Apr 21, 2021

Why price liquidity matters for Evolve’s ETHR ETF

Evolve ETHR’s NAV is calculated with CME CF Ether-Dollar Reference Rate, the most liquid, regulated Ether price

Ether ETFs flow

It’s a testament to Canada’s progressive institutional investment market that the first three Ether ETFs in the world were approved by the Ontario Securities Commission earlier this month, with all three beginning to trade this week.

It’s also another positive signal for the cryptoasset class as the pace of breakthroughs appears to accelerate. Just weeks ago, ETFs investing in the preeminent digital asset, Bitcoin, didn’t exist. Now, several exist, with four in Canada alone and the first-ever crypto portfolio ETF, Hashdex Nasdaq Crypto ETF, whose reference index is devised and managed by CF Benchmarks, trading on the Bermuda Stock Exchange.

This flurry of launches points to significant institutional investor demand—often reflective of consumer demand—for the simplified and most importantly, regulated, structure of ETFs as vehicles for crypto investment.

Competition follows

The other side of that demand is competition. And competition has been very much in evidence this week. Apart from the willingness of those Ether ETF sponsors to go head-to-head with each other by launching on the same day, this week saw a set of fee reductions—quite like the ones seen when Bitcoin ETFs began trading. First, Evolve announced that it would waive the management fee of its Ether ETF (TSX ticker: ETHR) until May 31st. A day later, CI Global Asset Management swiftly followed by slapping a “zero” management fee on its CI Galaxy Ethereum ETF till June 15th. CI’s fund was initially announced with a 0.4% fee. That left only the Purpose Ether ETF retaining its launch fee of 1% at the time of writing.

Commercial competition is healthy from a client perspective if it reduces client costs. Lower fees can, however, sometimes cloud other just-as-important factors that prospective ETF clients need to consider when choosing which one to invest in.

What price of Ether

One of the most critical is highlighted by the differing approaches to reference pricing and net asset value (NAV) adopted by Ether ETF sponsors. Purpose Ether ETF uses the TradeBlock ETX Index to calculate NAV. CI Galaxy Ethereum ETF’s holdings are priced by the Bloomberg Galaxy Ethereum Index.

Only Evolve Ether ETF, which uses the CME CF Ether-Dollar Reference Rate (ETHUSD_RR) as its reference index, is backed by a pricing source with a fully public and transparent methodology; and whose market integrity, representativeness and replicability have been demonstrated by published quantitative research.

A related ETHUSD_RR factor that’s just as critical is price liquidity. The preeminent block of assets referencing ETHUSD_RR are the CME Group’s Ether Futures, the only CFTC-regulated Ether futures contract. Between their launch, on February 8th, and a snapshot on April 7th, CME ETH futures grew by a total of 34,000 contracts traded, averaging 820 contracts per day. That’s equivalent to 41,000 Ether daily, or about 1.7 million Ether over the roughly 8-week stretch.

Of course, it’s still literally early days for CME Ether Futures.

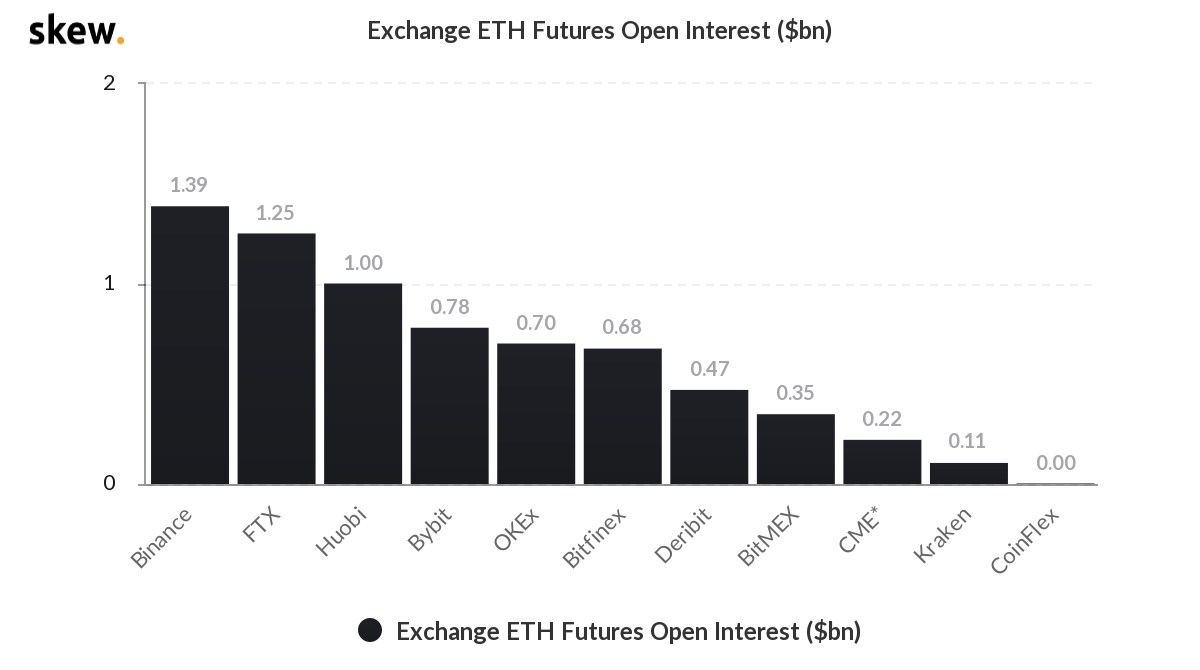

Understandably, CME Ether Futures open interest (OI)—the number of unsettled contracts opened on the exchange and hence a broader indication of volume—lags open interest on other large crypto futures exchanges, as shown in the chart from skewAnalytics below. (Figure 1).

Figure 1: ETH Futures Open Interest on major exchanges as of April 20, 2021 Source: skewAnalytics

Source: skewAnalytics

Crucially however, none of the CME’s rival large exchanges are CFTC-regulated. As such, given that institutional participants are obliged to transact futures only at regulated marketplaces, the assumption is that CME Group crypto open interest represents the most accurate gauge of institutional crypto derivative market activity.

That puts the rise of CME ETH open interest to $220m this week, from a standing start, into context.

Put another way, as far as the institutional Ether futures market goes, certainly in the U.S., CME Ether Futures are the Ether futures market.

Likewise, it follows that CME Ether Futures should also be the most significant section of the ETH futures market as regards institutional investment in the underlying asset.

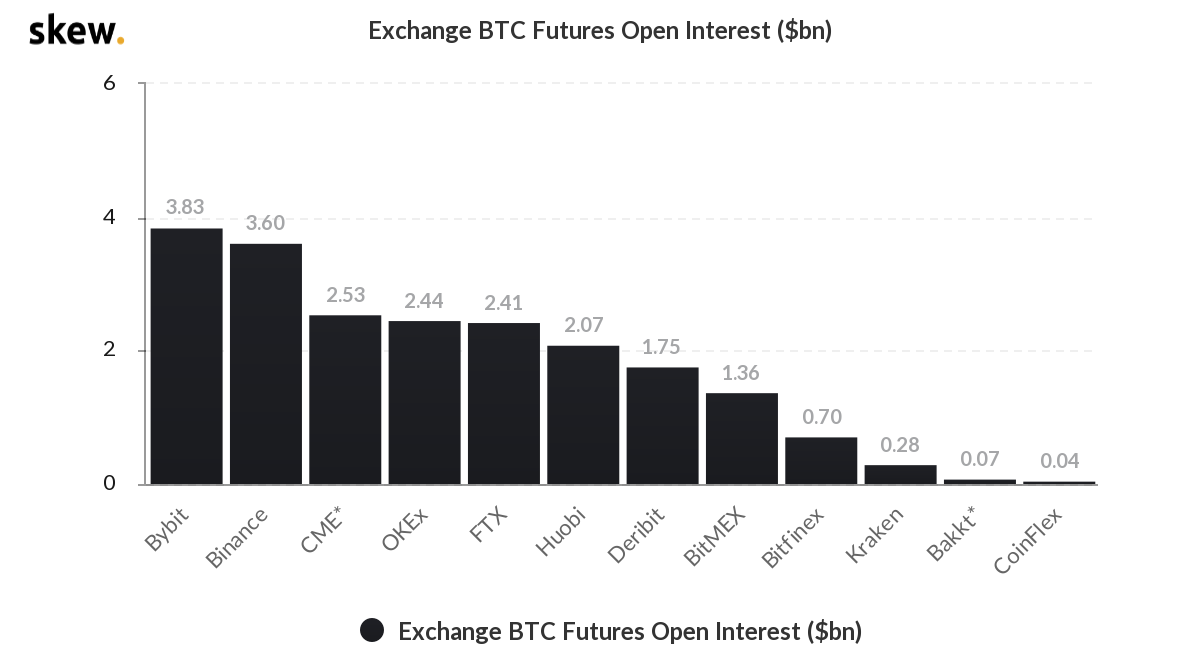

On that basis, it’s instructive to compare CME Ether open interest, with open interest in the group’s flagship crypto contract, Bitcoin Futures. (See Figure 2.)

Figure 2: BTC Futures Open Interest on major exchanges as of April 20, 2021 Source: skewAnalytics

Source: skewAnalytics

From a position towards the lower end of market share around a year ago, CME BTC open interest has regularly vied for the top spot over the last couple of quarters, and currently stands in third place. That’s compelling volume growth.

The rise looks partly due to CME Bitcoin Futures being among the best established BTC futures, having been launched late in 2017. Additionally, with end-to-end regulation of CME Bitcoin Futures (including their settlement index, the CME CF BRR) there’s no question that CME BTC is among the most appropriate markets for institutional participants—another explanation of CME BTC’s rapid growth.

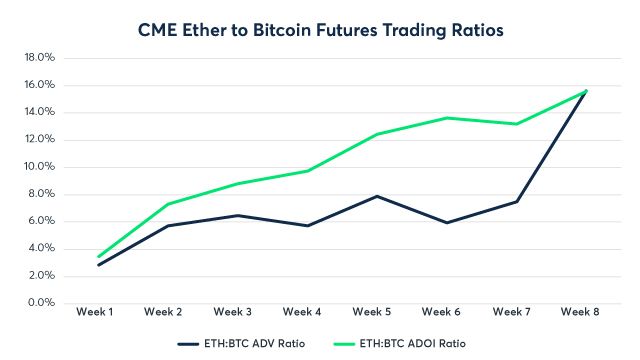

A fair takeaway for CME ETH Futures open interest then, is that growth should steadily increase from here, a notion backed by data showing CME ETH open interest growing faster relative to CME BTC open interest. (Figure 3).

Figure 3: ETH/BTC Average Daily Volume (ADV) ratio vs. ETH/BTC Average Daily Open Interest (ADOI) Source: CME Group

Source: CME Group

The growing liquidity of assets referencing the ETHUSD_RR has further implications, bearing in mind the importance of both overall market liquidity and the representative liquidity of individual assets. (There’s a quick refresher at the link).

Note that CME Ether futures surpassed $160m in terms of weekly trading volume in their first week of trading. Equivalent weekly volume was around $410m by April 7th, based on the ETHUSD_RR index price of $2,003.93 on that day.

All told, the ample and almost certainly growing liquidity of Ether at the CME CF Ether Dollar Reference Rate price, implies an edge of superior market efficiency for assets priced with the ETHUSD_RR, including Evolve Ether ETF.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Sell-Off Intensifies Amid Fed Uncertainty

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Gabriel Selby

Weekly Index Highlights, December 1, 2025

Large caps rebounded in a beta-led rally as Sectors like DeFi and Culture mean reverted. Staking rate changes wavered. Bitcoin implied volatility fell despite realized vol's rise; funding rates diverged: BTC (BIRC) steeper, USDT softer. In Factors: Downside Beta and Liquidity edged Growth and Value.

CF Benchmarks

CF Benchmarks Newsletter Issue 96

The checklist for a durable low—lower implied volatility, term structure back to contango, skew nearer neutral—has been partially met, but not conclusively so, as yet.

Ken Odeluga