Sep 15, 2021

CF Benchmarks Recap - Issue 40

-

Perfect BTC tracking via the CME CF BRR Liquidity Complex

-

CF Benchmarks-powered Bitcoin ETFs: an update

-

Bitcoin futures ETFs eye foothold in ‘physical’

Perfect tracking and fizzy alts

Summer’s done, and the waiting game for that elusive U.S. Bitcoin ETF continues. We thought it high time to update our round-up of CFB-powered filings. (See ‘Featured benchmarks’) We also caught up with homework in our latest white paper, a manual on how multiply-regulated megabanks can create BTC products that track BRR perfectly (also, in ‘Featured benchmarks’). In markets, attention on the ‘scalable’ sector effervesced Solana and Cardano further, whilst NFT Wave 2.0 helped buoy ETH and alternative Tezos. Anticipation of Cardano’s Alonzo mainnet lifted CF Cardano-Dollar Settlement Price to its benchmark peak of $2.996 on Sept 2, up ~186% in 6 weeks. Real-time ADAUSD_RTI slumped to $2.3845 by mid-Tuesday. ADA joined ETH and BTC in double-digit 1-week collapses. Strident opposition to El Salvador’s BTC adoption was the least plausible precipitant; Coinbase’s Wells Notice appeared more capable of sending a chill after August’s broad advance. (Reference Rate returns for August are summarised in ‘The Returns’). More ETH was burned than minted for at least one 24-hour stretch—a network first—following EIP-1559, triggering $4,026.87 on Sept 3, a 3-month top. The wheels came off 4 days later: a slide to $3,025.06 nixed Aug gains. Similar for BTC. Live benchmark BRTI marked $42,989.87, down from $52,881.12, its best since early-May, just 12 hours earlier.

Futures to physical: step one

With myriad moving parts governing regulations on listed funds, let alone crypto vehicles, apparent inconsistencies can creep in. One current oddity, however, could be telling: at least one prospective CME Bitcoin Futures-based fund, VanEck Bitcoin Strategy ETF (a ‘1933 Act’ filing) has the facility to “also invest in pooled investment vehicles, including ETFs listed and traded in Canada”. That would include Evolve ETFs’ EBIT, which strikes daily NAV against the regulated CME CF Bitcoin Reference Rate—handy for minimal tracking error. Unless cogent with informal ‘guidance’ it would be a risky facility to include. Elsewhere, further circumstantial indications of dialogue include voluntary withdrawals, late last month, by ProShares and VanEck, of separate applications to list Ether futures ETFs.

‘Big Bank’ crypto convergence continues

Increasing momentum by dominant U.S. bank holding companies towards crypto services and trading, despite unequivocal regulatory risks, underlines the timeliness of our CME CF BRR Liquidity Complex showcase for delivering compliant structured products (excerpted below). Citigroup joins the ranks of Wall Street lenders reportedly awaiting regulatory approval to trade CME Bitcoin Futures, and certainly “considering products such as futures for some of our institutional clients”. JPMorgan last month rolled out elective access to six private crypto funds for wealth management clients, including Osprey and Grayscale vehicles and, with stricter conditions, a NYDIG product with ‘physical’ collateral. There’s an intersection with Wells Fargo, which also partnered with NYDIG on a passive private BTC trust.

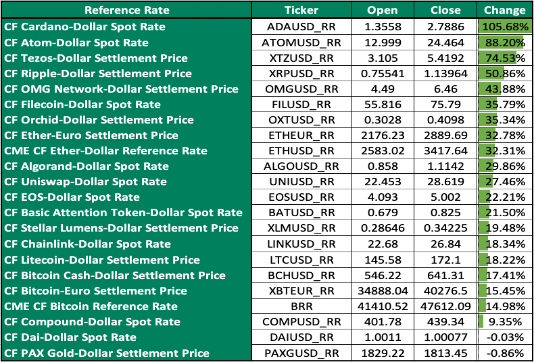

The Returns: August Reference Rate returns

August brought a potential maximum extension of the year’s alt-coin ascendance, with several assets reversing sharply after this snapshot.

Featured benchmarks: CF Bitcoin-Dollar US Settlement Price, CF Bitcoin-Dollar US Settlement Price

Our latest whitepaper shows how BRR-powered ETFs within the BRR’s ecosystem of institutional liquidity bridge the regulatory divide to big bank Bitcoin products

What's at stake

For the largest global financial services institutions, particularly U.S.-based multinational banks, it’s no secret that increasing cryptocurrency adoption, price appreciation and demand have been an enormous headache as much as a massive opportunity.

On the one hand, signal developments affirming continued normalisation of the asset class show no let-up. Take SEC chair Gary Gensler recently intimating how cryptocurrency ETF applicants might soon obtain regulatory approval. If that happens, client enquiries clamouring for crypto access can only get louder.

On the other hand, there are specific regulatory and legal considerations militating against dominant multinational banks getting involved outright in crypto.

Read the rest of this article on our website.

Keeping tabs on CF Benchmarks-powered U.S. BTC ETFs - Part II

One of the few certainties about the first U.S. Bitcoin ETF is that it will be powered by a regulated CF Benchmarks index

The typical late summer lull in institutional markets news means a quieter slate for crypto ETF applications, for now.

But what about the crypto ETF paperwork that’s been piling up on the SEC’s desk for almost every month of the year?

It’s largely a waiting game since the unprecedented volume of crypto filings in recent months. As we saw, BTC (and ETH) filing mania even stepped up a gear in August, following the SEC chair’s not particularly subtle hint on Bitcoin Futures-based ETFs. Beyond that, uncertainty lingers on several key fronts.

Read the rest of this article on our website.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks

CF Benchmarks

CF Benchmarks