Mar 25, 2024

Announcement of a Consultation on changes to the CF Digital Asset Classification Structure (CF DACS) Methodology

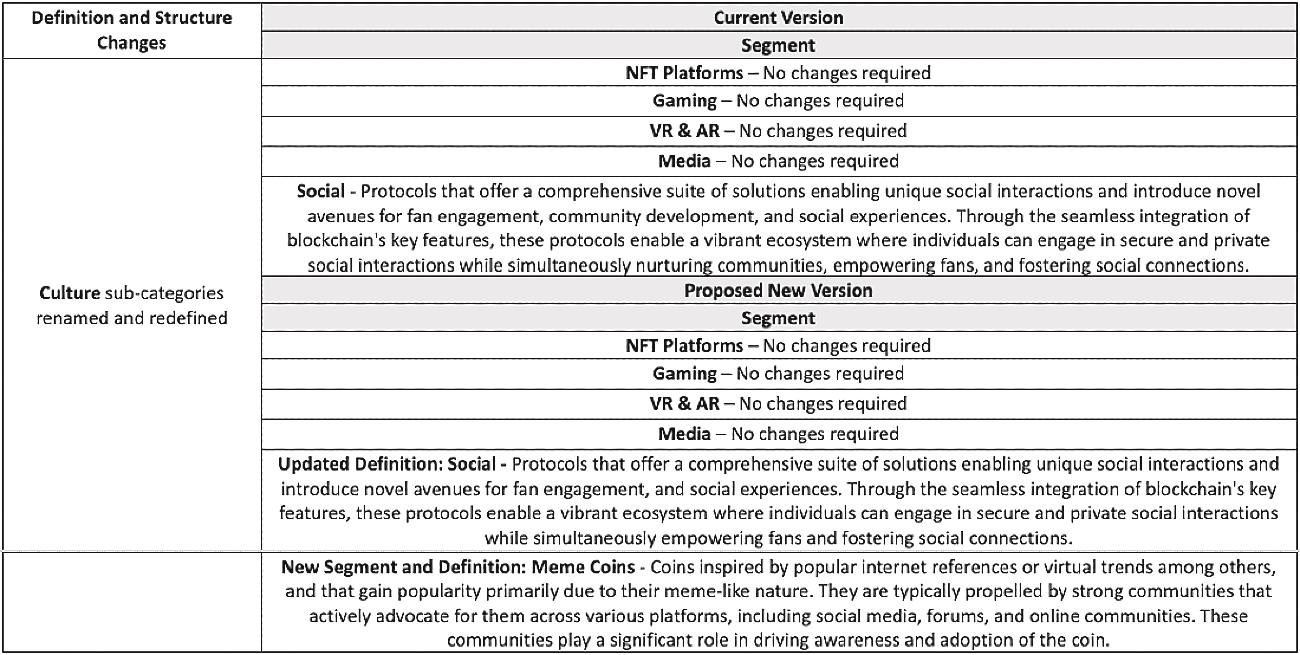

The Administrator announces that it is launching a consultation on proposed changes to the CF Digital Asset Classification Structure (CF DACS) Methodology. The Administrator proposes changes relating only to the sections of the methodology stated below:

- Section 3.2 – CF Digital Asset Classification Structure

- Section 3.2.1 – Definitions

- Section 3.2.2 – CF DACS Definitions

A table outlining proposed changes follows.

Rationale

The latest review of the CF Investible Universe as well as the evolution of Digital Asset definitions resulted in changes to the CF DACS classification structure, and definitions, specifically, a new segment needs to be introduced, and existing definitions need to be updated.

Implementation Timeline

The Administrator proposes to implement the proposed changes to the CF Digital Asset Classification Structure Methodology at 1100 London time on April 9th, 2024. This means all products will utilise CF DACS' new structure and definitions from that date onwards.

Consultation Process

The consultation will begin on March 25th, 2024, and will end on April 8th, 2024, at 1600 London Time. All responses will be treated confidentially in accordance with the Administrator's policies and procedures, and will be overseen by the CF Oversight Function in accordance with the UK Benchmarks Regulation (UK BMR).

Any questions or queries should be directed to [email protected]

Any complaints regarding this process can be filed confidentially at [email protected]

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Smart Contract and DeFi Tokens Lead Amid Mixed Macro Influences

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Gabriel Selby

Weekly Index Highlights, September 1, 2025

Markets pulled back sharply this week, with all major capitalization indices down more than 3%. Solana was the only major token to post gains. Bitcoin’s implied volatility spiked, with the CF BVXS up 12.5%, while put-side IV rose as hedging activity and downside protection demand picked up.

CF Benchmarks

Nasdaq Crypto Index Family – Free Float Supplies Announcement

The reconstitution and rebalance of the Nasdaq Crypto Index Family will take place on September 2nd, 2025.

CF Benchmarks