackle some of the most pressing issues plaguing the industry. In the U.S. for example, the traditional investment community still lacks a ‘spot ETF’ product that can track the underlying fund assets more closely. Additionally, regulatory gaps and opaqueness surrounding the formal categorization of digital assets has left many established institutions in limbo, forcing some users to seek services in less-sophisticated regulatory regimes. This has created an environment where consumer protections have been compromised or flat-out ignored. We believe that it is worth focusing more attention to the regulatory developments in the most pivotal regions that have global influence (such as the U.S. or EU).

Ultimately, the recent setbacks has shattered confidence and hurt investors should provide a new sense of urgency for policymakers. A clearer, robust regulatory framework is needed to help protect investors, while also allowing this emerging technology to continue to develop into its full potential. We believe that clarity surrounding existing and potential legislation will provide a positive catalyst for restoring confidence and accelerating the institutional adoption of digital assets.

Recovery: secular themes to spark a new cycle

Now that we are familiar with how this most recent bear market cycle has played out, investors are interested in answering the question “what are some key catalysts that will be supportive of digital assets?” It is our view that the next recovery phase will likely stem from the prevailing secular themes that once helped bolster crypto markets to their $3tn water-mark in late 2021.

- The pace of institutional investment into digital assets will likely shift into higher gear this coming year. Investors are likely to be attracted to the asymmetrical return potential that’s unique to crypto. Meanwhile, other traditional ‘risk-assets’ are likely to remain relatively challenged by the weaker growth environment ahead.

- Defi will likely stage its disruptive recovery. The potential benefits of public blockchains for enhancing existing financial services are apparent (such as autonomy and efficiency) and will likely lead to more milestones.

- Scaling solutions (and upgrades) are allowing layer-1 blockchains to solve bottleneck issues that have historically plagued these decentralized networks, paving the way for the next wave of projects and real-world use cases.

- Metaverse momentum will help foster growth in complimentary segments, such as Digital Culture and Web 3.0. Blue chip technology firms remain invested in developing both hardware and software solutions for this new virtual landscape.

Additionally, we would like to emphasize that the best approach for investors to take advantage of these secular themes is through a diversified, strategic (or longer-term) allocation to digital assets which will facilitate the forthcoming highlighted trends.

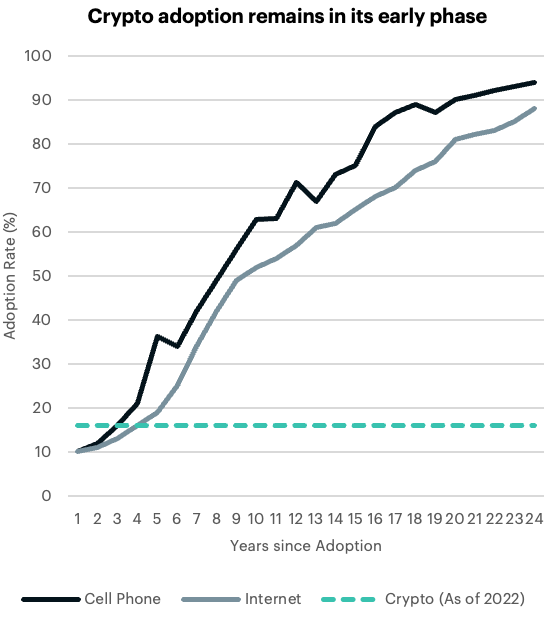

Institutional adoption gears up

The crypto market remains in its early days. If we were to compare its market capitalization (or size) to other traditional markets, such as global equities (+111tn) or fixed income ($128tn) then we can clearly see how marginal crypto’s sub $1tn amount is in comparison. One likely reason for this stark difference in size can be explained by the degree of institutional presence, where other traditional markets are dominated. Meanwhile, these large players are only getting started with gaining exposure to digital assets.

Looking at futures data on bitcoin as proxy for institutional demand, we can see that open interest, or outstanding positions, has remained on a steady uptrend. This is despite the recent bear-market cycle which started in late 2021. The divergence seen between the two is likely to boomerang in 2023. Like the mid-2020 period, open interest rose rapidly as the price of bitcoin remained relatively stagnant. Using history as a guide, we expect that the current divergence in institutional interest and lack of price action is indicative of where bitcoin prices are likely to go over the next 12-months.

Our view…

We believe that digital assets are likely to take another step forward in their maturity cycle. This incoming phase can be centered on the next wave of institutional adoption. Institutional investors are likely to be attracted to the asymmetrical return potential that’s unique to crypto. Meanwhile, other traditional risk-assets are likely to remain relatively challenged by the weaker growth environment in 2023.

DeFi poised for disruptive recovery

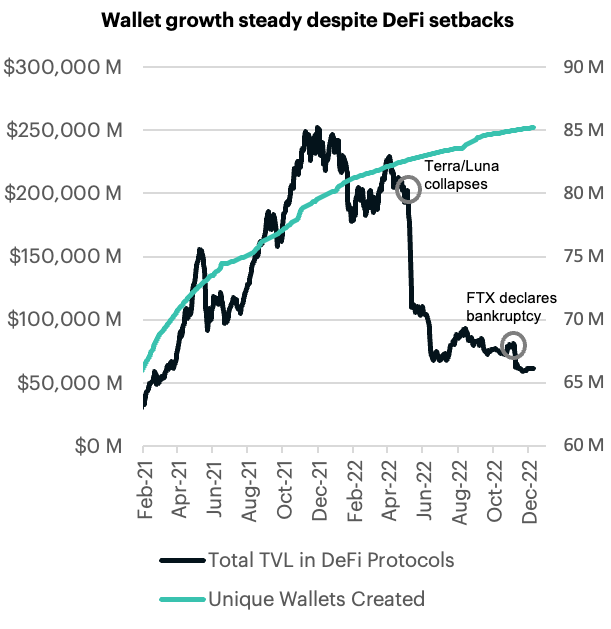

The challenging market conditions that led to crypto’s deleveraging exercise has had a material impact on the decentralized finance (DeFi) space. Last May, the collapse of the Terra / Luna ecosystem shrank total value locked (TVL) by approximately $130b. Recently, the FTX fallout caused another $20b decrease in TVL. This has left the size of the segment at just approximately $60b, down from over $250b a year ago. Other key metrics, such as Decentralized Exchange (DEX) trading volumes and developer activity, have trended lower in a similar fashion, making 2022 a year that has placed DeFi in existential crises.

However, not everything has been ‘doom and gloom’. Total wallet growth has remained resilient, and liquid staking, which allows staked assets to receive a tradable version of their locked-up token, has grown in popularity. Another positive development revolves around the momentum seen in scaling solutions. These developments have been very complementary to DeFi protocols as cost efficiency and bandwidth has historically challenged user experiences. Lastly, a DeFi pilot program by the Singaporean Central Bank successfully executed the first ever tokenized forex transaction on a public blockchain, marking a major milestone for the technology expanding into other, more traditional asset classes.

Our view…

The Defi space is one of the more nascent segments in crypto. The challenges this past year should be viewed as a temporary set back, not a death sentence. We believe that developer activity will recover along with transaction volumes (revenue). Lastly, the relative resilience and continued improvements in the segment should garner more interest from institutions. The potential benefits of public blockchains for enhancing existing financial services and trading other real-world assets (RWAs) are apparent (such as autonomy and efficiency) and will likely lead to more milestones in 2023.

Scaling out with roll-ups, sharding, and lightning

The crypto community witnessed a major achievement this year with the successful merge of ethereum's legacy blockchain to its newer, more efficient network. Executing this major change in the consensus mechanism was a risky endeavor, but the subsequent success of the upgrade has paved the way for wider adoption since a PoS network addresses the major environmental concerns that are apparent in running a large proof-of-work (PoW) blockchain network.

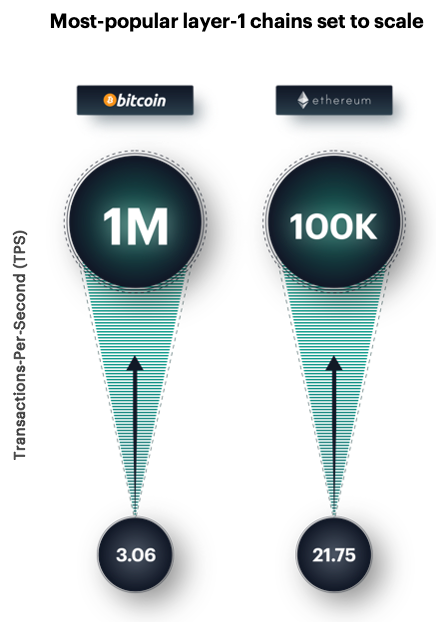

Layer-2 scaling solutions have taken advantage of the recent upgrade. Some of the most popular scalers have announced or launched ‘roll-up’ mechanisms on their respective side-chains. Roll-ups allow layer-2 blockchains to efficiently aggregate a series of transactions on a side chain by rolling them up into a single transaction on the parent layer-1 chain, such as ethereum. Furthermore, ethereum 2.0’s sharding mechanism, which is anticipated to be released in 2023, will also for these side-chains to split the load of processing transactions, without reducing the number of nodes or compromising security validation. Roll-ups and Sharding are viewed to compliment each other as they similarly help solve a blockchain’s so called ‘trilemma’ of decentralization, security and scalability. Some estimate that the ethereum network will be able to achieve up to 100K transactions-per-second (or TPS). Lastly, Bitcoin’s layer 2 payment protocol, known as the Lightning Network, works in a similar fashion. Lightning developers continued open bandwidth in 2022, and many estimate that its network can achieve a TPS capacity of 1,000,000, which would mean that these scaled networks are set to outpace traditional payment processors, such as Visa, which is claimed to only be able to process 24K TPS.

Our view…

Roll-ups and sharding will help layer-1 networks continue to solve blockchain’s “trilemma” of decentralization, security, and scalability. PoW blockchains, such as bitcoin, will follow the successful ‘Lightning Network’ roadmap which has allowed its original layer-1 chain to scale. These developments in decentralized networks is critical for real-world use case adoption. The recent achievements, along with planned updates in 2023, should be enough to tip the scales.

Metaverse momentum key for NFTs and web 3.0

Our digital culture segment, which allows investors to gain exposure to protocols that support cultural experiences like the metaverse, NFTs, gaming, and music, has also seen its 2021 euphoria evaporate over the past year.

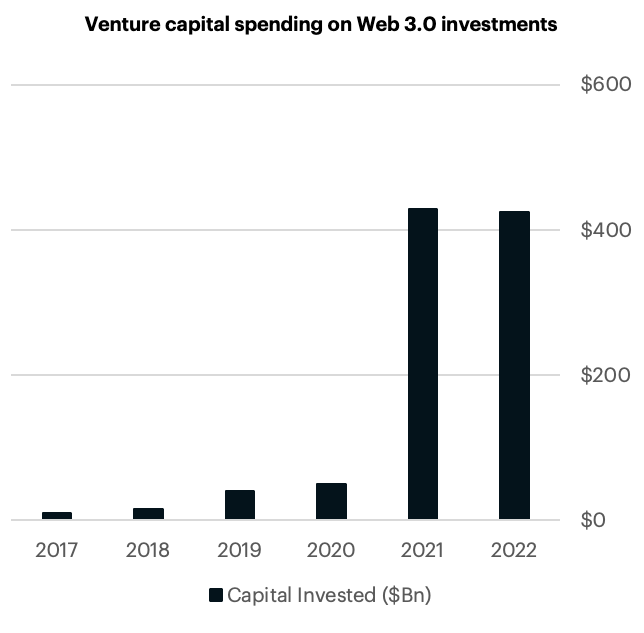

This has left investors questioning where the next positive wave may come from. Currently, major blue-chip companies are investing heavily into both software and hardware applications to support the metaverse. Like the 1990s, this emerging platform will feasibly transform the web as we know it. Big tech firms are studying ways to allow users to plug into decentralized applications (dApps) and allow users to share virtual artwork, interact in social media, or play games. Furthermore, metaverse and web 3.0 marketplaces will be centered on connecting crypto wallets which will allow for a companies to develop new product suites, and for their customers to unlock special rewards. Lastly, venture capitalists have remained interested in this digital ecosystem, albeit slowing allocations in the 2H’22. Funding for web 3.0 companies remained near all-time-high levels despite the recent cool down in digital assets and challenging macro environment.

Our view…

Broader adoption of the metaverse is likely to bring added tail winds for complementary segments, such as Digital Culture and Web 3.0. This virtual universe augments or blends technological assets like games, NFTs, virtual reality, or even social media, and it is even likely to reach the day-to-day office environment through virtual conferencing as soon as this coming year.

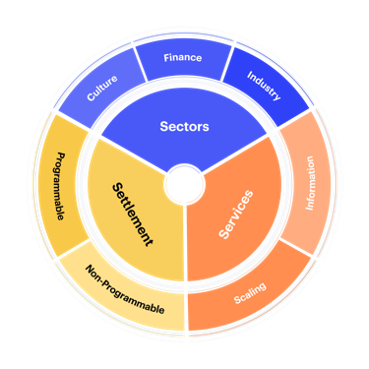

Appendix: CF Digital Asset Classification Structure

The CF Digital Asset Classification Structure (CF DACS) classifies coins and tokens based on the services that the associated software protocol delivers to end users, grouping assets by the role they play in delivering services to end users. The CF DACS powers CF Benchmarks' sector composite and category portfolio indices and allows users to perform attribution analysis to better understand the fundamental drivers of returns within their digital asset portfolios.

Additional Resources

For more information about our CF Benchmark indices and our methodologies, please visit the respective web links below:

- CF Diversified Large Cap Index

- CF DeFi Composite Index

- CF Web 3.0 Smart Contract Platforms Index

- CF Digital Culture Composite Index

- CF Blockchain Infrastructure Index

- CF Cryptocurrency Ultra Cap 5 Index

- CF Broad Cap Index - Market Cap Weight

- CF Broad Cap Index - Diversified Weight

Contact Us

Have a question or would like to chat? If so, please drop us a line to:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks