Power your crypto investment strategy with our SMA ready tools and indices

As the global adoption of crypto expands, investors are increasingly seeking diversified exposure to digital assets, beyond Bitcoin and Ether. We offer a suite of tools and fully customizable multi-asset portfolio indices designed to help wealth management professionals construct separately managed accounts (SMAs) with precision, aligned with the investment goals of their clients.

How we support decision making and portfolio construction

Multi-Asset Portfolio Indices

CF Capitalization Defined Series

Delivers market beta of the digital asset market using portfolio indices that rely on standard or modified market capitalization weighting for assets. Our index constituents are weighted using a Diversified Weighting Mechanism or Free Float Market Cap Weighting Mechanism.

Find out more about our indices:

CF Classification Series

Thematic portfolio indices that passively track the performance of categories, sub-categories, segments or a combination of all, within the CF Digital Asset Classification Structure (CF DACS). Our index constituents are weighted using a Capped Free Float Market Capitalization Weighting Mechanism or Free Float Market Cap Weighting Mechanism.

Find out more about our indices:

Construct diversified portfolios aligned to your clients' investment goals

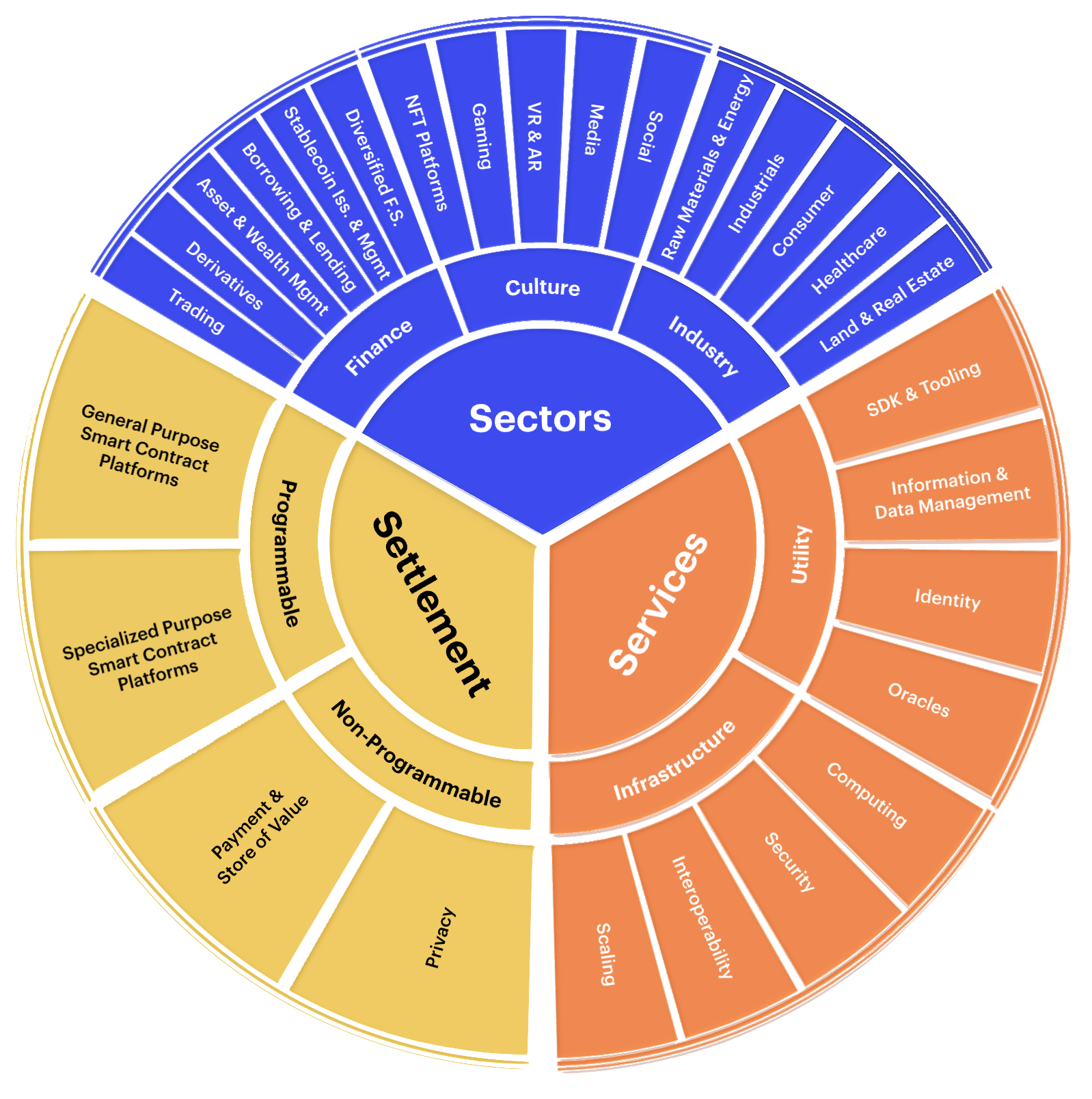

CF Digital Asset Classification Structure

Our CF Digital Asset Classification Structure (CF DACS) is a robust, multi-level system which classifies and segments digital assets by their functional purpose, enabling wealth managers to take a structured approach to SMA investment decision-making.

What is CF DACS used for?

CF DACS is intended to assist investors to better understand the blockchain economy, and to support the portfolio construction and analysis process, including by facilitating the construction of portfolios that capture any digital asset, entire value chains, or blockchain economic categories.

Why the London Market Close is the best time to strike NAV for new Aussie Crypto ETFs

CF Benchmarks has leveraged its unique position as administrator of the most liquid, established and trusted, regulated Bitcoin benchmark, CME CF Bitcoin Reference Rate (BRR), to determine the optimal time to strike NAV for Aussie Bitcoin ETFs.

Ken Odeluga

Global Crypto ETP Market: State of Play

For those new to this sector, it’s also important to note that a significant proportion of crypto ETP providers have opted to utilise CF Benchmarks’ tried and trusted (and FCA-regulated) Benchmark Methodology to underpin reference and NAV calculation prices

Ken Odeluga

CF Benchmarks launches Settlement Prices and Spot Rate indices for SUSHI, CHZ, ENJ, LPT

With institutional demand for Web3 and Metaverse-related tokens continuing to grow, the need for regulated, secure and reliable pricing of such assets is, in turn, becoming ever more critical.

Ken Odeluga